5 things we’ve learned since the Bitcoin halving

The halving turned out to be a “sell the news” event for BTC — and with continued uncertainty around interest rates, a fresh rally may be some time off.

It’s been two weeks since the Bitcoin halving — and in the short term at least, this rare event hasn’t delivered the explosion in price that bulls were hoping for.

You could argue a lot of this has been outside BTC’s control. Rising tensions in the Middle East have led to sharp, sudden declines in the crypto markets.

We saw this on April 19, when Bitcoin plunged below $60,000 following news that Israel had launched an attack on Iranian soil.

Although prices quickly recovered, further unrest or escalations in this increasingly complex conflict could cause further headwinds.

While $60,000 has proven a significant psychological threshold for BTC, resolve was sorely tested on May 1, when prices tumbled to lows of $56,555.

Here are five things we’ve learned since the halving that could help us chart what happens next.

1. April was Bitcoin’s worst month in almost two years

The Crypto Fear and Greed Index has been flashing scores of Greed or Extreme Greed for some weeks, but traders got a sobering reality check at the start of May.

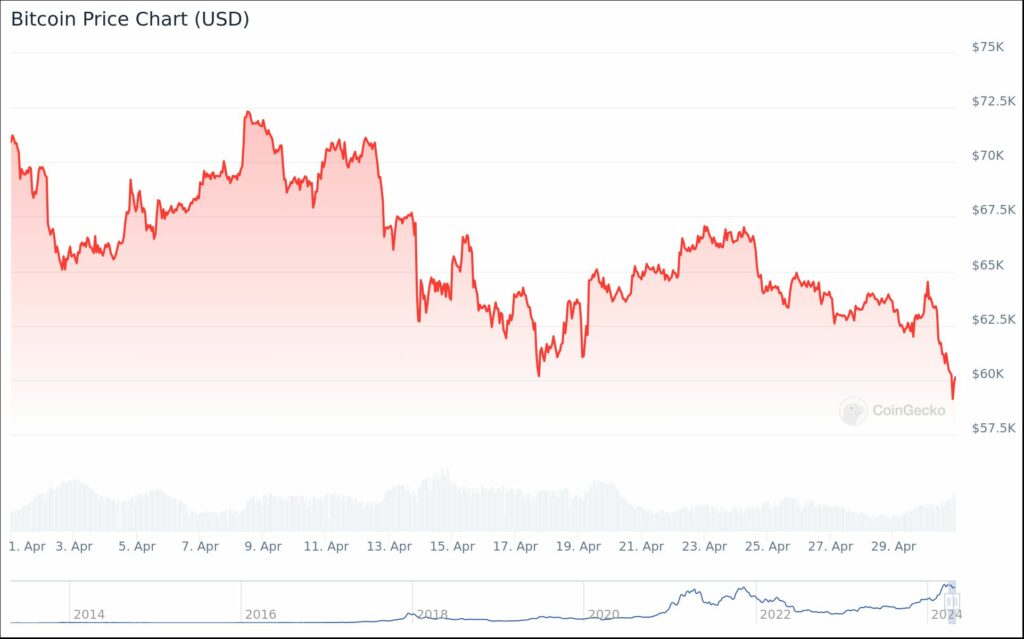

Why? Because BTC tumbled hard in April. After kicking off at a record high of $71,329.30, prices crashed by 14.95% — with a monthly close of $59,228.70.

Although values have now managed to recover, there is still wariness over what lies ahead. This is the first time that Bitcoin has hit a new all-time high before a halving.

Some analysts have argued this might be the best we’re going to get in the current bull cycle, while others believe there could be a long wait before a rally resumes.

2. Forecasts are mixed on Bitcoin’s prospects

Former BitMEX founder Arthur Hayes claims he saw this coming all along — with a perfect cocktail of events dragging Bitcoin downwards:

“U.S. tax season, consternation over what the Fed will do, the Bitcoin halving sell the news event, and a slowdown of U.S. Bitcoin ETF asset under management growth coalesced over the prior fortnight to produce a well-needed market cleansing.”

Arthur Hayes

Nonetheless, he does believe that Bitcoin has now hit a local low, and there will be “range-bound price action between $60,000 and $70,000 until August.”

While Standard Chartered has doubled down on its prediction that BTC will reach $150,000 by the end of the year, the bank’s warned a further drop to $50,000 is possible.

Bloomberg Intelligence’s senior commodity strategist Mike McGlone has also struck a cautious tone. In a note shared with crypto.news, he said “sticky inflation appears connected to speculative excesses in Bitcoin and equity prices” — and there may be some time yet before the Federal Reserve starts easing interest rates. He wrote:

“If the S&P 500 is starting to retrace the almost straight up rally from the October low, the highly volatile crypto might suffer. Our view is the Fed is unlikely to ease until beta tells it to by deflating, with headwinds for all risks assets and potential tailwinds for gold.”

