ARK Invest buys $17.77 million COIN, $11.19 million HOOD as BTC fell under $50k

Cathie Wood’s ARK Invest has started purchasing stocks of Coinbase and Robinhood again during a significant downturn in the market, marked by Bitcoin falling momentarily below $50,000.

On Aug. 5, ARK Invest acquired 93,797 shares of Coinbase Global Inc. (COIN) valued at $17.77 million. This marks ARK’s first acquisition of the cryptocurrency exchange’s shares after a period of selling off in 2024.

In addition, ARK bought 681,885 shares of Robinhood (HOOD), the crypto-friendly online brokerage, for $11.19 million, marking its first purchase since Feb. 13.

The buying activity was primarily within the ARK Innovation ETF (ARKK), which purchased 65,165 shares of Coinbase. The ARK Fintech Innovation ETF (ARKF) and the ARK Next Generation Internet ETF (ARKW) also participated, purchasing 15,629 and 13,003 shares of Coinbase, respectively.

Similarly, the ARKK fund acquired 461,100 Robinhood shares, while the ARKF and ARKW funds added 110,402 and 110,383 shares of Robinhood to their holdings, respectively.

Both COIN and HOOD experienced significant losses in their stock value on Monday, Aug. 5; COIN dropped by 7.3% to close at $189.47 and HOOD by 8.17% to $16.42 amid a broader market sell-off. The downturn was one of the most severe in recent times, affecting both crypto and global stock markets.

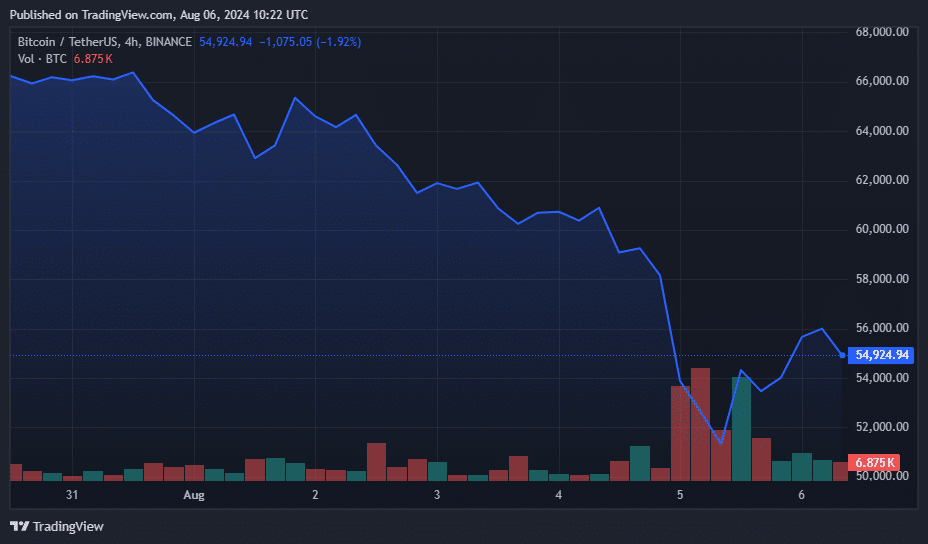

On the same day, Bitcoin’s (BTC) value dipped below $50,000 for the first time since February 2024, bottoming out at $49,800, according to price data from crypto.news. This sharp decline saw Bitcoin lose over 20% of its value, dropping from around $63,000 on Aug. 1 to a low before partly recovering to about $55,000.

Currently, Bitcoin is trading at $55,092, reflecting a 6.4% increase over the last 24 hours, although it is still down by 17% over the previous week.

ARK Invest typically increases its holdings in stocks during price dips, intending to sell them when their market values rise. The firm manages its portfolio to prevent any single investment from exceeding 10% of the total value of its ETFs, which has led to recent sales of COIN shares.