Mantra price and futures open interest hit ATH: can the surge continue?

Mantra, a leading blockchain network for real-world asset tokenization, continued its strong momentum in January.

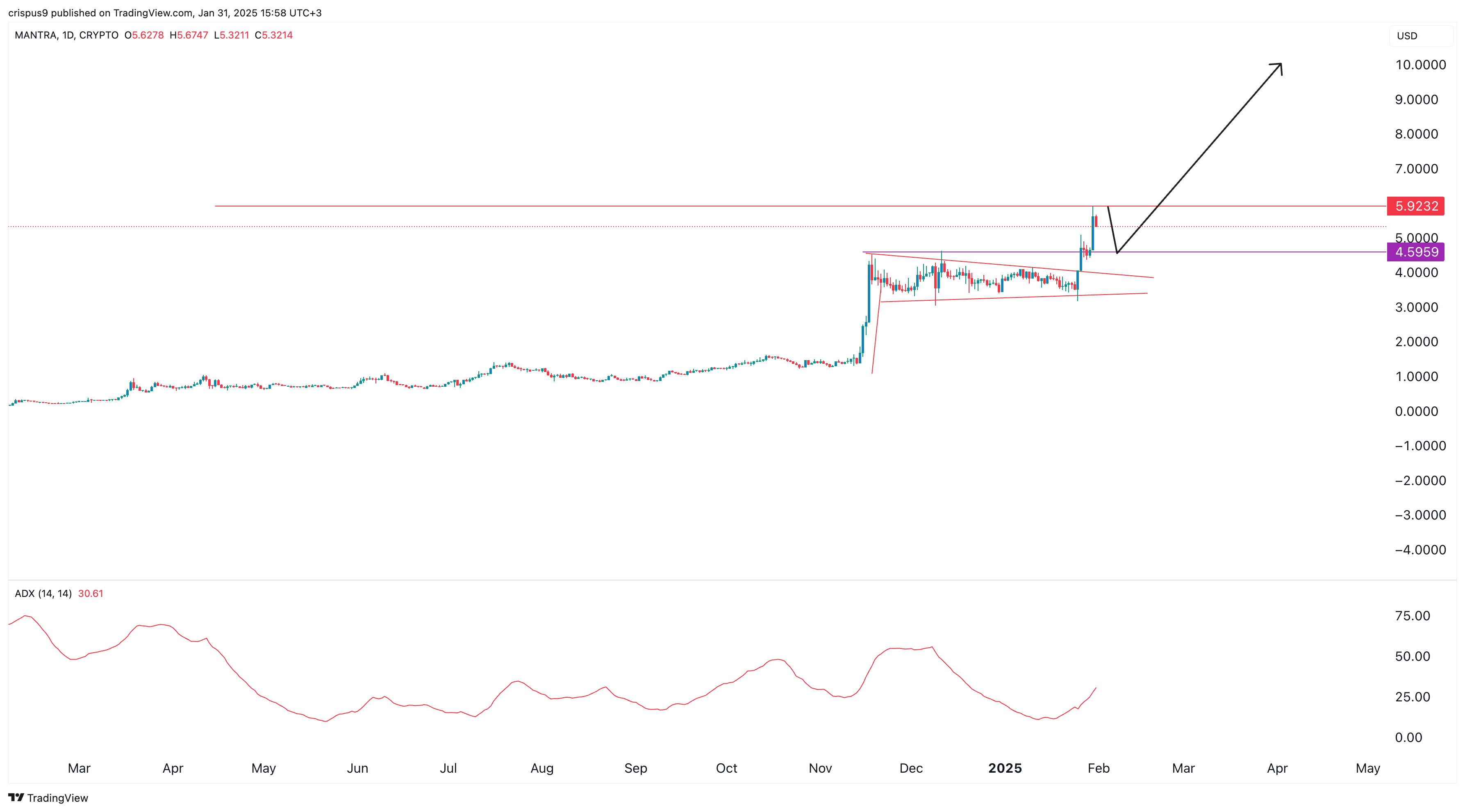

Mantra (OM) coin jumped to a record high of $5.92 as we predicted. It climbed 45% in January, reaching a peak of $5.9232 and bringing its market capitalization to over $5.3 billion. The token has now risen nearly 40,000% from its lowest point in 2023.

Mantra’s surge in January was mostly due to its huge partnership with DAMAC, one of Dubai’s largest real estate companies. Under the agreement, DAMAC will tokenize $1 billion worth of its real estate holdings.

A successful implementation of this project could lead to similar deals in the real estate sector, which is expected to see significant tokenization growth. Some analysts estimate that the real estate tokenization market could reach $3.2 trillion by 2030.

The financial services industry is another sector poised for tokenization. Tokenized funds such as BlackRock’s BUIDL and Franklin Templeton’s FOBXX have already attracted nearly $1 billion in assets.

BlackRock CEO Larry Fink has urged the Securities and Exchange Commission to approve the tokenization of stocks and bonds. This move could unlock a massive opportunity, as global stock markets have a total capitalization of $115 trillion, with the bond market even larger.

As tokenization expands, Mantra is well-positioned to benefit, with its MantraChain aiming to become the leading dedicated layer-1 network for the sector.

Mantra’s price surge also coincided with a sharp increase in futures open interest. Data shows that open interest in OM futures reached an all-time high of $450 million on Thursday.

Mantra price analysis

The OM token has experienced a meteoric rise over the past few years, climbing from near zero to almost $6. Between November and January, it formed a bullish pennant pattern, a widely recognized continuation signal, featuring a long vertical rally followed by a symmetrical triangle.

Mantra has now broken above the upper boundary of the pennant. Additionally, the Average Directional Index has surged to 30, its highest level since December. An ADX reading above 25 indicates strong momentum in an asset.

Therefore, Mantra will likely pull back to $4.50, the upper boundary of the pennant, before resuming its uptrend. This break-and-retest pattern is a commonly observed continuation setup. In the long term, Mantra’s price could rise to $10.