AI dApps gain 26% in April, challenge DeFi and gaming for dominance

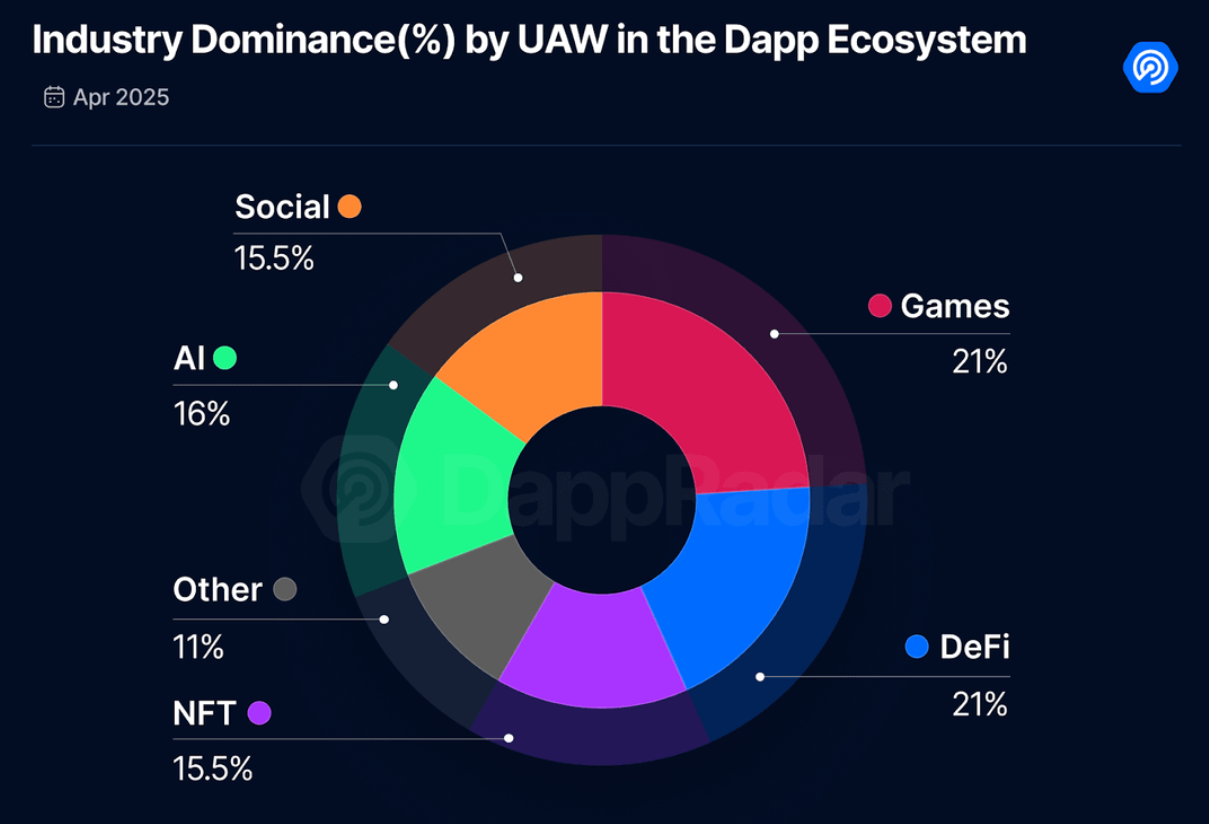

AI-focused decentralized apps saw a 26% month-over-month rise in active wallets in April, outpacing DeFi’s 18% growth and gaming’s 7%, data from DappRadar shows.

Artificial intelligence-themed decentralized applications saw a major boost in April, growing their user base by 26% from March to reach 3.8 million unique active wallets, making them the fastest-growing dApp category of the month, according to DappRadar’s latest report.

In the report, DappRadar’s blockchain analyst Sara Gherghelas revealed that the Social category followed closely, with an 18% increase to 3.6 million dUAW, suggesting that users continue to seek decentralized social experiences. In contrast, activity in decentralized finance dropped by 16%, settling at 4.8 million dUAW, equal to that of the gaming sector, which saw a 10% decline.

“For the first time in several months, Gaming and DeFi each hold 21% dominance, while AI has climbed to 16%, its highest yet. If this trend continues, AI could soon challenge the traditional dominance of DeFi and Gaming, signaling a new era in the dApp landscape.”

Sara Gherghelas

As Gherghelas put it, April was a month of “resilience and recalibration” for the dApp industry. While overall activity held steady at 23 million dUAW, the “real story lies in the changing dynamics beneath the surface,” she added.

In late April, analysts at Mike Novogratz’s crypto bank Galaxy Digital suggested that Bitcoin (BTC) miners with the right infrastructure and management talent can gain substantial value by pivoting into the booming AI and HPC data center market.

The analysts say crypto miners with experienced management teams capable of executing AI and HPC buildouts have a “tremendous opportunity” to bring “significant incremental value to their companies.” The appeal lies in the long-term contracts and strong, steady cash flow models of AI and HPC colocation — described by Galaxy Digital as “predictable and high margin cash flow streams” — a level of stability that’s often lacking in crypto markets.