As Fartcoin price surges, profit leaders are not selling

Fartcoin price continued its strong rally this week, soaring to a record high and becoming one of the best-performing meme coins.

Fartcoin (FARTCOIN) surged to a high of $1.5640, climbing nearly 10,000% from its November low. Its market cap has jumped to $1.5 billion, making it a top player in the Solana (SOL) meme coin ecosystem.

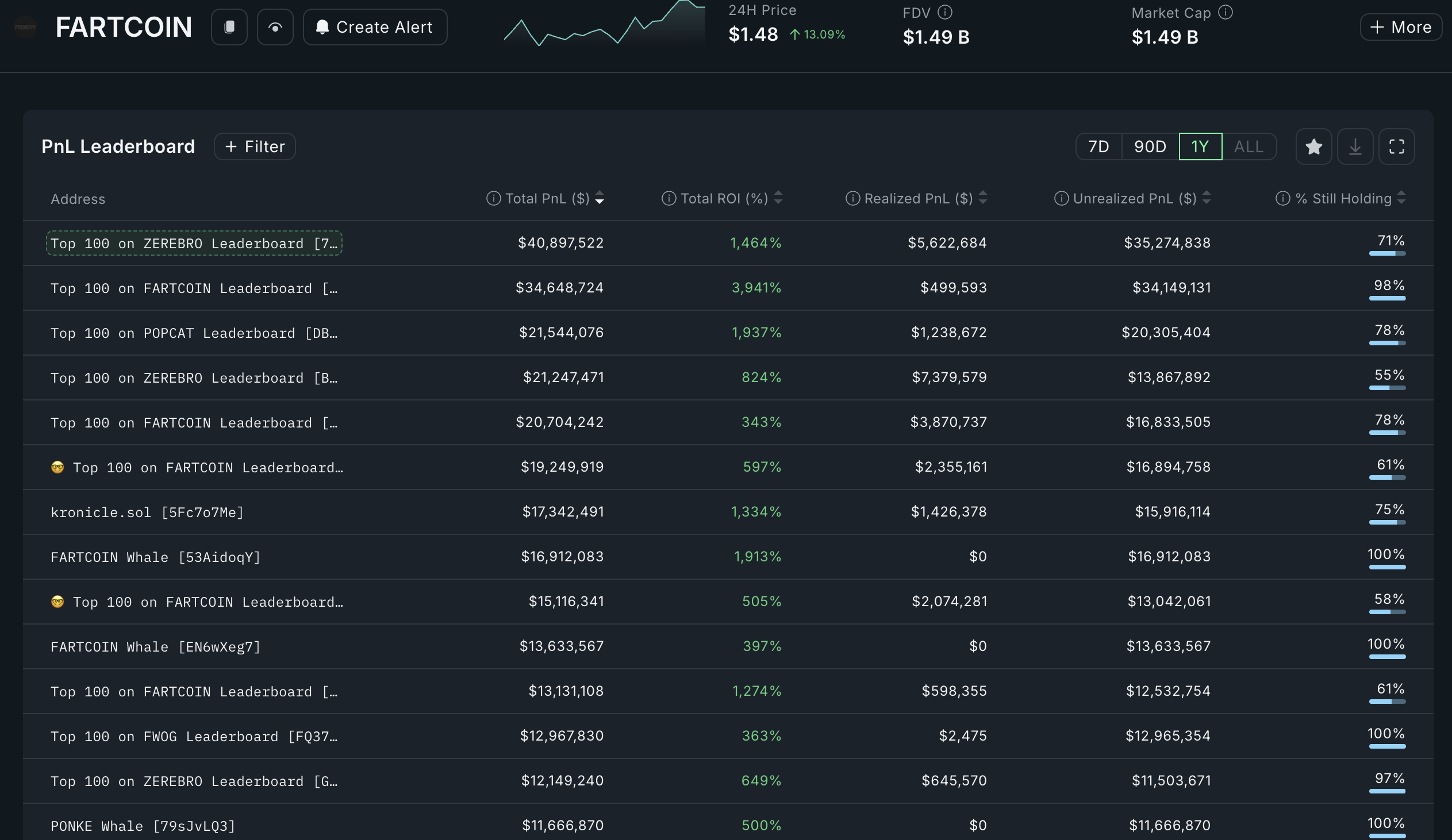

A closer look at wallet addresses shows that the most profitable traders are holding their tokens instead of dumping them as the rally continues.

According to Nansen, the most profitable Fartcoin trader has an unrealized profit of over $35 million. He has sold $5.6 million worth of tokens but is still holding 71% of his holdings.

The second most profitable trader has made a total profit of $34.6 million and continues to hold 98% of his positions, signaling that he anticipates further price increases.

The third most profitable trader, who also made significant gains from Popcat (POPCAT), is holding 78% of his Fartcoin tokens. Among the top 15 most profitable Fartcoin holders, only three have sold more than 25% of their positions.

