RWA sector, up 20% over the past 7 days, is one of the leading sectors in the broader market

The RWA sector doubled by more than 20% over the past week and now appears to be one of the strongest growing areas in the crypto market.

The real-world asset sector’s market capitalization is $40.41 billion, with a 24-hour trading volume of $3.22 billion. RWAs are gaining stability as the next point in the innovation process by being a bridge for blockchain technology that links real assets with art, commodities, and real estate.

The two sector leaders were Avalanche (AVAX), which rose 14.97% over the past week, and Chainlink (LINK), at 14.39%. More impressively, MANTRA (OM) rose 128.51% last week. In comparison, Maker (MKR) rose 15.89% – a testament to the immense interest that is currently stirring within communities for protocols in decentralized finance.

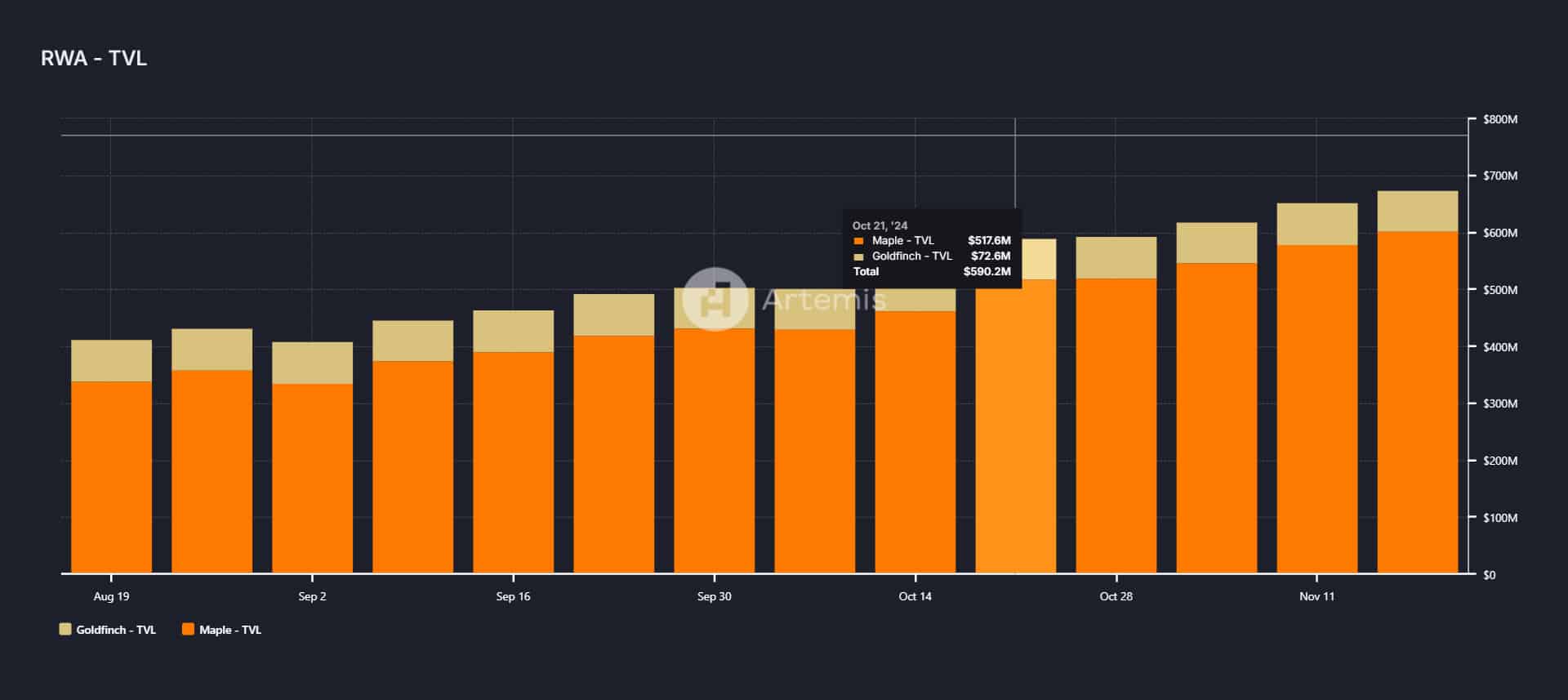

As of October 21, the Total Value Locked for the RWA sector had grown by $517.6 million on Maple Finance and $72.6 million on Goldfinch, two DeFi protocols trying to finance decentralized loans with RWA in emerging markets. The aggregate value locked in stands at about $590.2 million. This further points to increased investment value and the adoption of decentralized lending and borrowing protocols.

This increase in TVL speaks well to the growing usage case for RWAs in providing liquidity to traditionally illiquid assets. Players such as Maple and Goldfinch emerged as key entities in this process, in which blockchain solutions translated institutional-grade capital.

Companies like ADDX, Vertalo, and Polymesh also participate in innovative areas of this sphere. Vertalo is an SEC-registered transfer agent with focus on modernizing shareholder registries and tokenization.

Increasing demand for liquidity in illiquid asset classes

The U.S. Securities and Exchange Commission takes a conservative approach to RWAs. Unlike many cryptocurrencies, which the SEC scrutinizes often for possible securities offerings, typically, RWAs are structured to be well within regulation under security laws.

In a recent interview, David Hendricks, CEO of Vertalo, a company that provides software for over 100 entities involved in the RWA sector, including tokenized Warhols and racehorses, the future of the industry is in settlement technology. “SEC and FINRA will view this as a way to create investment products using technology. This isn’t the typical crypto space with rug pulls—it’s database technology aimed at creating investment products and increasing efficiency.”

With increased focus on RWA sectors, this sector is merging into decentralized finance, and new avenues for financial inclusion and innovation will be unlocked. Onlookers in this space, including investors and developers alike, are going by the potential space, which has to redefine ownership of assets and ultimately make them accessible to the market.