Alpaca crypto rallies post-listings, but becomes severely overbought

Alpaca Finance token experienced a significant surge this week, reaching a high of $0.227, the highest level since April 8.

ALPACA (ALPACA) rose by over 252% from its lowest point this year, making it one of the top-performing coins of the week. Its market cap climbed to over $37 million, while its 24-hour trading volume spiked to $142 million.

The token’s surge followed the listing of its perpetual futures on Binance, the largest centralized exchange in the industry. This listing potentially exposed the token to over 216 million users on the platform.

In addition to Binance, WhiteBit, a partner of FC Barcelona, also listed Alpaca Finance’s perpetual futures. According to WhiteBit’s website, it recorded a 24-hour trading volume of over $6.5 million.

Alpaca Finance is one of the top Decentralized Finance dApps in the BNB Smart Chain ecosystem with over $55 million in funds deployed across its V1 and V2 networks. It is an alternative to AAVE (AAVE) that lets people borrow and earn rewards.

It is common for altcoins to see substantial gains following their listing on major exchanges like Binance and Coinbase.

Alpaca token gets overbought

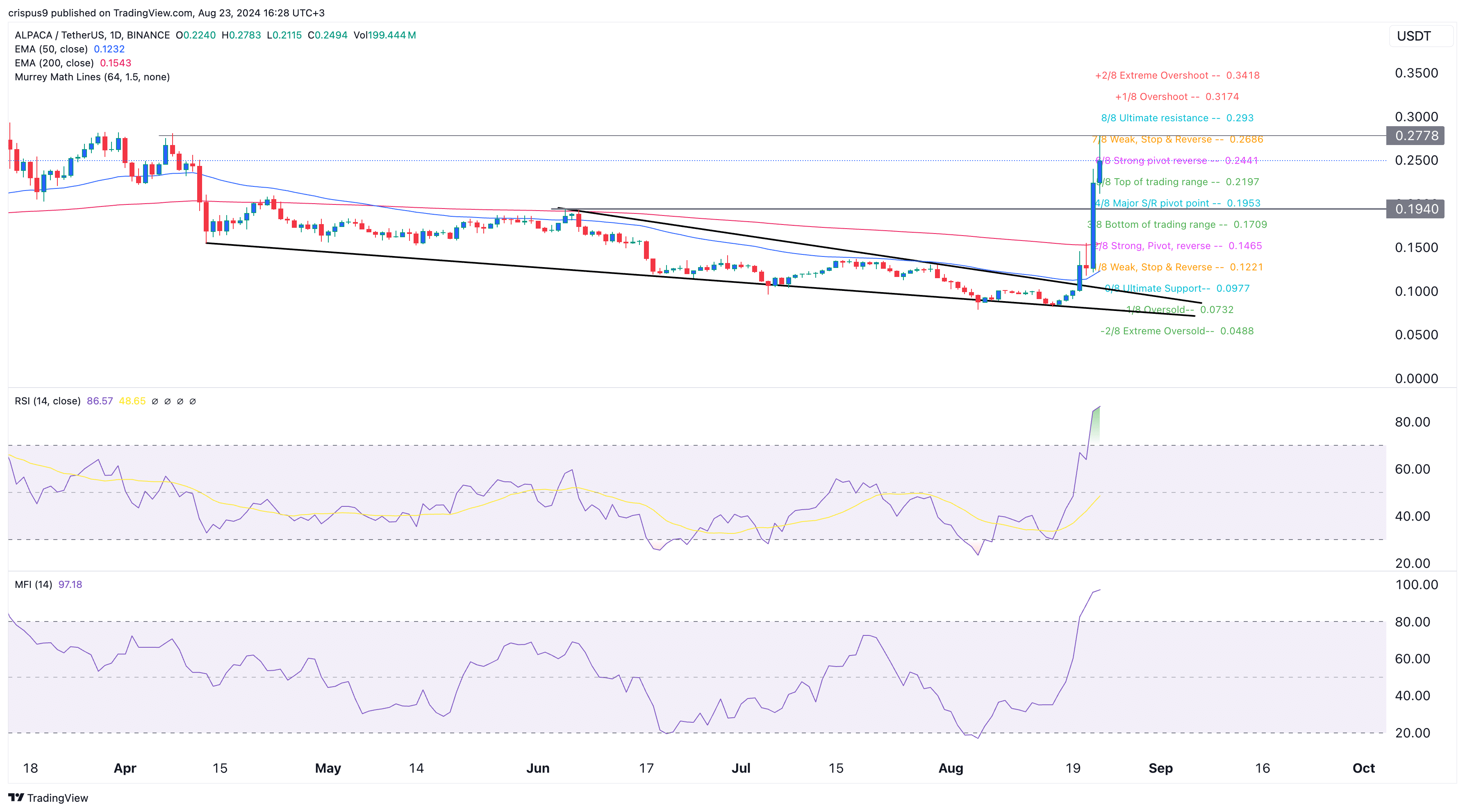

Alpaca’s price surge coincided with the convergence of two lines forming a falling wedge pattern, a technical setup that typically signals further upside potential.

The token broke above the key resistance level at $0.1940, the highest point on June 5, and surpassed both the 200-day and 50-day moving averages. This move indicates that bullish momentum is currently strong.

Alpaca reached a high of $0.2778, aligning with the weak, stop & reverse level of the Murrey Math Lines tool.

However, there are signs that it has gotten highly overbought. The Relative Strength Index rose to the extremely overbought point at 86 while the Money Flow Index indicator moved to 97.

While these overbought conditions reflect strong bullish momentum, they also suggest that a sharp reversal could occur as the initial excitement from the exchange listings fades. If a pullback happens, the key reference level to monitor would be $0.1940, which aligns with the major support/resistance pivot point of the Murrey Math Lines.