Commercial Bitcoin use Drops in Spite of Reduced Volatility

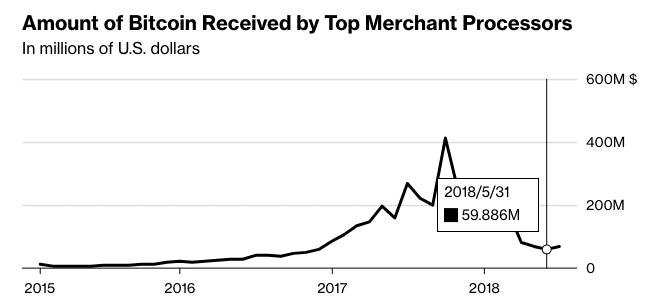

New data from Chainanalysis shows that despite the recent drop in volatility of the bitcoin market, bitcoin’s popularity as a commercial payment solution is slipping, as vendors report fewer and fewer bitcoin transactions. The data, which appeared in Bloomberg, shows that between September 2017 and present, bitcoin’s popularity as a payment method has fallen a staggering 685 percent.

Once a Darling

In September 2017, bitcoin hit a peak transaction value of $411 million, a sum calculated by totaling the sums of money taken in by the 17 largest crypto merchant-processing services. At the time, bitcoin was in the middle of a strong but moderate growth period. This all changed by the end of the year and going into the new year, when the world’s largest cryptocurrency briefly touched $20,000, with euphoric speculators and investors piling in to get a share of the action.

(Source: Bloomberg/Chainanalysis)

Tracking that period, through the bitcoin price falls of early to mid-2018, the commercial bitcoin transaction total figure shows a linear reduction, hitting $60 million in May 2018. In June, there was a slight uptick to $69 million, but this notwithstanding, it was still more than 600 percent down from the peak figure, not to mention 400 percent down on the June 2017 figure.

The news comes as a blow to many within the cryptosphere who see bitcoin as the lodestar of cryptocurrencies, destined to one day take the position of fiat currencies in everyday business and commerce. What the figures show is that the market tried to get into bitcoin as a commercial payments solution, and then voted with their feet after trying it out. It was either a fad that did not last or a sign of poor operational logic. Nicholas Weaver, a senior researcher at the International Computer Science Institute, does not doubt as to why. Speaking in an email to Bloomberg, he said:

“It’s not actually usable. [Sometimes], the net cost of a Bitcoin transaction is far more than a credit card transaction.”

According to Weaver, the market peaked in September 2017 because there was a sufficient critical mass of interested people who wanted to find out how to use bitcoin in their everyday lives. Things went sour when this class of people realized that aside from a cool story and some internet bragging rights, bitcoin offers no transactional advantage over fiat currency.

A single bitcoin transaction can take several minutes to be confirmed, and if a customer demands a refund, bitcoin’s blockchain ledger ensures that transactions cannot be reversed.

Speculating Instead of Transacting

As mentioned earlier, the bitcoin payments slump tracks closely to the rise in speculative investment that drove bitcoin’s price into nosebleed territory. According to Kim Grauer, senior economist at Chainanalysis, the use of bitcoin as a risky asset made it extremely unprofitable for use as an everyday payment solution. The continued hangover of this may be part of what makes many users hesitant to get back to using bitcoin as an everyday item despite its near halving in value. Speaking to Bloomberg, Grauer said:

“When the price is going up so rapidly last year, in one day you could lose $1,000 if you spent it. [Now], high transaction fees have made paying for small-ticket items like coffee with Bitcoin impractical.”

In January 2018, BTCManager reported that the payment service, Stripe, halted support for BTC transactions amidst wildly swinging prices and a significant dip in usage. Several online businesses and payment processors followed suit, reasoning that bitcoin’s main functionality is as a stock market item.

Their case was not helped by skyrocketing transaction fees, which hit a peak of $54 in December – a thoroughly impractical transaction fee to pay for say, buying a bag of potato chips worth $2 with bitcoin. These days, many see bitcoin as a means of paying overseas vendors and freelancers, instead of going through the convoluted conventional banking process. Many in countries like Venezuela and Zimbabwe also see it as a welcome and more stable alternative to their national fiat currencies.