Analyst projects Ethereum potentially to $2k amid market consolidation

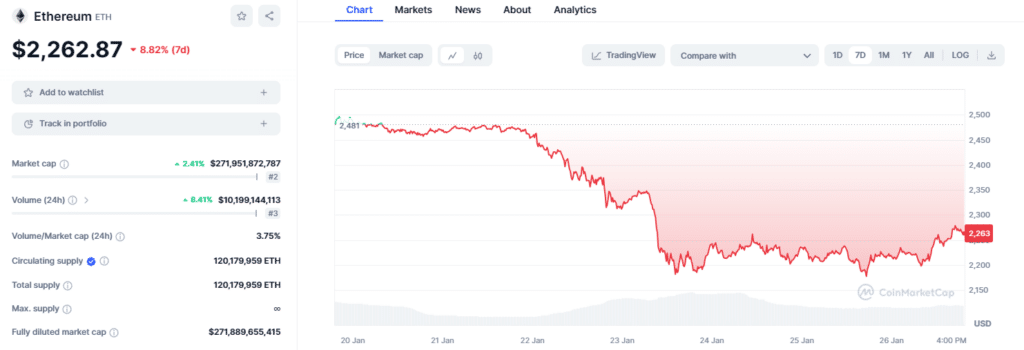

FxPro senior analyst Alex Kuptsikevicha projects Ethereum’s price could further dip towards $2,000, as the altcoin is down by over 8% weekly.

The crypto market is experiencing a period of subdued volatility, with the total market capitalization hovering around $1.6 trillion for the third consecutive day. Simultaneously, equity indices in the stock market have also significantly declined in the past 24 hours.

However, the impact on cryptocurrency investors has been minimal. Kuptsikevich thinks that the fall in stock values is seen more as a result of individual corporate stories rather than an indication of a global shift in market sentiment.

Bitcoin is benefiting from this consolidation phase, with its market share exceeding 50% once again. On the other hand, Ethereum has found itself at the lower end of the consolidation range, which it has been in for most of December. Kuptsikevich predicts that Ethereum is showing signs of possibly dropping to the $2,100 area, a level that marked the upper end of its November consolidation phase.

Kuptsikevich suggests that a further decline towards the $2,000 mark is possible, citing the cryptocurrency market’s inherent volatility. This potential dip could mirror a similar retracement in Bitcoin to the $37,500 level.

The SEC has also delayed its decision on BlackRock’s application for a spot Ethereum ETF until March 10. While some experts remain optimistic about the ETF’s approval by May, with a probability of 50-to-70%, others are wary of regulatory resistance.

The introduction of spot Bitcoin ETFs in the U.S. has broadened the appeal of cryptocurrencies to a wider audience. According to the head of institutional at Coinbase, this marks a potential shift towards mainstream adoption of digital currencies.

However, the influx of new capital into new cryptocurrencies is expected to be a gradual process, unfolding over months or even years.