Stablecoin Transactions Grow, Indicating New Buying Opportunities for Strategic Crypto Investors

Following the rapid correction of the crypto market despite optimistic expectations of many holders, stablecoin transactions have increased significantly, confirming risk aversion behavior of most traders.

Causes of Increased Demand for Stablecoins

The demand for stablecoins mostly depends on the general adoption of cryptocurrencies by a broader population and the perception of market risks by crypto investors. In particular, during the periods of the rapid crypto market growth, investors and traders focus on the most profitable altcoins that can generate the maximum returns in the short run or Bitcoin as the major long-term investment. In contrast, during the periods of recessions and corrections when the fiat value of crypto assets declines, most crypto investors tend to shift to stablecoins that have the fixed fiat or gold value. In this manner, they accumulate additional assets that may be actively used when the situation in the market is subject to change.

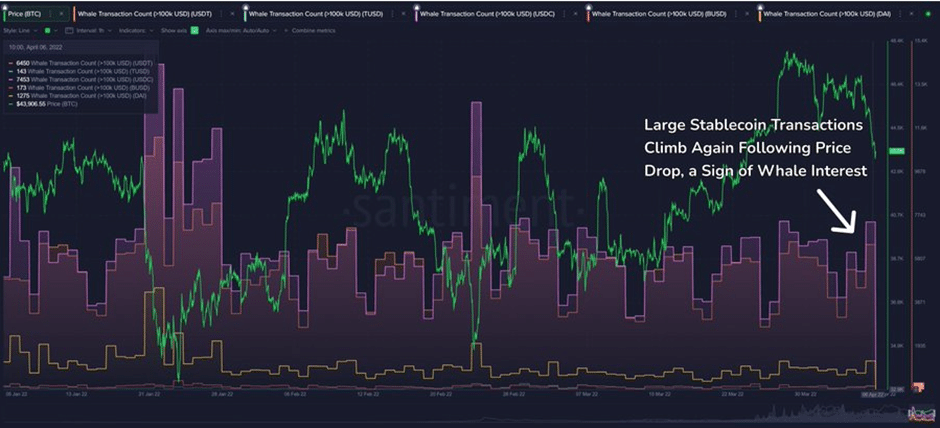

According to the recent data provided by the blockchain analytics company Santiment, the amount of large stablecoin transactions has recently increased, implying that many whales prefer to shift some portion of their assets to less volatile coins. In particular, the major demand increases are observed in regards to the following stablecoins: UST, USDC, BUSD, TUSD, and DAI. These data confirm that crypto investors tend to shift their preferences toward those stablecoins that use innovative algorithms for ensuring the stability of their exchange rates or those backed by various crypto assets such as BTC and ETH. Even this shift implies the growing crypto market independence from traditional fiat markets.

Short-Term Implications

The identified pattern of the demand for stablecoins has different short- and long-term implications for the entire crypto market. On the one hand, some investors’ reorientation to stablecoins reflects the changed conditions in the market and reduced returns associated with the investments in cryptocurrencies. On the other hand, such investors’ decisions also imply the growing concerns about the future dynamics of the crypto market and Bitcoin in the following weeks. As whales traditionally have access to the latest analytical technologies, they believe that such a rapid price decline indicates some fundamental problems that may prevent the rapid restoration of the crypto market to its historically maximum levels.

The recent announcement about the Federal Reserve’s plans to increase its basis rate by 50 points largely contributes to such concerns. The reason is that the higher interest rates will prevent investors from accessing cheap credit resources that may be used for investing in risky assets. As a result, the demand for the major cryptocurrencies can decline even further. According to CoinGecko, all cryptocurrencies from Top-20 (including meme coins) have demonstrated the negative price and capitalization dynamics within the past 24 hours. Therefore, the major short-term effects of such external shocks and the changed patterns of crypto investors’ behavior are highly negative. The risks of further price decline and prolonged “crypto winter” significantly increase.

Long-Term Implications

The long-term implications of the identified patterns in the crypto market are very different. In fact, the strategic development of the crypto market will mostly depend on the prevalence of the following fundamental factors: scarcity, adoption of new technologies, integration of blockchain with traditional financial markets, the development of DeFi, Metaverse, and other segments, etc.

Moreover, the Federal Reserve and other central banks will be unable to increase basis interest rates for a long period. After reducing inflation to the acceptable degree and facing the risks of unemployment and economic recession, they will have to implement a more liberal policy. Thus, investors will finally receive access to the funds that can be directed to acquiring risky crypto assets.

Moreover, according to the historical data provided by Santiment, such periods of the atypically high demand for stablecoins constitute the optimal opportunity for long-term investors in terms of opening long positions involving BTC and other major cryptocurrencies. The reason is that they may be around their local bottoms at that time. By not following the general panic reactions, long-term investors and hodlers can receive returns that considerably exceed the average profitability and return generation opportunities available in other crypto markets. Thus, long-term implications of the current market situation are highly positive for crypto traders.