Analysts hint to short-term panic orders amid Bitcoin’s drop

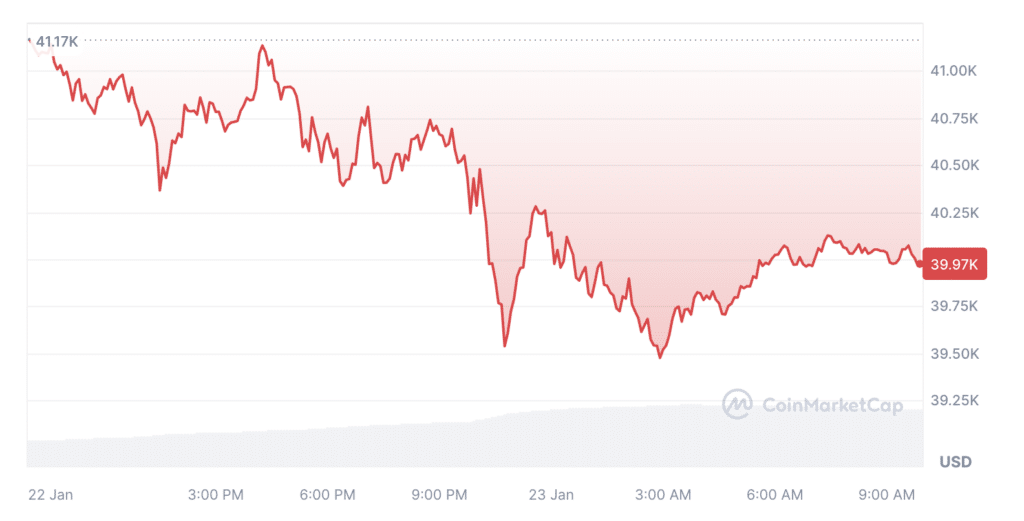

For the first time since the beginning of the year, Bitcoin (BTC) fell below the $40,000 level, leading to panic in the market.

Analysts at the Greeks.live service noted that the fall of BTC below $40,000 on the night of Jan. 22-23 led to a certain number of short-term panic orders on the market, and the bearish strength of the market has increased. However, overall, long and short positions are relatively balanced, and it is still a “fierce game.”

Bitcoin is still in a correction phase after launching several Bitcoin spot exchange-traded funds in the US for the first time. Over the past 24 hours, the price of the largest cryptocurrency has dropped by 3% to $39,970 at the time of writing. At the same time, BTC trading volumes have sharply increased over the past 24 hours by 113%, reaching $29.2 billion.

Greeks.live previously highlighted that the impact of the BTC spot ETF is over; the core of the recent market play is Grayscale selling pressure and new investor buying; the market is likely to occur mainly during the ETF trading session.

Meanwhile, spot Bitcoin ETFs experienced net outflows of $76 million in one day, according to Bloomberg analyst James Seyffart.

The leader in the outflow of assets was a fund from Grayscale with a total of $3.45 billion. However, the head of Grayscale, Michael Sonnenshein, remains optimistic about the fate of his company’s ETF, noting that Grayscale has been around for over ten years with a diverse investor pool and the most considerable liquidity of any spot Bitcoin ETF.