94% of Bitcoin holders are in profit; will they sell?

The number of Bitcoin addresses in profit has significantly increased following its price surge above the $65,000 zone.

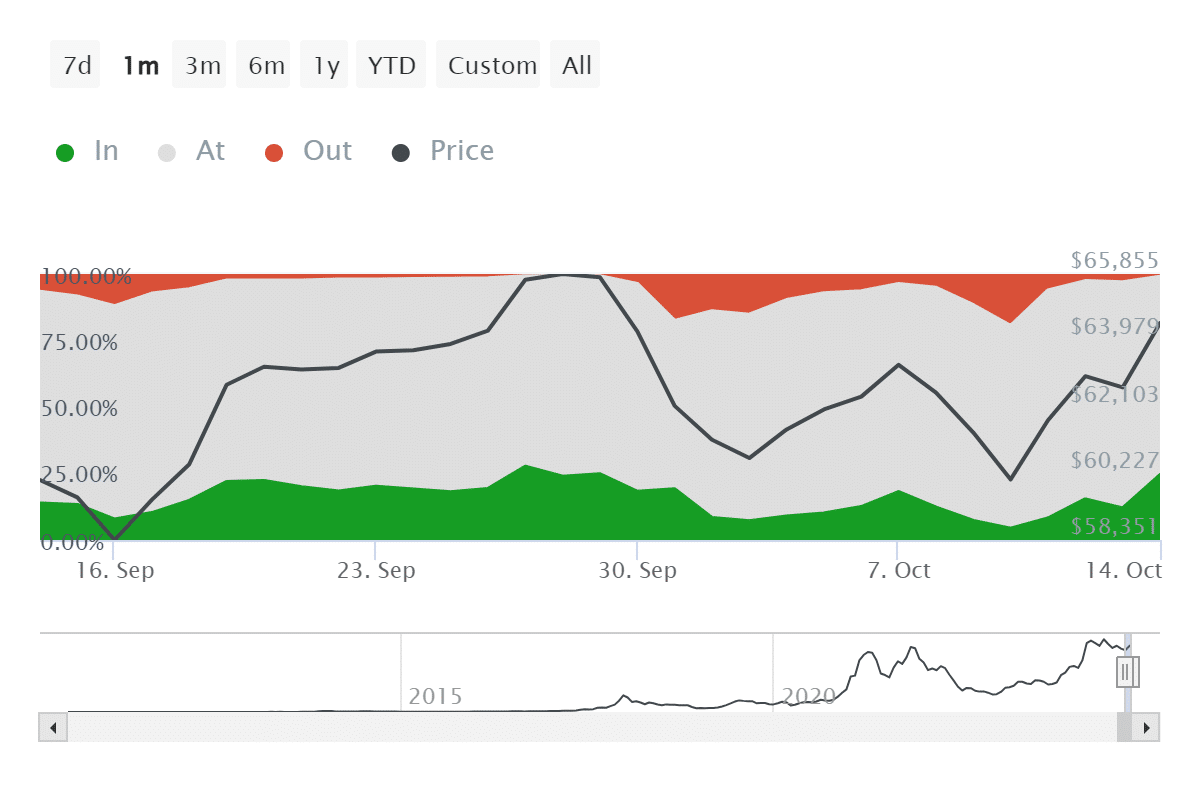

According to data provided by IntoTheBlock, over 50.67 million Bitcoin (BTC) addresses have accumulated the asset below $65,500, accounting for 94% of the total BTC holders.

The remaining 6%, around 3.37 million addresses, purchased Bitcoin for an average price of $68,139 with a total volume of 1.58 million BTC, per data from ITB.

Of this tally, over 80,000 daily active addresses are in profit and around 247,000 holders are close to their initial investment, per ITB data. At this point, only 3,440 of the active addresses are losing money.

A pretty similar movement was also noticed in late September as Bitcoin plunged from $65,800 on Sept. 28 to $60,000 on Oct. 3 as the investors and traders aimed for short-term profits. The current chart hints at a local top as the market has been moving without long-term catalysts.

One of the key drivers behind the BTC price surge is the sudden increase in short liquidations. Per a crypto.news report, over $145 million in crypto assets have been liquidated in the past 24 hours, with Bitcoin leading the pact with $63 million in liquidations.

Moreover, the $555.9 million inflows in spot BTC exchange-traded funds in the U.S. also triggered bullish sentiment around investors and traders as well.

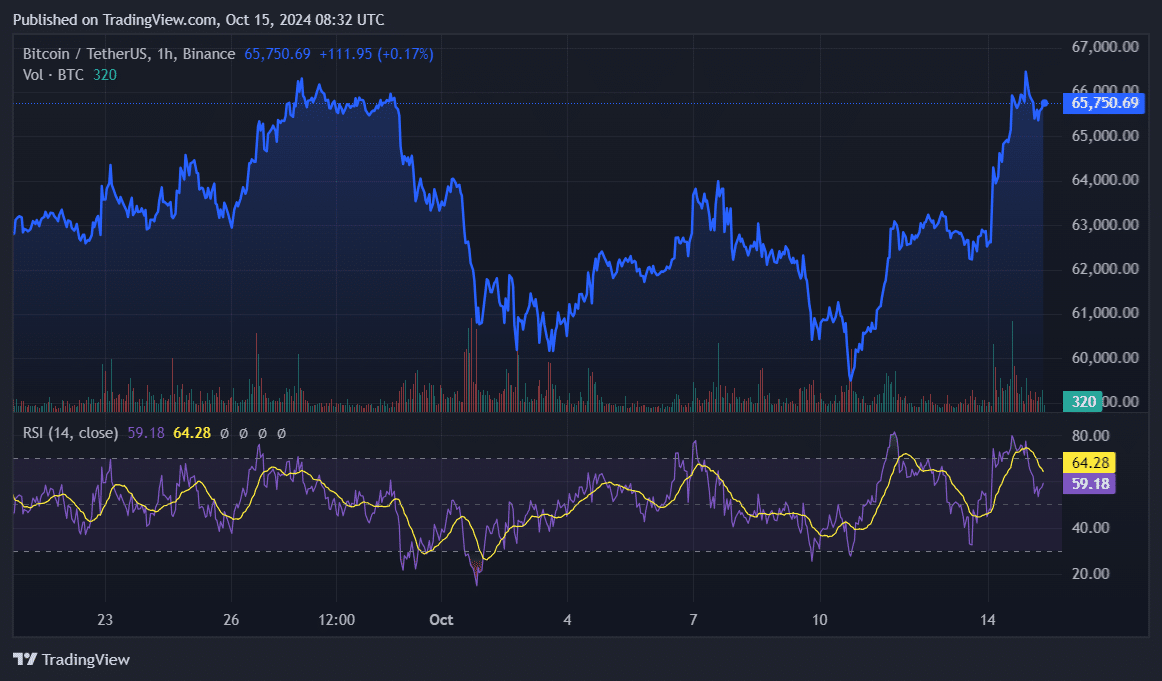

Despite the latest correction, the BTC price is still up 1.8% in the past 24 hours and is trading at $65,750 at the time of writing. The asset’s market cap is sitting at $1.3 trillion with a daily trading volume of $39.5 billion.

Data shows that Bitcoin’s Relative Strength Index is hovering at 64, showing that the asset is slightly overbought at this point. A further price hike would be expected for Bitcoin if the RSI cools down close to the 50 mark.