3 reasons why Cardano price may surge by 70%

Cardano price has retreated in the last three consecutive days as last week’s surge took a breather.

Cardano (ADA) price dropped to a low of $0.70 on Sunday, down from the year-to-date high of $0.747. This article explores the top three reasons why the coin may jump by 70% and retest the key resistance level at $1.176.

Cardano whales are buying

The first bullish catalyst that may push the Cardano price higher is that whales are accumulating the coin.

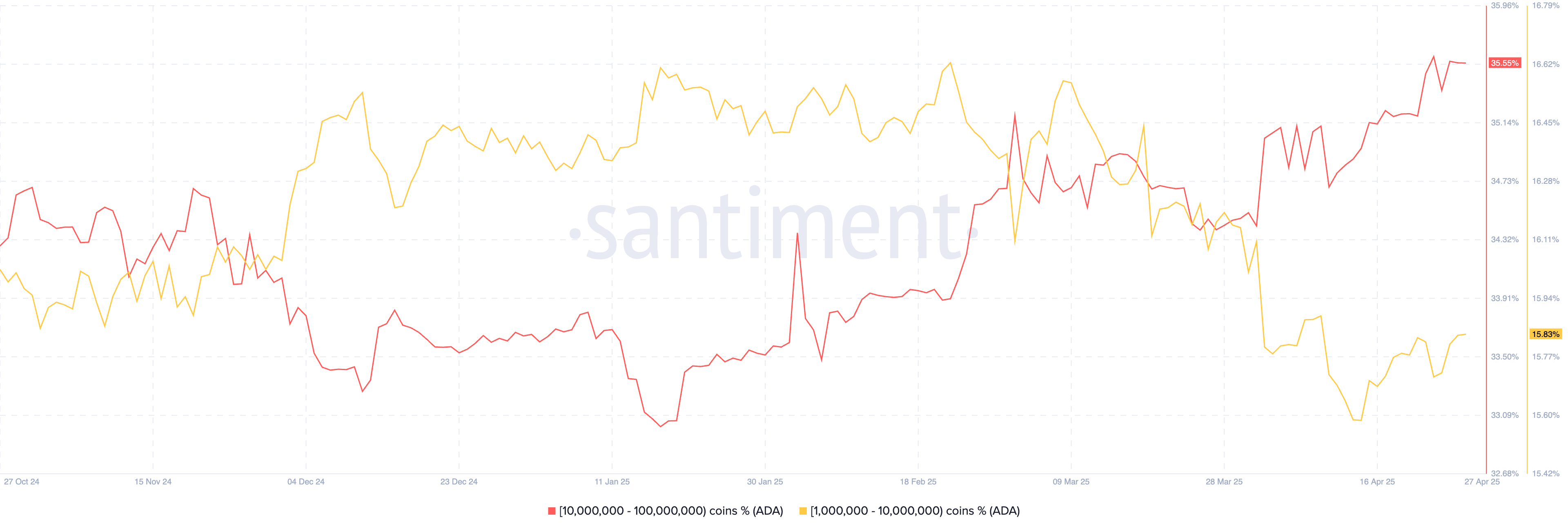

Santiment data shows that addresses holding between 10 million and 100 million ADA coins account for about 35.5% of all coins in circulation. The percentage stood at 33% in January.

ADA holders with balances of between 1 million and 10 million have jumped to 15.83%. This whale activity is a sign that these investors anticipate more gains ahead. Historically, whale accumulation is seen as a better bullish catalyst than their dumping.

ADA ETF approval and Bitcoin staking feature

Cardano price will likely do well as odds of a spot ADA ETF rise now that the Securities and Exchange Commission has confirmed Paul Atkins as the new agency chair. Polymarket odds of this ETF approval happening this year have jumped to 55%.

The SEC is reviewing over 70 crypto-related ETFs. Under Paul Atkins, it is likely that it will approve most of these funds. Most notably, the agency may also approve tokens with staking features, allowing ETF investors to earn monthly returns.

Charles Hoskinson, co-founder of the Cardano blockchain platform, has continued to promise more Bitcoin (BTC) integration. The goal is to provide Bitcoin holders with a way to generate a return through a safer zero-knowledge solution. ZK proofs are better than centralized options like Celsius, which collapsed in 2022.

Bitcoin staking on Cardano will be enabled by its sidechains, like Midnight and Midgard. Midnight will enable BTC to be represented on Cardano while maintaining transaction privacy.

Cardano price has double-bottomed

The other catalyst for ADA price is that it has formed a double-bottom pattern at $0.510. A double bottom is usually a bullish sign, signaling that short-sellers hesitate to place short bets below a key price. Its neckline is at $1.176, its highest level on May 3.

The coin also hovers at the 61.8% Fibonacci Retracement level, which is known as the golden ratio, where rebounds happen. It has also formed a small bullish flag pattern.

Therefore, the Cardano price will likely have a bullish breakout in the coming weeks as bulls target the double-bottom’s neckline at $1.17, about 70% above the current level.