Analyst predicts $52k Bitcoin amid declining whale activity

Bitcoin (BTC) has gained bullish momentum amid declining whale activity while an analyst expects a downfall to the $52,000 mark could be possible.

BTC is up by 3.5% in the past 24 hours and is trading at $63,170 at the time of writing. The asset’s market cap surged to $1.24 trillion with a daily trading volume of $21.5 billion.

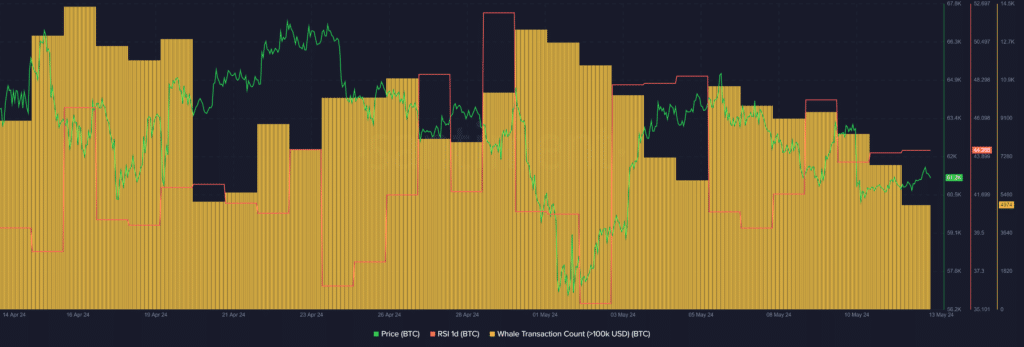

According to data provided by Santiment, whale transactions consisting of at least $100,000 worth of BTC have been consistently declining over the past four days — falling from 9,408 transactions on May 9 to 4,974 unique transactions at the reporting time.

The declining whale activity could mean that big players might be waiting for a price surge. Notably, the Bitcoin whale activity has dropped to this level for the first time since December 2018, data shows.

Per a report on May 12, the on-chain activity on the Bitcoin network plunged to its five-year lows — last noticed in 2019.

On the other hand, the Bitcoin Relative Strength Index (RSI) is currently hovering at 44, according to Santiment. The indicator shows that the flagship cryptocurrency is slightly undervalued at this point.

With the recent indicators in play, BTC could potentially witness a further price hike.

However, veteran investor and analyst Michaël van de Poppe said in an X post that Bitcoin is hovering in “the crucial level of support.” He added that negative news could trigger a fall to the $60,000 mark.

The analyst believes that dropping below the $60,000 zone could potentially trigger “a test” between $52,000 and $55,000.