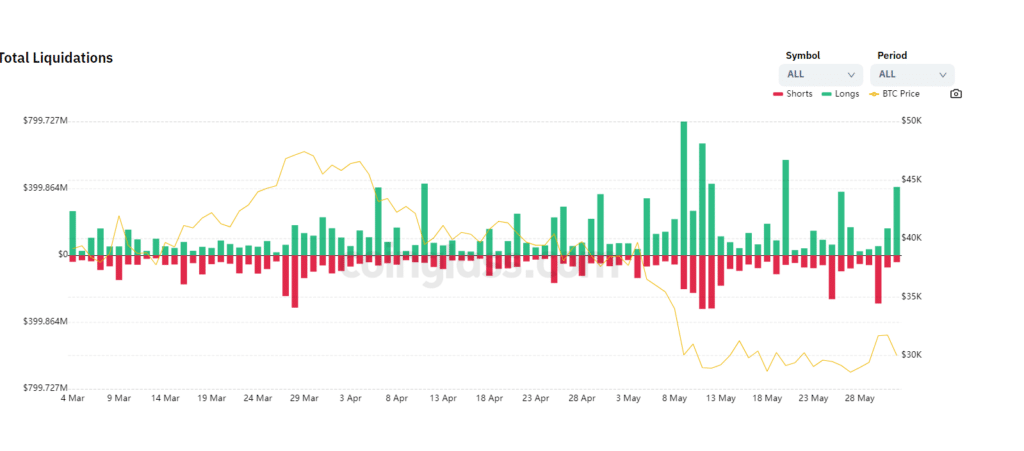

Over 86.9k Long Traders Liquidated when Bitcoin Fell Below $30k

The dump of Bitcoin prices below the $30k level saw over 86k traders lose their shirts and roughly $500 million of long positions liquidated, according to trackers.

The Bitcoin Liquidation

Despite the optimism, Bitcoin prices remain in a long-term bear run traced to late November 2021, when it peaked. At spot rates, Bitcoin has more than halved from $69k all-time highs to around $29.5k when writing. However, this week’s recovery saw most traders ape in, buying the dips with most confidence that Bitcoin was finally turning the corner.

Trackers show that the June 1 sell-off saw 86,926 traders liquidated as the total liquidation rose to $478.90 million. Drilling down, data revealed that most of these liquidations were from BitMex, a perpetual trading platform supporting leverage trading of Bitcoin. Other trading portals which saw Bitcoin long traders got unwound, including Binance Futures and FTX.

Leverage allows traders to borrow funds from the trading platform and initiate larger trade sizes than they would ordinarily have. Depending on the trading platform and applicable rules, leverage can be anywhere from 2X to 100X. While positive, leverage can cause massive losses if a trader’s prognosis is incorrect. On June 1, Bitcoin prices tumbled from the $32k level—a recent multi-week high.

From late May, when Bitcoin prices crashed to as low as $26.7k, registering new 2022 lows and causing massive jitters, the coin recovered to retest $32k, a critical reaction and resistance level. This move saw traders shift their positions, doubling their long positions, only for BTC to dump to spot levels unexpectedly.

Bitcoin Price Candlestick Arrangement Points to Sellers

Currently, there is a three-bar formation signaling bears with the June 1 candlestick engulfing bar, a reminder for optimistic traders that sellers are still in a firm position.

What’s even worrying from a technical perspective is that the June 1 bear bar is with relatively high trading volumes, suggesting strong trader participation. With prices forced down, Bitcoin is now still trading inside the two sell candlesticks of May 9 and 11, respectively. Technically, this could indicate weakness as Bitcoin is yanked back into a bear flag.

Since Bitcoin prices are in a bear formation, the relieving expansion of early this week suggests that it was a dead cat bounce. Overall, sellers are in a vantage position. Judging from how Bitcoin candlesticks are arranged in the daily chart, the path of least resistance is bearish. Only after there are strong conclusive breaks above, especially $32k and $34k, will Bitcoin likely turn the corner and bottom-up, tempering what is a weak market with apprehensive traders.

Interest Rates Hike Pulverized Crypto Prices

The correction of crypto prices, especially Bitcoin, is pinned on several factors. The primary reason is that central banks are shifting their monetary policies. The FED and the BoE have hiked funding rates to tame rising inflation while ending their bond purchasing programs concurrently. Following their move, traditional market assets, mainly the stock market, corrected with the sell-off spilling over to the cryptocurrency markets.