However, a potential risk for Fartcoin is that smart money investors, who are typically more sophisticated, have begun taking profits. The number of smart money investors has dropped from 102 in December to 84 today, and their holdings have been trending downward.

Fartcoin price has more upside but faces risks

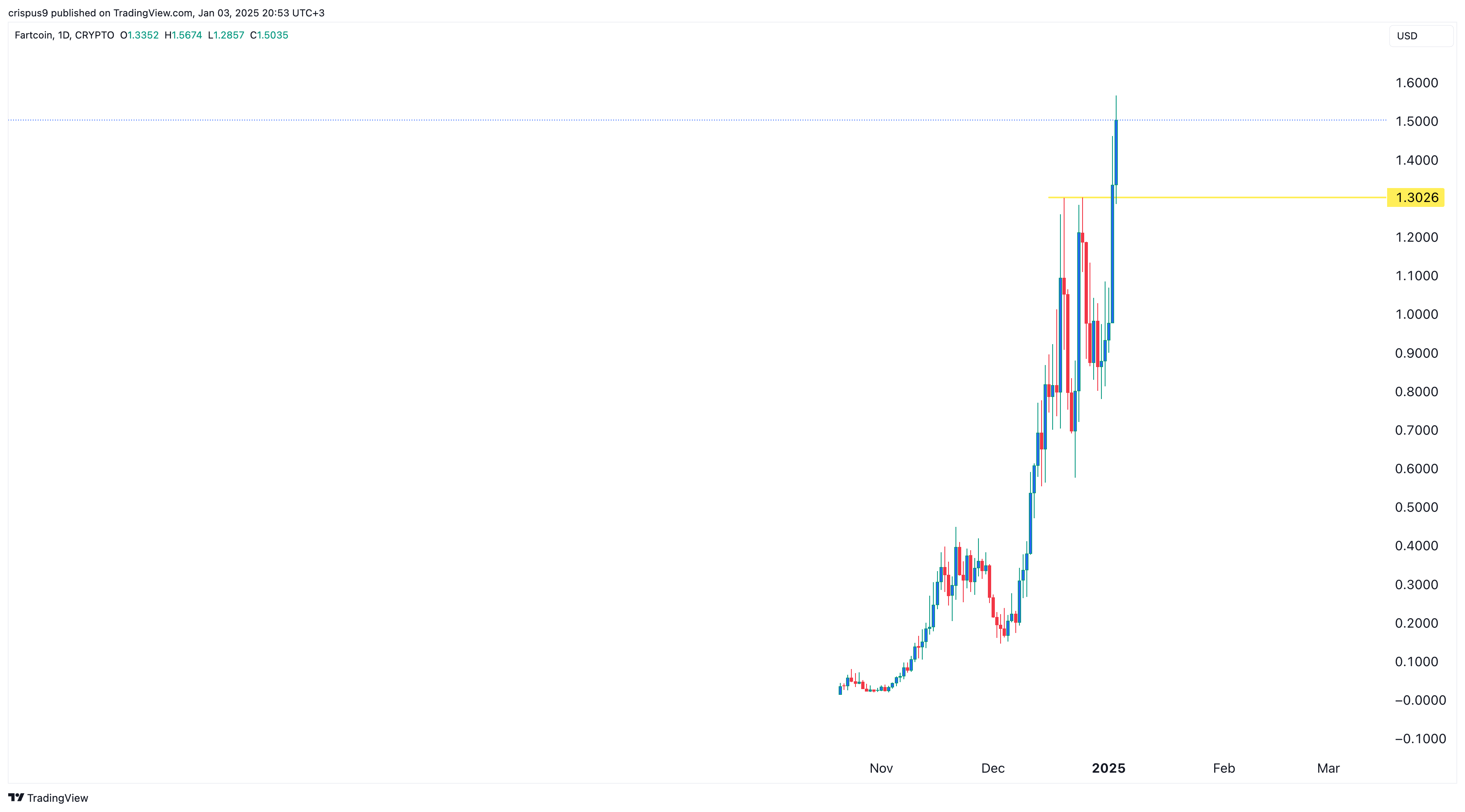

The daily chart shows that Fartcoin has been on a strong rally, and on Thursday, it crossed the key resistance level at $1.3026. By breaking through this level, the token invalidated a risky triple-top chart pattern, which typically signals a bearish reversal.

By moving above this resistance, Fartcoin demonstrated bullish momentum, suggesting that it could continue its upward trajectory. If the rally holds, the token could reach the next resistance level at $2.

However, there is a risk that Fartcoin could enter a markdown phase of the Wyckoff Method, similar to what happened with VIRTUAL token. The current markup phase, driven by higher demand than supply, may shift to a markdown phase if a pullback triggers more selling. Retail traders, in particular, could push the price below $1 if sentiment sours.