UNI price climbs 9% as Uniswap explores new layer-2 integration

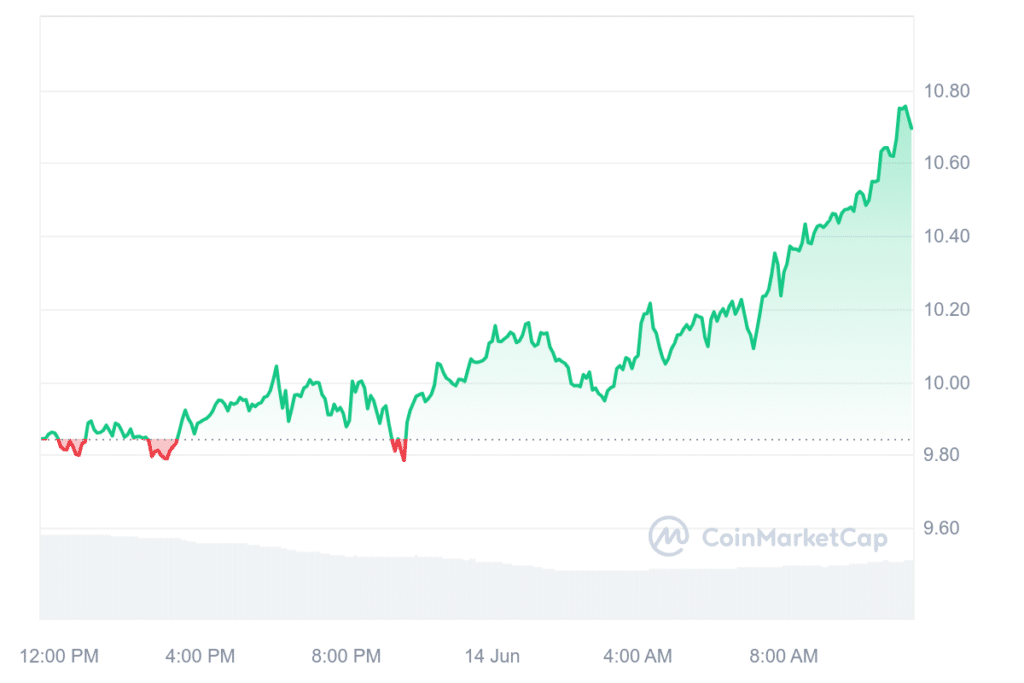

UNI, the native token of decentralized exchange (DEX) Uniswap, has surged 9% to become the top gainer in the crypto market today.

At the time of writing, UNI has been trading at $10.69, which is up 8.5% over the past day. In the same timeframe, the crypto asset experienced a 31% drop in trading volume, suggesting existing holders might be holding onto their UNI tokens in expectation of a further price rise.

Meanwhile, Uniswap’s market cap had risen to $6.4 billion, bringing the token to the 18th largest crypto asset asset per data from CoinMarketCap.

The latest surge in price comes as the decentralized exchange shared a new enigmatic X post early on June 14 featuring the message: “Locked in. Ready for the Endgame.” The message was paired with an image of a man intently sitting forward in his chair, a meme used by gamers when things are getting serious.

A following attached post from June 1 subsequently suggested that Uniswap v2 is gearing up to add support for a new Layer-2 blockchain.

Although the specific L2 protocol was not disclosed, speculation among the crypto community on X leans towards ZKsync, a renowned trustless Layer 2 solution known for scalable, low-cost Ethereum transactions.

Meanwhile, multiple members of the community also expressed discontent regarding the potential deployment on ZKsync.

Another potential cause for the recent price surge in UNI could be the impressive growth in L2 volume processed through the Uniswap Protocol, as highlighted in a June 13 X post by Uniswap Labs.

It took 22 months to hit the $100 billion mark, 10 months to reach $200 billion, and just 3 months to surpass $300 billion,’ the Uniswap team noted, showing data from analytics platform Dune. The exponential growth outlines the growing utility and adoption of Uniswap’s services in the defi space.

Additionally, an X user with the pseudonym “Kyledoops” pointed out the rising popularity of Uniswap v2 pools on various L2 solutions like Optimism, Arbitrum, and Polygon.

These platforms are being favored for their promise of scalability, reduced transaction fees, and enhanced user experience, further contributing to the demand for Uniswap’s offerings.

While Ethereum continues to lead in defi, the integration of L2 networks with Uniswap is evidently propelling quicker and more economical transactions, positioning these networks as strong contenders in the evolving crypto space.