Analyst: ‘undervalued’ Stellar Lumens price is ripe for a comeback

Stellar Lumens price has risen for two consecutive days, and some crypto analysts expect it to continue its comeback.

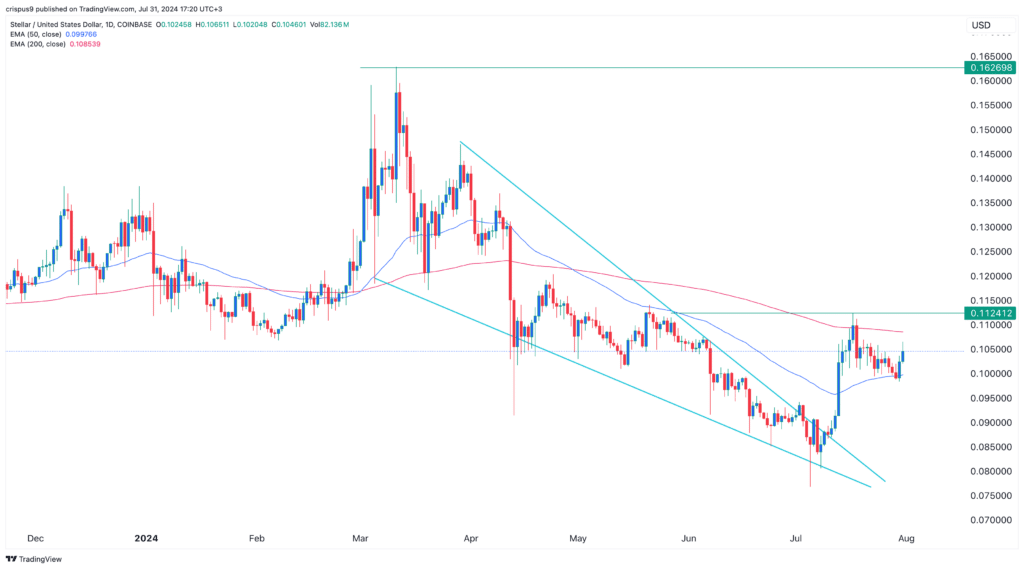

Stellar (XLM) was trading at $0.105 on Wednesday, up by 6% from its lowest point this month and by 36% from its July low.

Ripple (XRP) and Stellar have similar origins and goals. Stellar was established by Jed McCaleb, a computer programmer who served as Ripple’s Chief Technology Officer. Stellar is now mostly known for its partnership with Circle, the creator of USD Coin. Data by Circle shows that the total supply of USDC in Stellar stood at $228 million on July 31.

Stellar has also partnered with MoneyGram in a deal that lets USDC recipients access their cash in thousands of its locations globally.

Additionally, Stellar powers Franklin Templeton’s OnChain U.S Government Money Market Fund, which has accumulated over $402 million in assets. FOBXX is a tokenized fund similar to Blackrock’s BUIDL that aims to provide holders with regular income.

Some crypto analysts believe that Stellar Lumen’s has more upside to go. In an X post, Jonathan Morgan, the lead crypto analyst at Stocktwits, noted that Stellar was one of the most undervalued cryptocurrencies in the market. The other two were Algorand (ALGO) and Zcash (ZEC).

In another X post, Cryptosahintas, an analyst with over 155,000 followers, predicted that the XLM price would rise to $0.73. If this happens, it will imply a 600% increase from the current price.

XLM price needs to clear key resistance levels

For this Stellar forecast to work out, the token will need to flip the key resistance point at $0.1125 (July high) into support. It should then rise above the year-to-date high of $0.1626, which is about 55% above its Wednesday’s trading level.

On the positive side, this price action is possible since the token formed a falling wedge chart pattern between March and July. A falling wedge is one of the most popular signs in the financial market.

However, fundamentally, Stellar has some key issues. Its Soroban blockchain platform has gained little traction among developers. It has attracted just 6 Decentralized Finance developers and $11.70 million in total value locked.