As Bitcoin rebounds to $66k, short-term holders sell at ‘basically zero profit’

While large investors appear to demonstrate their interest in Bitcoin, the growth has yet to accelerate in order to make the rally sustainable, analysts at CryptoQuant say.

The price of Bitcoin managed to recover to the $66,000 mark late Wednesday following the news of lower-than-expected inflation in the U.S., resulting in minimal or no profit for short-term holders who are selling.

In a recent research report, blockchain analytics firm CryptoQuant said short-term Bitcoin holders are selling “at basically zero profit,” adding though that the growth “has yet to accelerate in order to make the rally sustainable.”

“[…] traders are now experiencing unrealized losses on their positions, a situation that in the past has coincided with a local bottom in prices.”

CryptoQuant

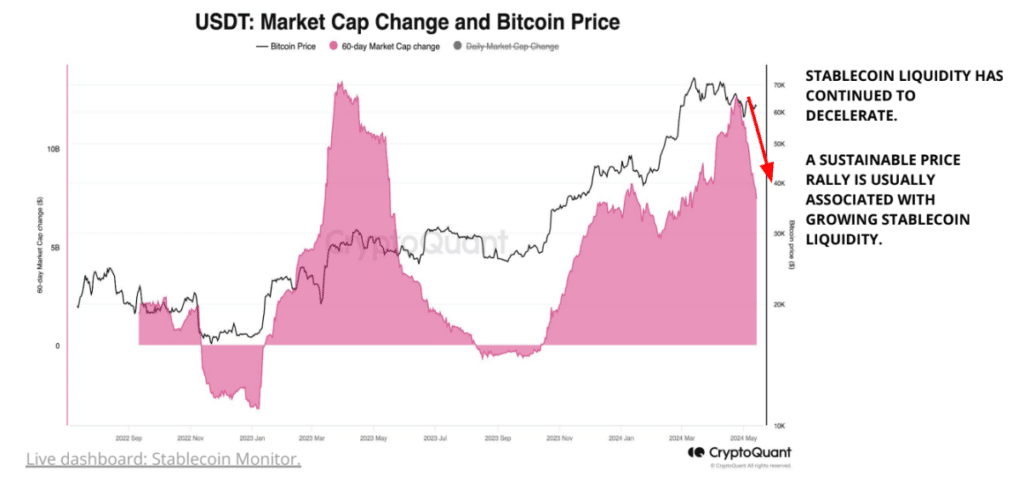

Additionally, the report notes that the balance of Bitcoin at over-the-counter desks has stabilized since late April, suggesting a decrease in the supply of Bitcoin entering the market through these channels. However, analysts caution that despite this stabilization, stablecoin liquidity growth, which is often associated with sustainable price rallies, is “still slowing down” from a market liquidity perspective.

The analysts also pointed out that Bitcoin’s price remains relatively undervalued from a miner profitability standpoint.

“Bitcoin miners are currently extremely underpaid and their profitability has fallen to the lowest since March 2020, a few days after the COVID market crash.”

CryptoQuant

Meanwhile, analysts at blockchain firm Kaiko suggest that Bitcoin’s recent halving might soon force miners to sell their crypto holdings should the prices fail to recover fast. This is because the daily average network fees, which spiked after the halving, are now decreasing. Initially, these fees gave miners some relief, Kaiko says, noting they’re falling again as the initial excitement about the Runes protocol has “cooled off.”