AAVE jumps 11% fueled by heightened whale activity

AAVE, the native token of the decentralized lending platform Aave, has recently attracted attention from whales as its price surged by over 11% on Sep. 5.

At the time of writing, Aave (AAVE) had climbed to become the 42nd largest cryptocurrency, up from its 47th position on August 20. The token’s market capitalization exceeded $1.98 billion, marking a more than 4% increase in the past 24 hours.

According to price data from crypto.news, AAVE was trading at $132.95, rising from its weekly low of $116.13 reached just the day before. The token has seen a significant 60% increase over the last 30 days. Despite this recent rally, AAVE remains 80% below its all-time high of $661.69, achieved in May 2021.

The latest surge in AAVE has been largely driven by a major jump in whale activity. On Sep. 5, Lookonchain reported that two whales acquired around $2.2 million worth of AAVE within a span of less than three hours.

Moreover, the previous day, another whale purchased a substantial 50,604 AAVE tokens, valued at approximately $6.78 million, with an average price of $134.60 per token. This brought their total holdings to 125,605 AAVE tokens, valued at about $16.9 million at current prices.

AAVE has increasingly gained traction among whales in August, likely due to its solid fundamentals. Data from DeFiLlama shows that Aave holds over $11 billion in assets and has generated more than $281.39 million in fees this year.

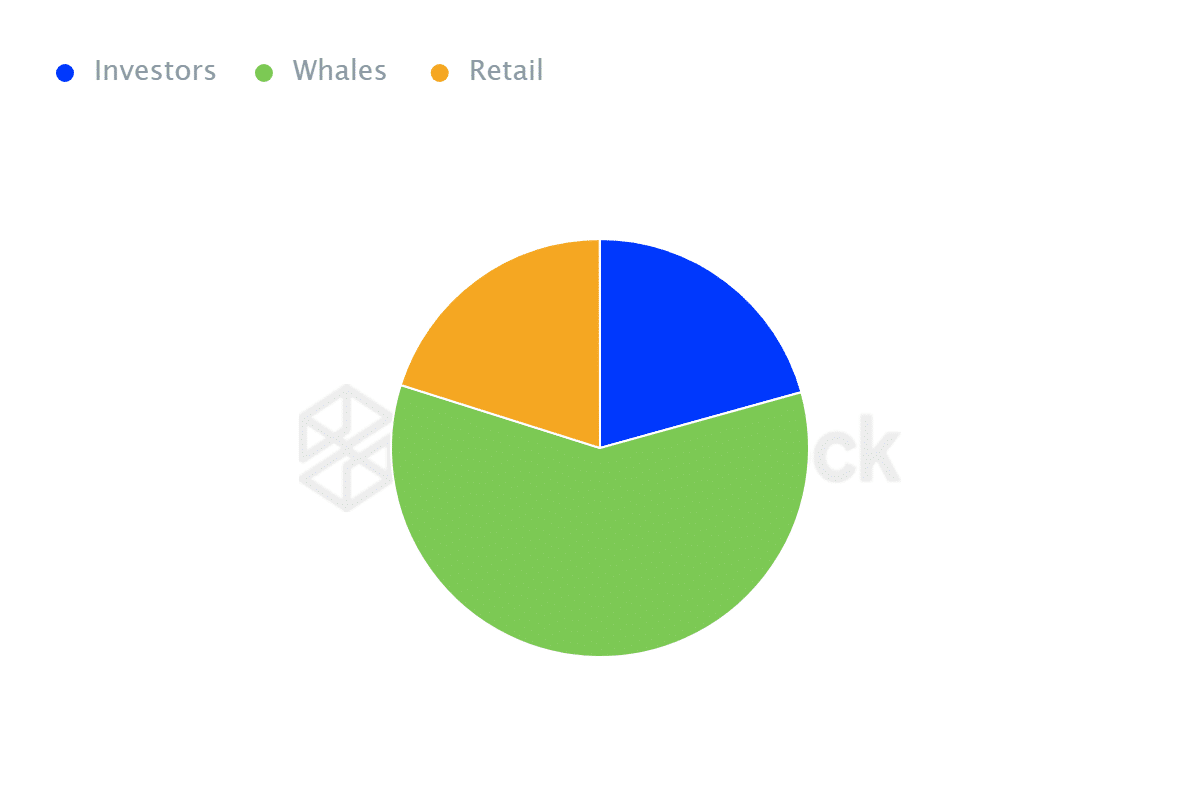

Moreover, data from IntoTheBlock reveals that whales controlling over 1% of Aave’s circulating supply now hold 59.17% of the total supply. The high concentration of large holders suggests that AAVE’s price is being influenced by whale activity.

Additionally, there has been a sharp increase in both the inflows and outflows of AAVE among large holders, with inflows rising by 326% and outflows by 353% over the last week. However, the net flow of AAVE among large holders surged by 61% in the same period, indicating strong buying interest that has helped drive the upward momentum in AAVE’s price.

The recent price surge in AAVE also comes after Donald Trump announced his DeFi initiative, World Liberty Financial. This project plans to develop a decentralized financial system using Aave’s non-custodial lending platform and Ethereum’s infrastructure.

Gabriel Shapiro, a legal adviser for the initiative, explained that it will function as a “lightweight non-custodial feeder” into Aave, enabling users to make deposits without the need for creating a fork. The venture aims to introduce Trump supporters to DeFi, which has bolstered confidence in Aave’s potential for mainstream adoption and spurred speculative buying.

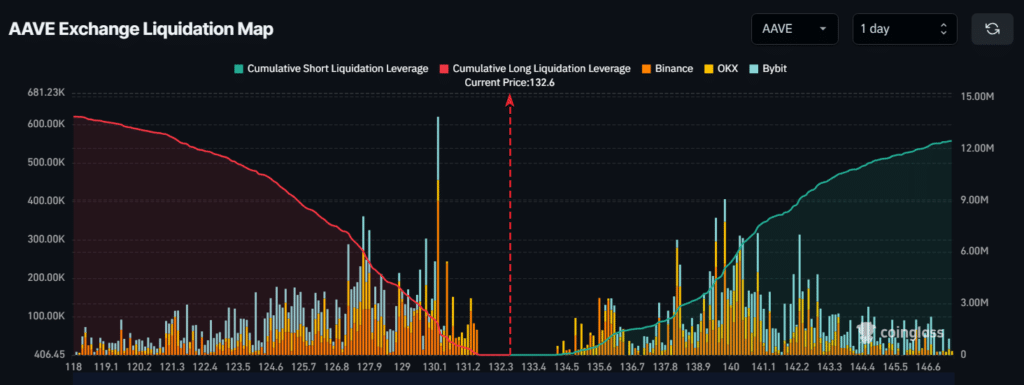

Major liquidation levels

Currently, key liquidation levels are around $130.2 on the lower end and $139.8 on the upper end, with intraday traders highly leveraged at these points, according to on-chain analytics firm Coinglass.

If market sentiment shifts and AAVE’s price drops to $130, nearly $1.78 million in long positions could be liquidated. On the other hand, if sentiment improves and the price climbs to $139.8, about $5.04 million in short positions may face liquidation.

At press time, data indicated that bears were in control, with the potential to trigger liquidations of long positions at lower levels.