Analyst: Grayscale Bitcoin Trust sellout has clear reasons

A crypto trader shared why he believes Grayscale Bitcoin Trust is seeing a mass sellout.

Grayscale Bitcoin Trust (GBTC) has been observed selling off its Bitcoin (BTC) holdings, with recent reports indicating that the firm recently moved $1.3 billion of Bitcoin to Coinbase. Pseudonymous crypto trader Ash Crypto explained that he believes that market forces are the sole reason behind this liquidation in a Jan. 18 X post.

Historically, GBTC has been a significant holder of Bitcoin. This accumulation was primarily due to their practice of redeeming shares by paying investors in USD rather than selling off the underlying BTC. This approach changed following the approval of Bitcoin spot exchange-traded funds (ETFs).

According to Ash Crypto, two primary drivers exist for investors pulling their funds from GBTC. Firstly, Grayscale charges a 1.5% annual management fee, significantly higher than what ETF issuers charge. This fee disparity has made other ETFs more attractive to investors.

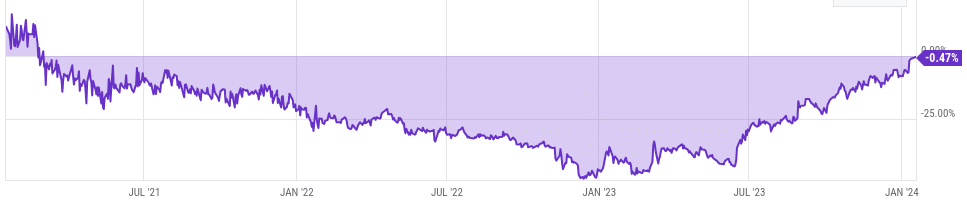

Secondly, the shift in the market sentiment is partly due to the pricing structure of GBTC shares. Many investors bought into GBTC at a substantial discount, reaching up to 49% in January 2023. However, with the discount now eliminated — standing at 0.47% as of press time — these investors are choosing to exit their positions, seeking more profitable or stable opportunities elsewhere.

These factors have led to a situation where GBTC is compelled to sell off BTC holdings to meet the redemption demands of exiting investors. Ash Crypto points out that this sell-off could have short-term implications for Bitcoin’s market performance, potentially leading to sideways movement or a decline in BTC value over the coming weeks.

The longer-term outlook suggested by Ash Crypto sees investors reallocating their funds from GBTC to other ETFs that offer lower management fees. The analyst warns that impulsive reactions and a lack of patience could lead investors to lose out in the volatile crypto market, especially given the influence of major players like Wall Street.