Are inflation fears the cause of Avalanche and Helium’s recent upward trend dip?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Avalanche and Helium see slowed momentum, Coldware is gaining attention for its practical, hardware-driven approach to blockchain adoption.

Crypto markets are still feeling the weight of inflation fears, and some recent winners are starting to dip. Avalanche and Helium have pulled back, which raises questions about what’s causing the shift.

At the same time, Coldware (COLD) is moving in the opposite direction. With real devices and everyday usability at its core, it’s gaining traction where others are stalling.

Here’s a closer look at what’s happening with AVAX, HNT, and why Coldware might be built for what comes next.

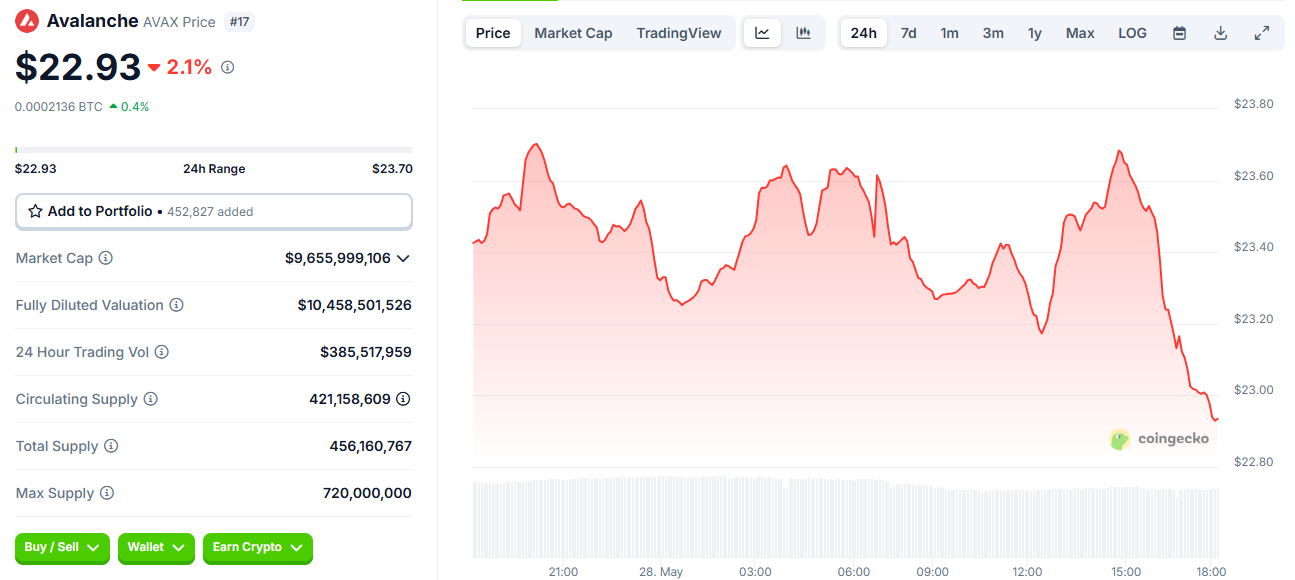

Avalanche pulls back slightly after recent gains

Avalanche is still finding ways to stay relevant. One of its latest wins is that Bergen County in New Jersey is planning to tokenize $240 billion worth of real estate deeds using Avalanche tech.

It’s one of the biggest real estate tokenization moves in the U.S. so far, and a strong sign that institutional interest in Avalanche is still there.

On the technical side, AVAX has just broken out of a falling wedge pattern. Analysts say if it holds above $20, the next resistance level could be around $35.

On the other hand, DeFi activity on the network has slowed quite a bit. Avalanche’s Total Value Locked (TVL) has dropped to around $1.56 billion, down 86% from its all-time high. DEX trading volumes have also taken a hit.

Right now, AVAX is trading at about $22.93, down 2% over the past 24 hours.

Helium’s growth slows after recent spike

Helium has been pushing to decentralize wireless networks by letting people set up their own hotspots and earn crypto for powering IoT connectivity.

It launched a $50 million grant program this month to support network growth in underserved areas, including regions across the U.S. and Mexico.

The project also rolled out a new tool called Observed Demand, which helps pinpoint where coverage is most needed and makes it easier for operators to place hotspots strategically, not just randomly.

The number of active Helium hotspots has stabilized around 350,000 to 370,000, which means the network might be shifting from quantity to quality.

Helium’s HNT token is trading at about $3.63, with a market cap of nearly $674 million.

Coldware is bridging blockchain with everyday devices

COLD is a Layer-1 blockchain that doesn’t just live in browser—it runs on real devices. It’s built to make blockchain easier and more practical for everyday people.

Most blockchains are all code, no hardware. Coldware comes with its own gear: the Larna 2400 smartphone and ColdBook laptop. These devices let use dApps, send crypto, chat securely, and stake tokens without a complicated setup or third parties.

What’s actually on these devices?

- Coldware Wallet – A multi-chain wallet with biometric login.

- Coldware Chat – Private messaging, fully encrypted.

- dApp Store – Access to blockchain apps directly from the device.

- dVPN – A built-in VPN that runs on decentralized tech.

Coldware is making it easier for people, especially those in underserved areas, to join the crypto space. Users don’t need fancy hardware or deep tech knowledge. Just a Coldware device, and they’re good to go.

The presale has already raised $50 million counting and a big chunk of tokens has already been snapped up.

Final thoughts

Avalanche and Helium are still in the game, but their recent dips show how quickly market sentiment can shift, especially in uncertain economic times. Both projects are evolving, but they’re also facing real challenges with momentum and adoption.

Coldware, on the other hand, is gaining ground by focusing on real-world use and accessibility. With working devices, a growing ecosystem, and a strong presale, it’s proving there’s still room for fresh, practical ideas in blockchain.