Mike McGlone

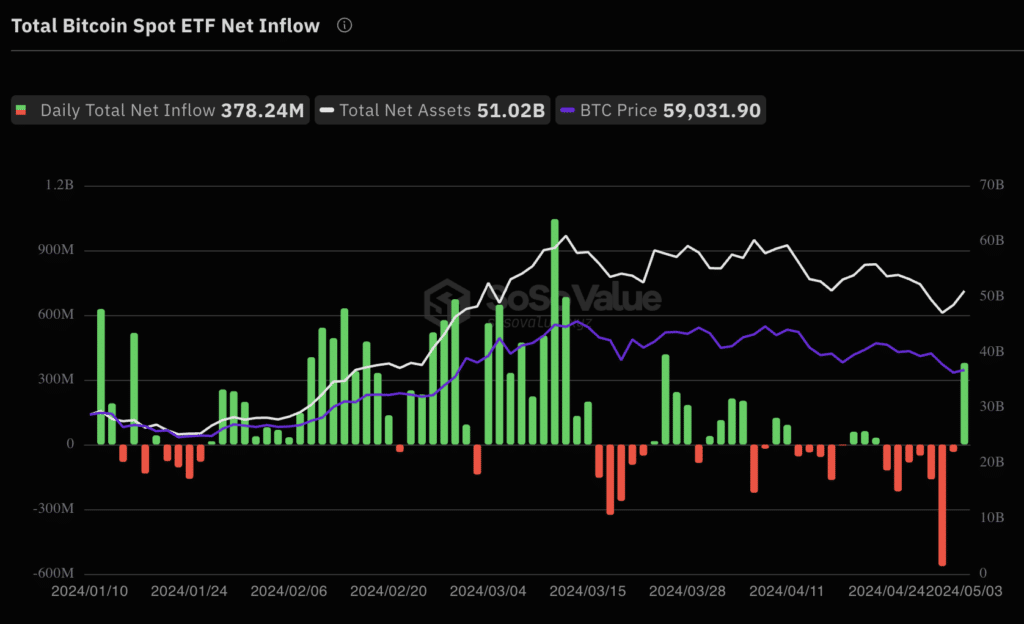

3. Times are tough for Bitcoin ETFs

After initial euphoria following their approval by the U.S. Securities and Exchange Commission in January, appetite for exchange-traded funds based on Bitcoin’s spot price looks like it’s starting to cool.

Data from SoSo Value shows there were record outflows of $563 million from BTC ETFs on May 1 — with a six-day streak in the red snapped on May 3, when there were total inflows of $378 million. Bloomberg Intelligence analyst James Seyffart said at the time that “inflows and outflows are part of the norm in the life of an ETF.”

Nonetheless, despite lofty predictions that the arrival of Bitcoin and Ethereum ETFs in Hong Kong would deliver trading volumes that far exceeded the debut on Wall Street, it was a disappointing launch, to say the least.

Just $8.5 million in trading volumes were recorded across spot Bitcoin ETFs on day one — 98.6% less than the $628 million seen when they arrived in the U.S. But JAN3 CEO Samson Mow believes exchange-traded funds in Asia just need time to find their feet:

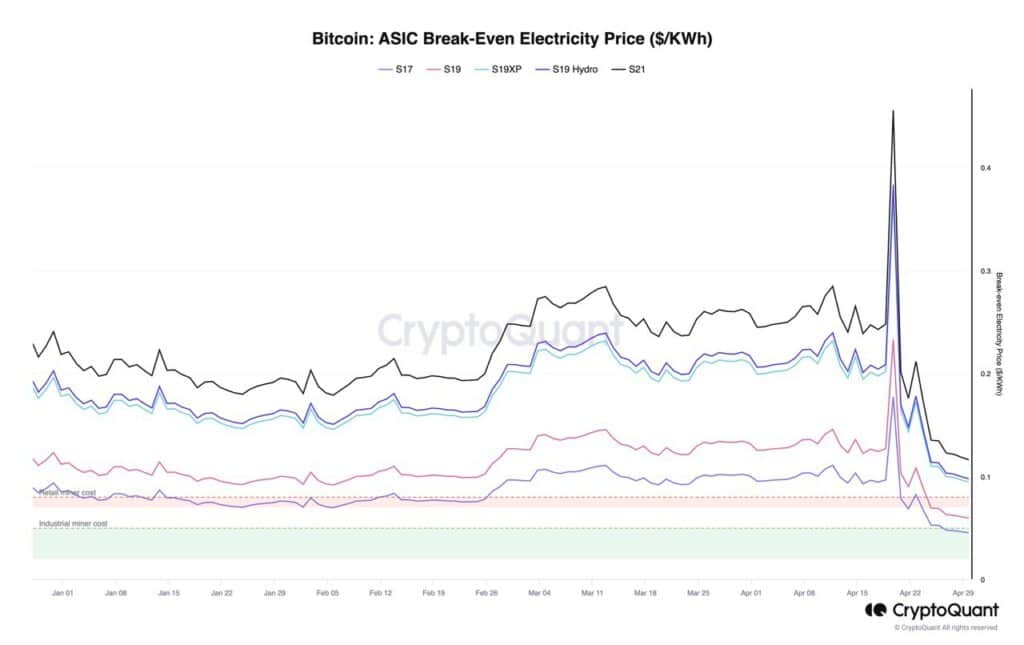

4. A nervous wait for miners

CryptoQuant recently told crypto.news that Bitcoin miners could face significant challenges unless prices recover in the coming weeks — with higher electricity costs and permanently lower block rewards leaving the industry feeling the pinch. Head of research Julio Moreno said:

“[The market is] more likely to see a miner capitulation if prices don’t recover significantly during the summer. Especially with the hashprice (average miner revenue per hash) making new lows.”

Julio Moreno

But there’s a problem: trading volumes across the board tend to decline during the summer months — with Bitcoin typically performing below average between June and September.

5. Keep an eye on these two

Undeterred, some executives are continuing to get their hands on as much Bitcoin as they can.

MicroStrategy now owns 214,400 BTC, paying an average price of $35,180 per coin. Given Bitcoin’s trading at $63,600 at the time of writing, Michael Saylor’s big bet means the company’s sitting on paper profits of $8.1 billion.

Meanwhile, Block — led by former Twitter CEO Jack Dorsey — has now started allocating a chunk of its gross profits to buying additional BTC.

There’s no predicting where Bitcoin will head next, but it looks like there are reasons to be optimistic.