ArcBlock’s new staking feature drives ABT token up 20%

ArcBlock’s native token, ABT, surged over 20% in the last day, reaching a high of $0.31 before pulling back to $0.25.

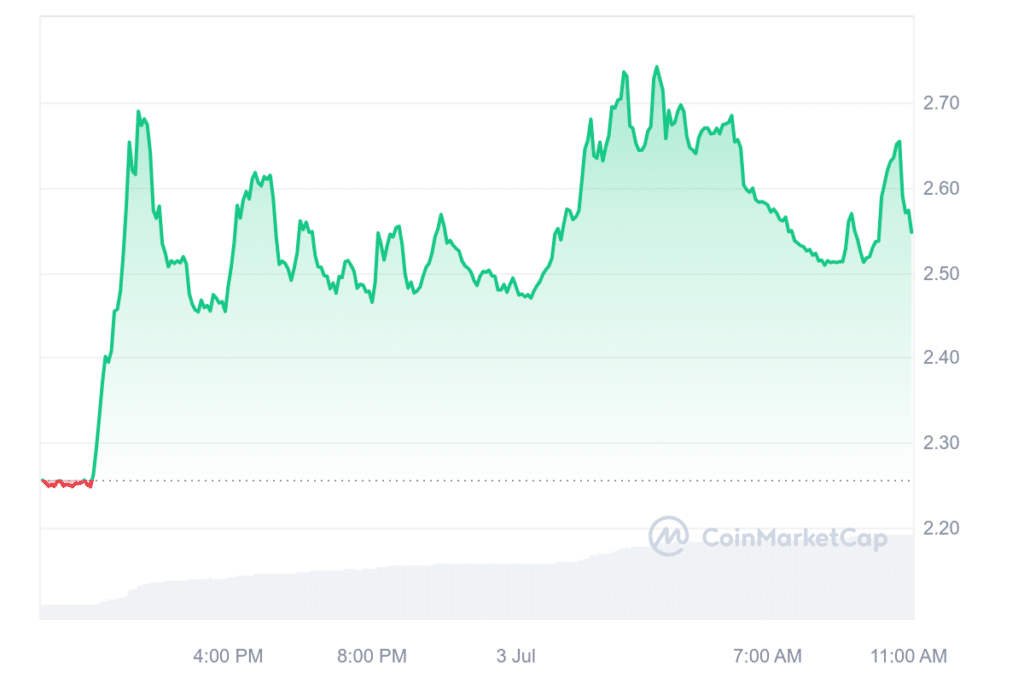

The price of Arcblock (ABT) surged over 20% in just 24 hours earlier today, rising from $2.26 to an intraday high of $2.74 before pulling back to $2.55 as of press time. This marks a nearly 13% gain over the same period.

The surge in ABT’s value was accompanied by a significant rise in trading volume, which spiked by over 450% to reach $8.3 million within the last 24 hours, compared to $1.43 million the previous day. This surge in activity also boosted the token’s market capitalization to $251 million.

Despite the recent gains, ABT remains 44% below its all-time high of $4.7, which was achieved on May 22. Currently, ArcBlock has a circulating supply of approximately 98.5 million ABT tokens out of a total supply of 186 million.

ArcBlock’s platform combines blockchain technology with cloud computing to facilitate the development and deployment of decentralized applications (dApps). The ecosystem is designed to be user-friendly and cost-efficient, supporting a variety of services, components, and applications. As an ERC-20 token, ABT is primarily used for payments within this framework.

A key component of ArcBlock’s ecosystem is its AI apps engine, AIGNE, which simplifies access to large language models and generative AI technologies. This engine allows users to build complete applications using AI without needing to write code, making it accessible to a wider audience.

The latest surge in ABT’s price could be attributed to ArcBlock’s announcement on July 1. The company introduced a major update to its Blocklet Store, implementing a “Stake to Publish” feature.

According to the ArcBlock team, staking ABT ensures quality, as bad actors risk losing their stake in distributing spam or malware in published Blocklets.

This update is seen as a move to enhance the platform’s security and quality, possibly driving increased investor interest and confidence.

While ArcBlock is performing well, the broader cryptocurrency market is experiencing a downturn. The global market cap currently stands at $2.26 trillion, with the Fear and Greed Index—a measure of investor sentiment—indicating a neutral outlook at 48.

Bitcoin, the largest cryptocurrency by market cap, has also seen a decline, with its price down by 3% to $60,967 at the time of reporting.