Aave Horizon tops $50M in deposits days after launch

Aave Horizon has surpassed $50 million in deposits within days of its launch, while early borrowing activity has already reached $6.2 million, primarily in USDC.

- Aave Horizon has surpassed $50 million in deposits just days after launch, dominated by RLUSD and USDC.

- Borrowing activity is still modest at $6.2 million, with nearly all loans taken in USDC.

Just days after launch, Aave Labs’ institutional lending platform Horizon has already surpassed $50 million in deposits. While borrowing activity remains modest at around $6.2 million, the rapid inflow of liquidity highlights growing institutional interest in tokenized assets and on-chain credit markets.

The bulk of the deposits so far have come in RLUSD ($26.1M) and USDC ($8M), with USDC accounting for nearly all borrowing activity at $6.19 million, according to live market data. Other supported assets like GHO, tokenized U.S. Treasuries, and collateralized loan obligations have yet to see borrow-side traction.

How Aave Horizon works

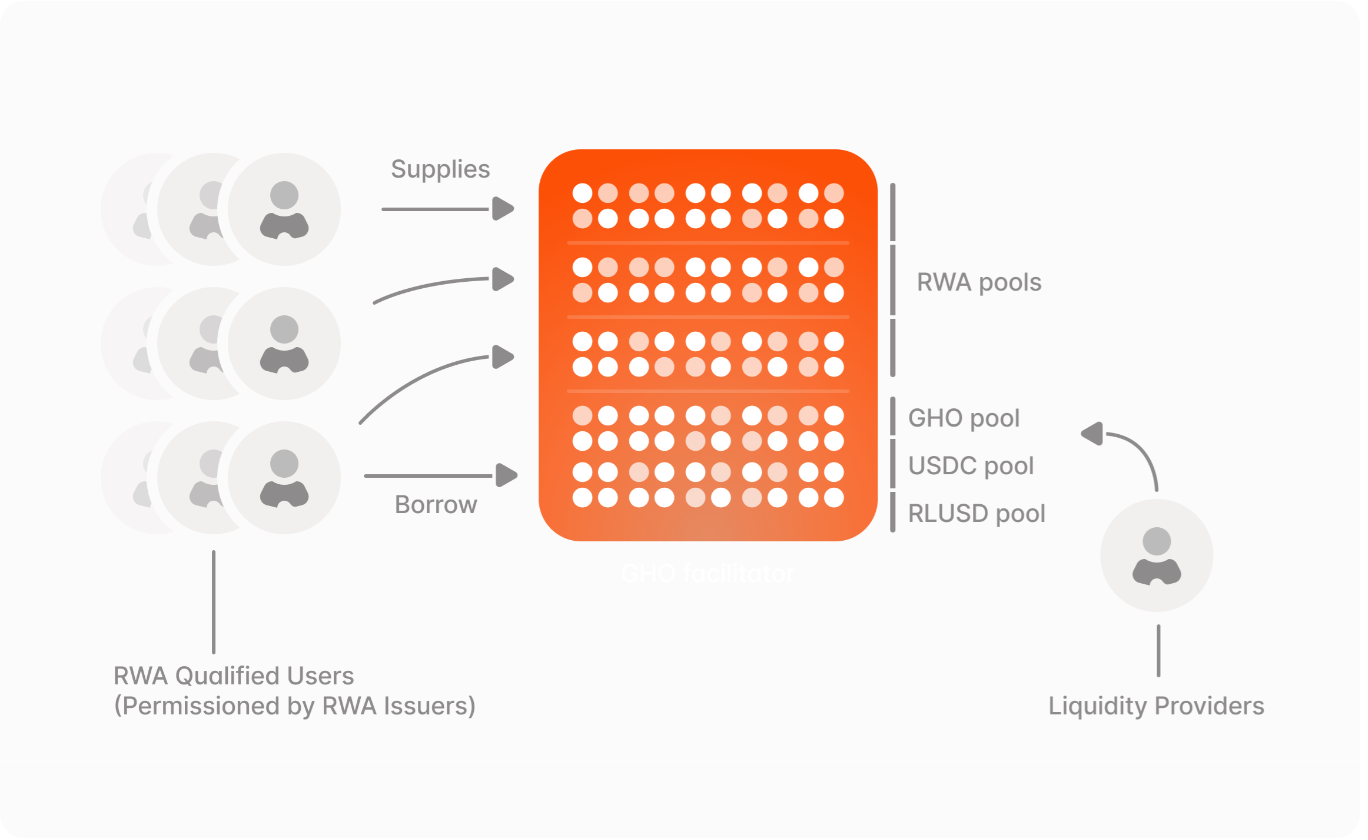

Behind the scenes, Horizon operates through a system of segregated pools — one set for tokenized RWAs, and another for stablecoin liquidity. Qualified users, vetted and permissioned by RWA issuers, can supply their tokenized assets (such as USTB/USCC by Superstate and JTRSY/JAAA by Centrifuge) into designated RWA pools. Once deposited, these assets serve as collateral for borrowing stablecoins like USDC, RLUSD, or GHO from the corresponding liquidity pools. USDt-b, Ethena’s synthetic, yield-bearing stablecoin, is also set to be added to the platform.

On the other side of the market, liquidity providers — who don’t require any permissions — supply stablecoins into these lending pools, earning yield from institutional borrowers. The result is a two-sided market: institutional-grade collateral flows in from regulated entities, while stablecoin liquidity is sourced from the broader DeFi ecosystem.