Your ultimate guide to finding the next cryptocurrency to explode

Explore the market’s future with insights on the next crypto to explode in 2024. Learn the key factors that signal a coin’s potential.

Table of Contents

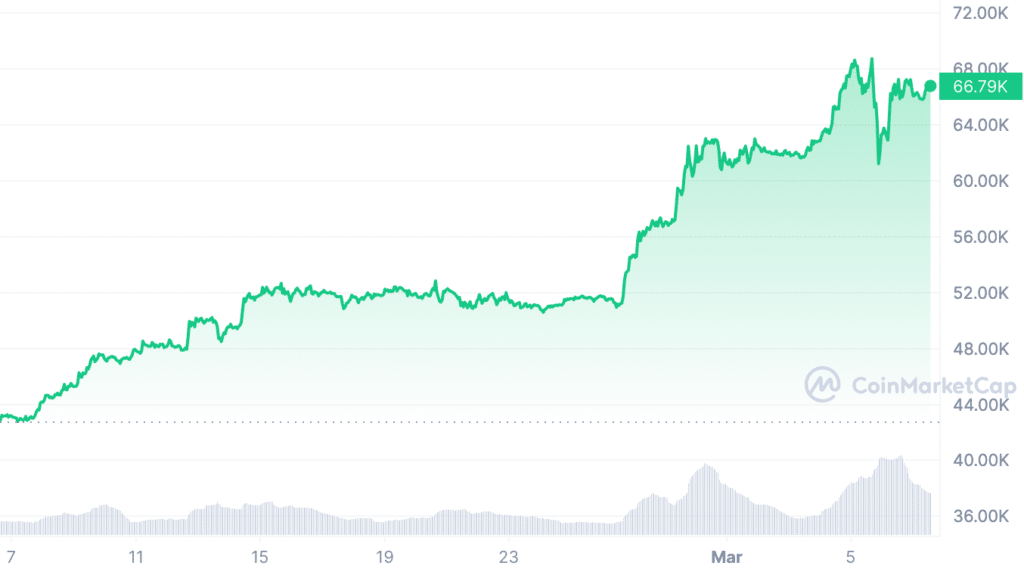

As we progress into 2024, Bitcoin (BTC) has surpassed its all-time high set in Nov. 2021, reaching a high of $69,045 on Mar. 5.

The introduction of spot Bitcoin exchange-traded funds (ETFs) has been a recent catalyst behind this growth, with these ETFs collectively amassing over $55 billion in market cap as of this writing.

As we anticipate the potential for an upcoming bull run in the crypto market, it’s essential to analyze past trends and data to identify crypto that will explode.

In previous bull runs, altcoins such as Ethereum (ETH) experienced unprecedented increases in value, capturing the market’s attention with dramatic rises.

This trend continued in the 2020-2021 bull market, with altcoins like Binance Coin (BNB) and Cardano (ADA) making significant gains.

In light of these developments, let’s try to assess what the next crypto bull run might entail and how you can identify the next coin to explode.

Market dynamics and historical context

When identifying potential high-growth cryptocurrencies, a deep dive into market dynamics and historical context is essential. This involves looking beyond simple price trends to understand the underlying factors driving market movements and how they can inform future predictions. Here is how you can do it:

Understanding market cycles

Cryptocurrency markets move in cycles, typically characterized by periods of rapid price increase (bull markets) followed by downturns (bear markets).

For instance, Bitcoin experienced a significant bull market in 2017, where its price rose from about $1,000 in January to nearly $20,000 by December. This was followed by a bear market in 2018, with the price dropping substantially. Similarly, BTC reached its all-time high in Nov. 2021 and plummeted to $16,000 levels by Dec. 2022.

Understanding these cycles can help in predicting when the market might turn bullish again. Always remember that trend is your friend, but trends can always change.

Historical price movements

Examining the price history of successful cryptocurrencies reveals patterns. For example, during the 2017 bull run, not only did Bitcoin surge, but altcoins like Ethereum also saw massive gains.

Ethereum’s rise was fueled by the ICO boom, as it was the primary platform for these offerings. Similarly, in the 2020-2021 bull run, decentralized finance (defi) tokens experienced significant growth due to the burgeoning interest in defi applications.

To identify the next cryptocurrency poised for explosive growth, it’s crucial to understand the driving forces behind the market in 2024.

Currently, the spotlight is on spot Bitcoin ETFs, the upcoming Bitcoin halving scheduled for Apr. 2024, and regulatory developments like the outcome of the Ripple (XRP) vs. SEC case.

Monitoring current market dynamics and analyzing past price data and news events can provide valuable insights and position you well to identify promising opportunities in the crypto space.

Volume and market capitalization

These are crucial metrics. A sudden increase in trading volume can indicate growing investor interest, often preceding price increases.

Market capitalization gives a sense of the relative size and dominance of a cryptocurrency. For instance, a low market cap coin might have higher growth potential but also higher risk compared to a large market cap coin.

