2 reasons MSTR stock fell as Bitcoin price rallied

MicroStrategy stock price has dropped 27% from its highest level this year, despite Bitcoin reaching a record high.

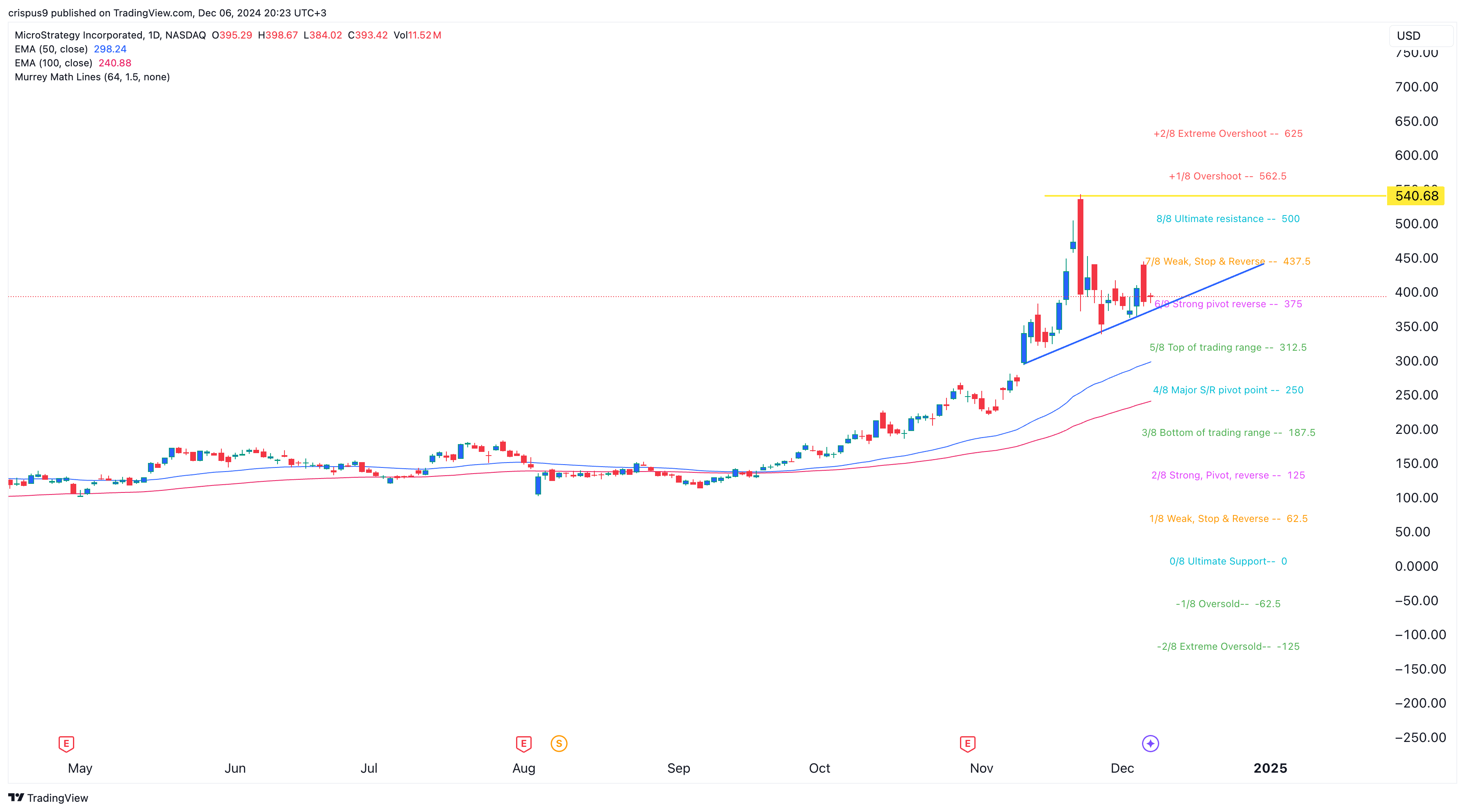

MSTR shares were trading at $390 on Dec. 6, continuing a decline that began on Nov. 21, when the stock peaked at $541. Even with this pullback, MicroStrategy remains one of the best-performing stocks this year, up over 500%, with a market cap exceeding $91 billion. It is also the top gainer in the Russell 2000 index.

There are two possible reasons why the stock has retreated this month. First, this decline is because of profit-taking among investors who have benefited from its climb.

Second, investors are likely concerned about its valuation, which stands at about $91 billion. This is a big premium considering that MicroStrategy holds 402,100 coins valued at under $40 billion. As such, there is a $50 billion gap that cannot be filled by the struggling original data analytics business.

Therefore, some investors believe that the company’s valuation will ultimately drop to bring its valuation close to its Bitcoin (BTC) holdings.

Still, most Wall Street analysts are optimistic that the stock has more upside left. According to Yahoo Finance, some of the most bullish analysts are from Cowen, Barclays, Benchmark, and Bernstein. The average estimate for the stock is $492, higher than the current $390.

MicroStrategy’s stock has also mirrored the performance of other Bitcoin-exposed companies. Marathon Digital, the second-largest Bitcoin holder, has declined 14% from its November peak, while Coinbase, Riot Platforms, and Hut 8 Mining have also experienced pullbacks.

What next for MSTR stock?

MicroStrategy’s stock has pulled back but remains above the ascending trendline connecting the lowest swings since Nov. 11. It is also trading above the 50-day and 100-day moving averages, suggesting potential support for further gains.

It has also bottomed at the strong pivot reverse point of the Murrey Math Lines tool. Therefore, the stock will likely bounce back if Bitcoin continues rising, as analysts expect.

If this happens, the stock will likely continue rising as bulls target the all-time high of $540. A break above that level will point to more gains, potentially to the extreme overshoot level at $625.

Conversely, a drop below the rising trendline could see the stock have a mean reversal and drop to the 100-day moving average at $240. This price coincides with the major S&R level of the Murrey Math Lines.