Tron price prediction as Nasdaq listing looms: Bullish continuation ahead?

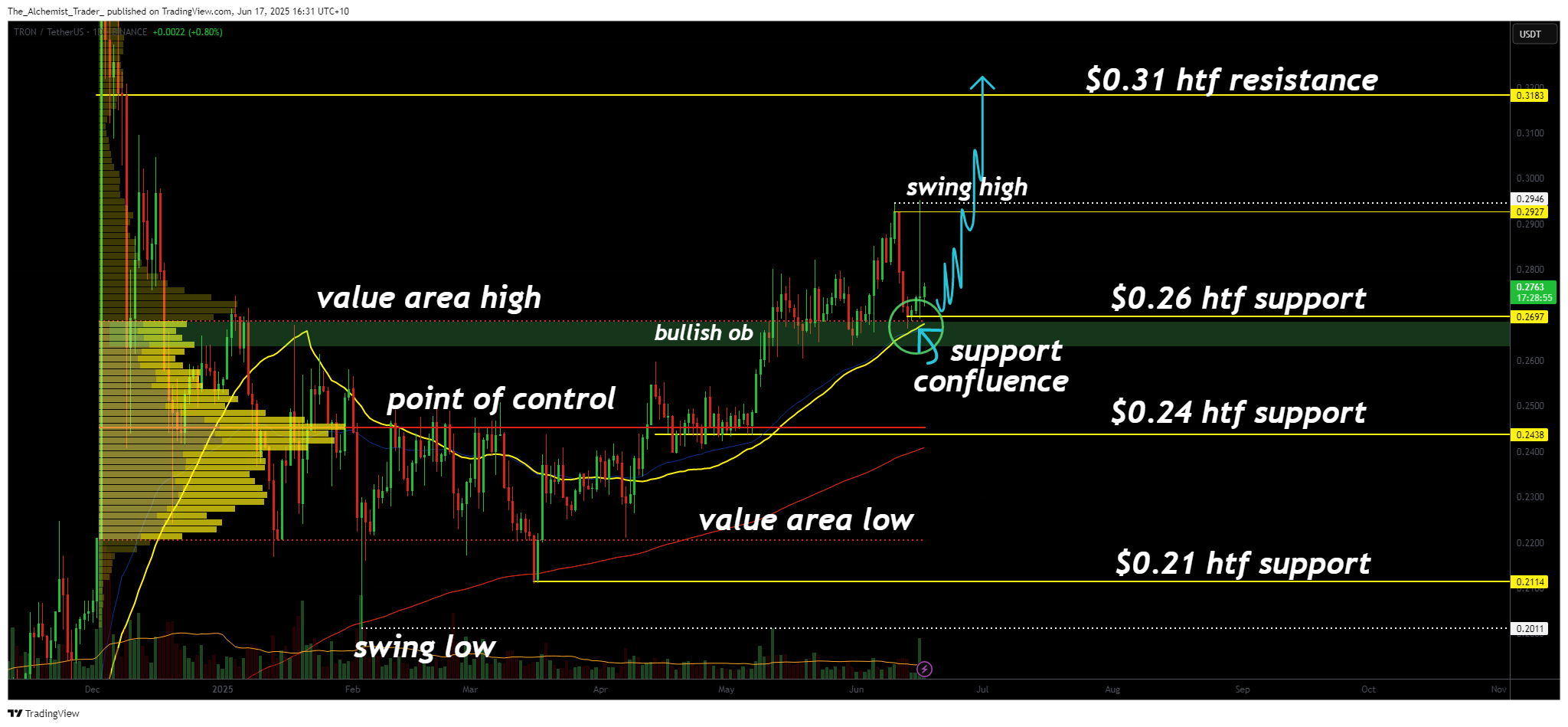

Tron continues to respect its bullish structure with consecutive higher highs and higher lows, supported by volume and key technical levels. As price holds above the $0.26 region, a key support confluence, a push toward the $0.31 resistance appears increasingly likely.

Since establishing a swing low, Tron (TRX) has rallied in a clean bullish trend. The price action has respected the 200-day moving average, reclaimed major volume zones, and continues to build strength above high-timeframe support levels. With recent price action now consolidating just above the value area high — at a time when Tron is eyeing a Nasdaq listing, which also aligns with a bullish order block and the 0.618 Fibonacci retracement, the structure remains strongly supportive of further upside.

Key technical points

- Support Holding at $0.26: Price remains above high-timeframe support, value area high, and 0.618 Fibonacci with multiple candle closes confirming strength.

- Wick Fill Toward $0.31 Likely: Previous rejection created a selling wick at $0.31, which now has a high probability of being filled based on volume and trend continuation.

- Market Structure Remains Bullish: Consecutive higher highs and higher lows, with support from the 50 MA and 200 MA, signal strength.

Tron is currently trading in a technically significant region, having reclaimed and closed multiple candles above the $0.26 support zone. This level aligns with the value area high, a bullish order block, and the 0.618 retracement level, forming a strong confluence of support. The 50-day moving average is also acting as dynamic support, further reinforcing the bullish setup.

The recent price rejection at $0.31 formed a notable selling wick, which historically acts as a price magnet. These “wick fills” often occur in strong trends, and with Tron’s current structure, a return to the $0.31 resistance, a move of roughly 16% from current levels, remains technically probable.

Tron’s market structure continues to post higher lows and higher highs, with no signs of a bearish reversal. Price has moved consistently through the value area low, point of control, and value area high, confirming that buyer demand remains intact and is defending key support zones effectively. The volume profile shows sustained buyer interest throughout the recent uptrend, suggesting momentum remains in favor of the bulls.

What to expect in the coming price action

As long as Tron holds above the $0.26 support confluence, the path toward $0.31 remains technically valid. Volume, trend structure, and dynamic support all point toward bullish continuation. Unless market structure breaks, expect higher prices in the short term.