a16z leads funding for Pakistan stablecoin startup

a16z leads a funding round for a startup that is exploring the use of stablecoins in Pakistan and other emerging countries through neighborhood stores.

- Andreessen Horowitz (a16z) is leading a $12.9 million funding round for Zar, a fintech startup founded in 2024 that enables cash-to-stablecoin conversions through local agents in emerging markets.

- According to a16z’s State of Crypto 2025 report, stablecoin transactions surpassed $46 trillion over the past year, nearly triple Visa’s volume, as adoption rises alongside improved blockchain infrastructure.

According to a recent report from Bloomberg, Andreessen Horowitz is spearheading funding for a fairly new startup called Zar that seeks to help countries with high unbanked populations to use stablecoins. At the moment, the firm aims to test out dollar-backed digital coins in Pakistan, which has the third-largest unbanked population according to the World Bank.

In a statement shared by the firm, Zar recently raised as much as $12.9 million in a financing round involving major capital ventures including Dragonfly Capital, VanEck Ventures, Coinbase Ventures and Endeavor Catalyst.

Established in 2024 by Brandon Timinsky and Sebastian Scholl, Zar is a fintech and crypto startup. It aims to enable cash-to-stablecoin conversions via physical agents such as local corner shops in neighborhoods within emerging countries.

The way that the startup operates is by employing thousands of mobile phone kiosks, convenience stores and money agents to facilitate cash-to-stablecoin conversations. Users can walk into a local shop, scan a QR code to download the platform and hand over cash to the storekeeper in exchange for stablecoins that will pop up in the user’s mobile wallet.

The startup specifically targets emerging countries with significant cash usage and less stable currencies, such as Pakistan, Indonesia, Nigeria, Argentina, and 20 other countries that have large unbanked populations.

In a previous funding round, back in April 2025, a16z also joined in. The venture capital firm helped the startup raise $7 million in financing which included VanEck Ventures, Coinbase Ventures and Solana (SOL) co-founders.

At the time, the platform had about 100,000 users lining up to register and 7,000 stores expressing their willingness to collaborate with Zar.

a16z report: Stablecoin transfers surpass Visa transactions

According to Andreessen Horowitz’s State of Crypto 2025 report, stablecoins have been used to process $46 trillion in transaction throughout the past year. When compared to Visa’s annual transaction volume, the number has nearly tripled.

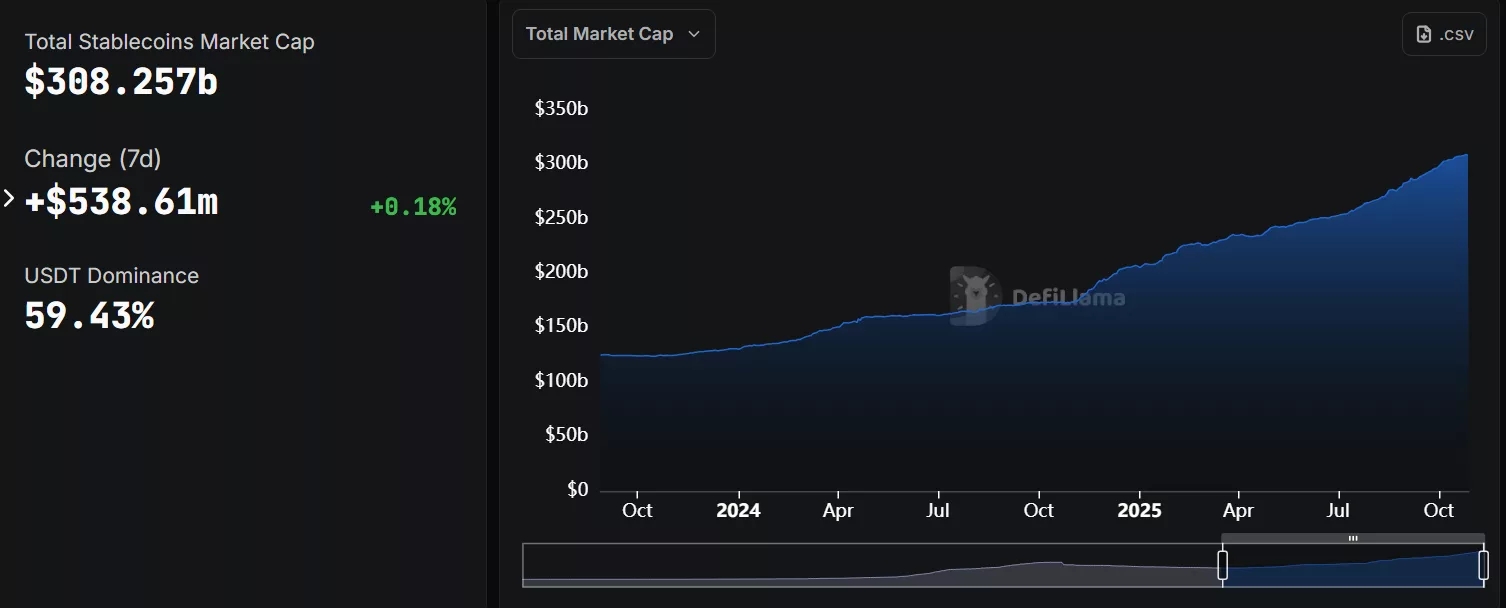

The report notes that stablecoin transaction volumes reached nearly $1.25 trillion in September 2025, marking one of the highest monthly totals to date. The market value for stablecoins have surged to $308.25 billion, with an increase of $538.6 million within the past week. However, most of the industry is still dominated by U.S-backed tokens, specifically USDT (USDT) which is nearing 60% in domination.

Analysts from a16z also highlighted that the growth of the stablecoin industry has become increasingly detached from the overall crypto trading activity, suggesting that stablecoins are now being used for real-world economic transactions rather than mere speculative trading.

Not only that, the number of monthly active crypto users now has increased by around 10 million people over the past year. It now ranges somewhere between 40 million to 70 million. This rise in users has been fueled by major improvements in infrastructure.

For instance, nowadays blockchain networks can handle over 3,400 transactions per second, representing a more than hundredfold increase in processing capacity compared to five years ago.