External market factors

Global economic factors, such as inflation rates, economic downturns, or stock market crashes, can also influence the crypto market.

For example, the COVID-19 pandemic initially led to a market crash in March 2020, but subsequently, there was increased interest in cryptocurrencies as a potential hedge against inflation and economic uncertainty.

Meanwhile, a global recession is predicted for 2024, which in turn could have broader repercussions for the crypto market as well.

Past performance and future potential

While past performance is not always indicative of future results, it can provide insights.

Cryptocurrencies that have shown resilience and consistent growth over multiple market cycles may be poised for future success.

However, it’s crucial to balance this with an assessment of current trends and future potential based on technological advancements and market shifts.

Technological innovation and practical uses

In 2024, identifying the next cryptocurrency to explode requires a nuanced approach that considers a spectrum of factors beyond mainstream coins.

This entails delving into diverse technological innovations and assessing their real-world applicability across various sectors. Here’s a deeper and more insightful look:

Under-the-radar technological breakthroughs

Beyond well-known projects such as Bitcoin or Ethereum, there are numerous lesser-known cryptocurrencies innovating in areas like artificial intelligence (AI), rollups, sidechains, off-chain computations, and advanced consensus algorithms.

For instance, coins focusing on quantum resistance or implementing advanced cryptographic methods could gain prominence as cybersecurity becomes a paramount concern in the crypto space in the future.

Real-world utility beyond financial transactions

The next crypto to skyrocket could be one that extends blockchain utility beyond financial transactions. This includes projects focusing on tokenization, decentralized data storage, digital identity verification, or supply chain optimization.

Cryptocurrencies involved in these or any other sectors could offer solutions to real-world problems, driving their value and adoption.

Potential in interoperability and cross-chain solutions

As the blockchain ecosystem becomes more fragmented, cryptocurrencies that facilitate interoperability between different networks could play a pivotal role.

Projects working on cross-chain solutions or blockchain bridging protocols could be the next coin to explode, as they enable seamless interaction between disparate blockchain systems.

Green cryptocurrency and regulation compliance

With increasing focus on sustainability, cryptocurrencies that offer energy-efficient transaction processing could gain significant attention.

Additionally, coins that are proactively addressing regulatory compliance issues might have a competitive edge, especially in jurisdictions with strict regulatory frameworks.

Assessing market readiness of new cryptos

For new or emerging cryptocurrencies, market readiness is key. This includes evaluating the maturity of the project, the experience of the team, the clarity of their vision, and the responsiveness to community feedback.

Early-stage projects that demonstrate a clear path to market application and user adoption might be among the altcoins to explode.

Community engagement and development activity

The strength and activity of a cryptocurrency’s community, alongside its development efforts, are critical indicators of its potential for success and growth.

A vibrant community often translates to a robust support system for the cryptocurrency, fostering innovation and adoption.

Developer activity, on the other hand, reflects the ongoing commitment to improve and evolve the platform, which is crucial for its long-term viability.

For instance, Ethereum and Cardano’s robust community has been a key factor in their success. With thousands of developers, both these platforms have become a hub for leading to the creation of several decentralized applications.

This level of engagement is also quantifiable: Ethereum and Cardano consistently rank high in developer activity metrics, such as the number of GitHub commits and contributors. Such activity not only enhances the platform but also instills confidence in investors and users.

Strategic partnerships and ecosystem integration

The partnerships a cryptocurrency forges and its integration into broader ecosystems can significantly impact its market performance. Strategic partnerships often serve as a validation of the cryptocurrency’s technology and its potential for real-world application.

A prime example is Ripple (XRP), which has formed partnerships with numerous financial institutions for cross-border payments. These partnerships have been crucial in demonstrating Ripple’s practical utility beyond the speculative nature of the crypto market.

Combining these factors

When assessing a cryptocurrency’s potential, it is important to look at both its internal community and development dynamics, as well as how it interacts with and is perceived by external entities through partnerships.

A cryptocurrency with a strong, active community and significant development activity, coupled with strategic partnerships that enhance its utility and integration into larger ecosystems, is more likely to experience sustained growth and success.

The road ahead

As we look forward to seeing which cryptocurrencies will explode in 2024, it’s important to approach the market with a mix of interest and caution.

Finding the next big cryptocurrency requires a deep understanding of the intricate interplay between technological innovation, market forces, and the perspectives of investors.

The appeal of investing in cryptocurrencies with very low prices is strong, tempting many with the prospect of significant returns. However, the importance of conducting in-depth research and evaluating risks cannot be overstated.

While looking for potential altcoins to invest in, focus on those introducing novel technological advancements, practical applications, or strong community support.

For anyone looking to discover the next cryptocurrency to experience rapid growth, the key is to stay well-informed, exercise patience, and make thoughtful, well-considered decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.