Peter Schiff preaches Bitcoin FUD: here’s why he is wrong

Bitcoin’s post-halving consolidation has prompted cynical rhetoric from popular crypto naysayer Peter Schiff.

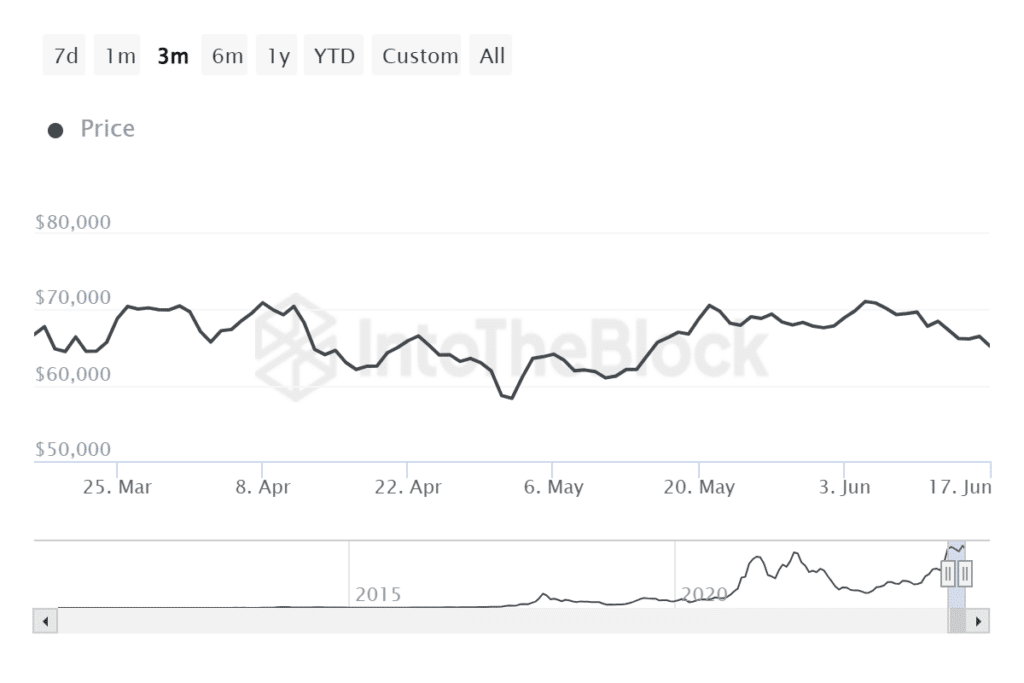

Bitcoin (BTC) skeptic Peter Schiff suggested that the value proposition driving spot BTC ETF demand might quickly fade, contradicting expert predictions and market performance so far. BTC has grown over 55% year-to-date (YTD), but Schiff noted that the token has traded sideways for over three months and posted minuscule gains for spot Bitcoin ETF investors.

Spot exchange-traded funds track the price of an underlying asset. In this case, the asset is BTC, and profits are tied to increments in the cryptocurrency’s price.

Schiff’s statement about BTC’s sideways price patterns may be true, but the assertion perhaps lacks context. Bitcoin has surged nearly 70% since the U.S. Securities and Exchange Commission (SEC) approved spot BTC ETFs.

