94% of TRX holders in profit amid quick price recovery

The majority of TRON holders are currently in profit but mixed social and on-chain signals have been dominating the asset.

TRON (TRX) is up by 2.2% in the past 24 hours and is trading at $0.136 at the time of writing, while its market cap is currently sitting at $11.8 billion with a daily trading volume of almost $300 million, per data from crypto.news.

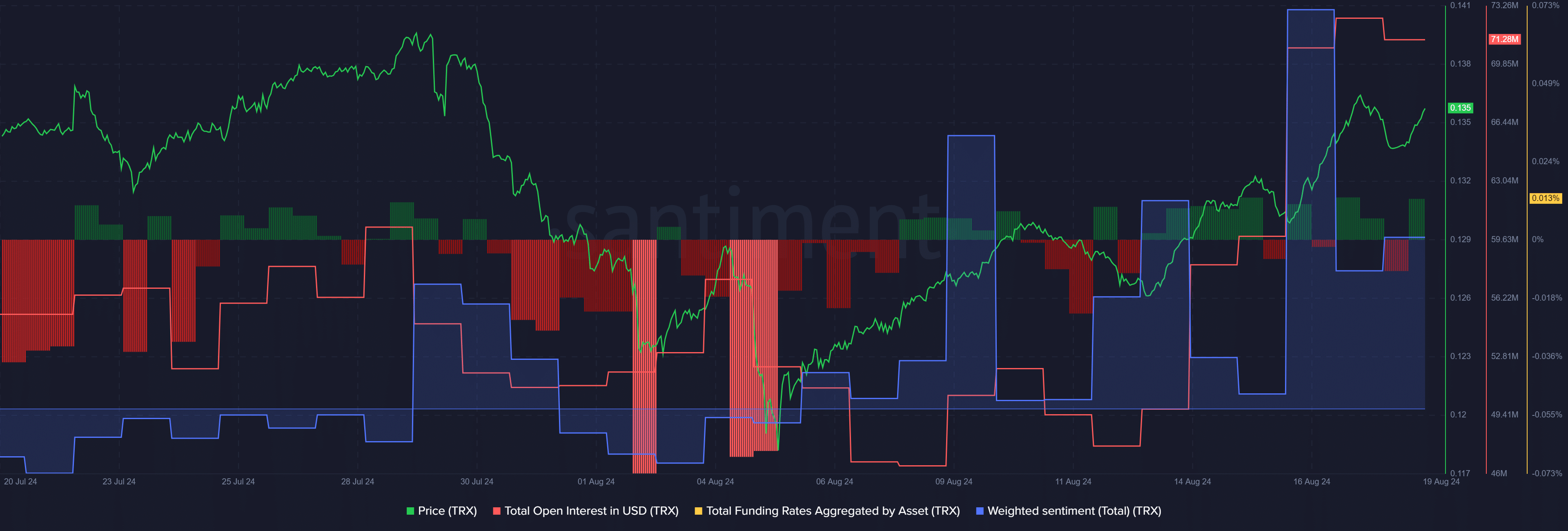

Santiment metrics reveal that TRX’s price surge from $0.126 has led to a significant increase in total open interest over the past week, climbing from $47 million on August 12 to $71 million at the time of reporting, reaching a five-month high.

A sudden surge in TRX’s open interest could potentially mean higher liquidations that can cause high price fluctuations.

Data from the market intelligence platform shows that the total funding rates aggregated by TRX rose to 0.012% after falling to the negative zone on Aug. 18. Historically, TRX faces a price correction despite traders’ bullish stance on the asset. Quite similarly, the weighted sentiment around TRON remains mostly bullish, per Santiment.

TRON’s high concentration raises volatility risks

According to data provided by IntoTheBlock, roughly 94% of TRX holders are currently in profit despite the price being 55% down from its all-time high of $0.30 in January 2018. Only 3% of TRX addresses have accumulated the asset between $0.136 and $0.166 and the remaining tokens are neither in profit nor at loss.

When the amount of holders in profit reaches a very high level, some addresses could potentially take profits before the price declines.

It wouldn’t be surprising if TRX faces high price volatility due to its token concentration. Per ITB data, over 56% of Tron tokens are sitting in whale wallets and 34% belong to retail investors. While on-chain indicators show the possibility of a price downturn, TRX could still hike due to increased positive sentiment on social platforms.