Altcoins gain as Bitcoin dominance falls to 57%: Fed narrative fading?

According to Binance Research, altcoins are the main beneficiaries of potential Fed rate cuts. Bitcoin, not so much.

- Bitcoin dominance is falling, suggesting a rotation into altcoins.

- Top altcoins significantly outperformed Bitcoin in August.

- Expectations of Fed policy change are boosting risk-on sentiment.

Macroeconomic changes are boosting altcoins, while Bitcoin (BTC) wavers. A September report from Binance Research shows that Bitcoin’s dominance fell to 57.3%, while Ethereum’s dominance rose to 14.2%. This reflects a broader market rotation toward altcoins, likely caused by the anticipation of September rate cuts by the Federal Reserve.

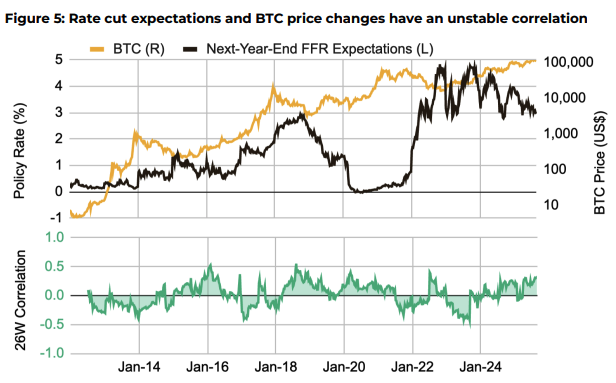

The market typically sees rate cuts as a bullish sign for Bitcoin. However, according to Binance Research, historical data do not support that view. The correlation between Bitcoin’s price and Fed interest-rate expectations is both low and highly volatile.

Instead, the relationship between BTC price and interest rates is more complex. Since rate cuts are likely already priced in, the driver for Bitcoin’s price is how these expectations change. Critically, the market will react to whether the Fed’s decision differs from what is already priced in.

Why altcoins outperformed Bitcoin

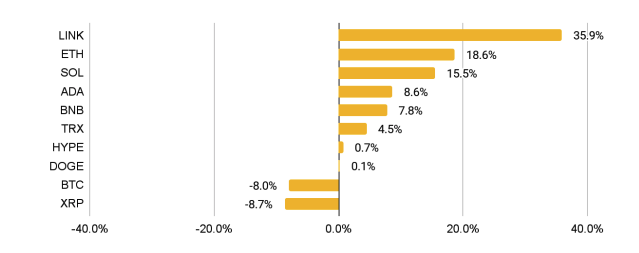

This also shows up in relative price performance between Bitcoin and altcoins. In August, out of the top ten altcoins, only one underperformed Bitcoin, which declined 8% in that period. Meanwhile, Ethereum (ETH) rose 18.6%, thanks to accumulation from both institutions and retail. ETF inflows and corporate treasury accumulations were the main contributing factors to Ethereum’s performance.

At the same time, Solana (SOL) rose 15.5% due to a mix of institutional interest and technical updates. For one, SOL corporate treasuries started to gain momentum, while the Alpenglow upgrade boosted overall market sentiment.