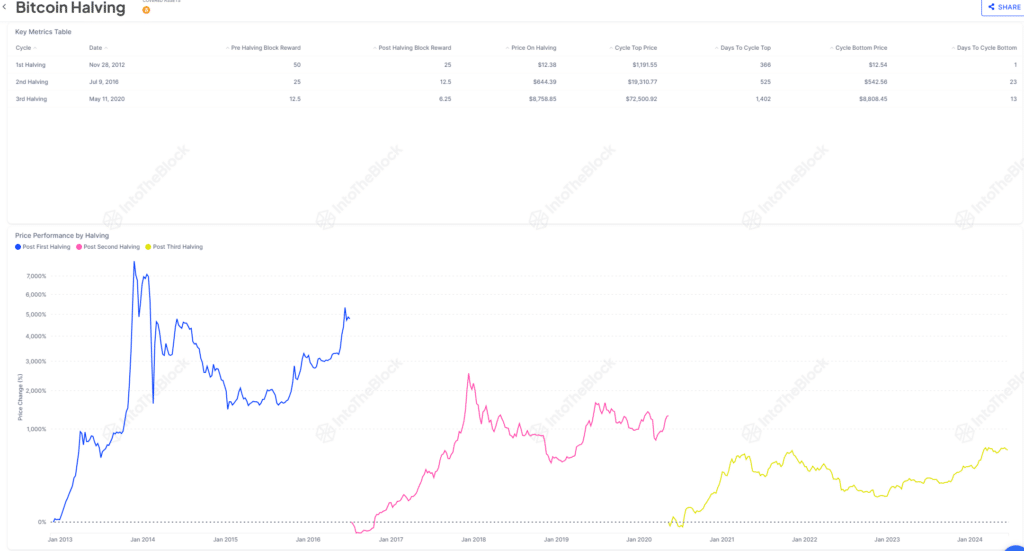

Additionally, BTC’s multi-week consolidation is not new following a halving. The asset transitioned from an accumulation phase into a parabolic run during the last two cycles at least.

Growing institutional Bitcoin demand

BlackRock and Fidelity’s respective spot BTC ETFs made the best debuts in over 30 years on Wall Street. Within weeks, both funds amassed over $10 billion in assets under management (AUM). Despite billions in demand, Schiff scrutinized Bitcoin’s bullish thesis and price progression. “ If ETF investors have been buying, who has been selling, and why?”

Meanwhile, Bloomberg’s ETF expert Eric Balchunas has repeatedly spoken about capital flows from futures ETFs into spot BTC funds. The halving’s change in dynamics also saw some sell-offs from crypto miners to maintain cash reserves.

However, on-chain data showed that Bitcoin balances on centralized exchanges hit a four-year low, meaning that spot holders are not selling but rather holding on for dear life, commonly known as “hodling” in the digital asset industry.

Schiff surmised that ETF buyers could become tired of waiting and start liquidating shares as the asset continues in a consolidation range. While the scenario remains a possibility, growing institutional demand suggests otherwise.

Entities like the Wisconsin Investment Board have parked hundreds of millions into spot BTC ETFs, likely with a long-term view on the asset considering its growth over the years.

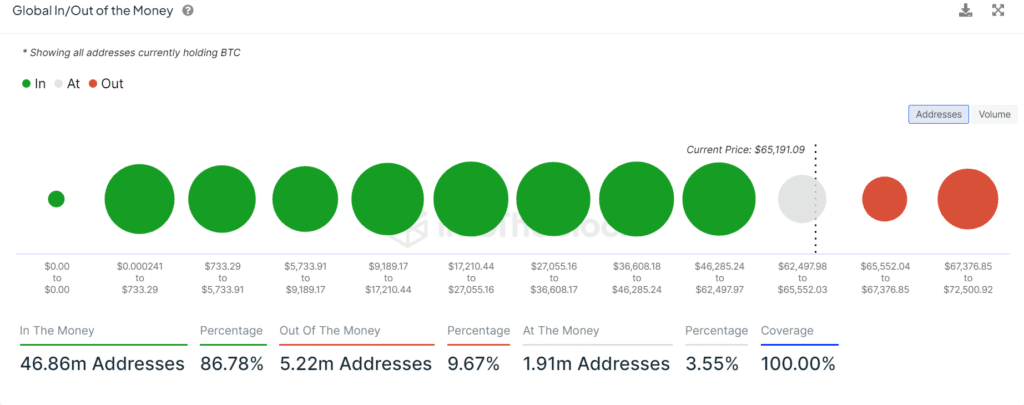

BTC jumped over 145% in the past year. In comparison, the S&P 500 has returned 85% in the last five years, bolstering the reward argument for investing in the top cryptocurrency by market cap. Furthermore, IntoTheBlock data showed that over 80% of BTC buyers are in profits.

Balchunas and other experts also opined that major institutions have yet to enter the spot BTC ETF scene. Yet, the market is over $40 billion strong and growing. As crypto adoption rapidly increases and analysts expect the global ETF market to nearly triple by 2035 to a $35 trillion market, the bullish thesis behind Bitcoin’s ascent is arguably stronger than ever.