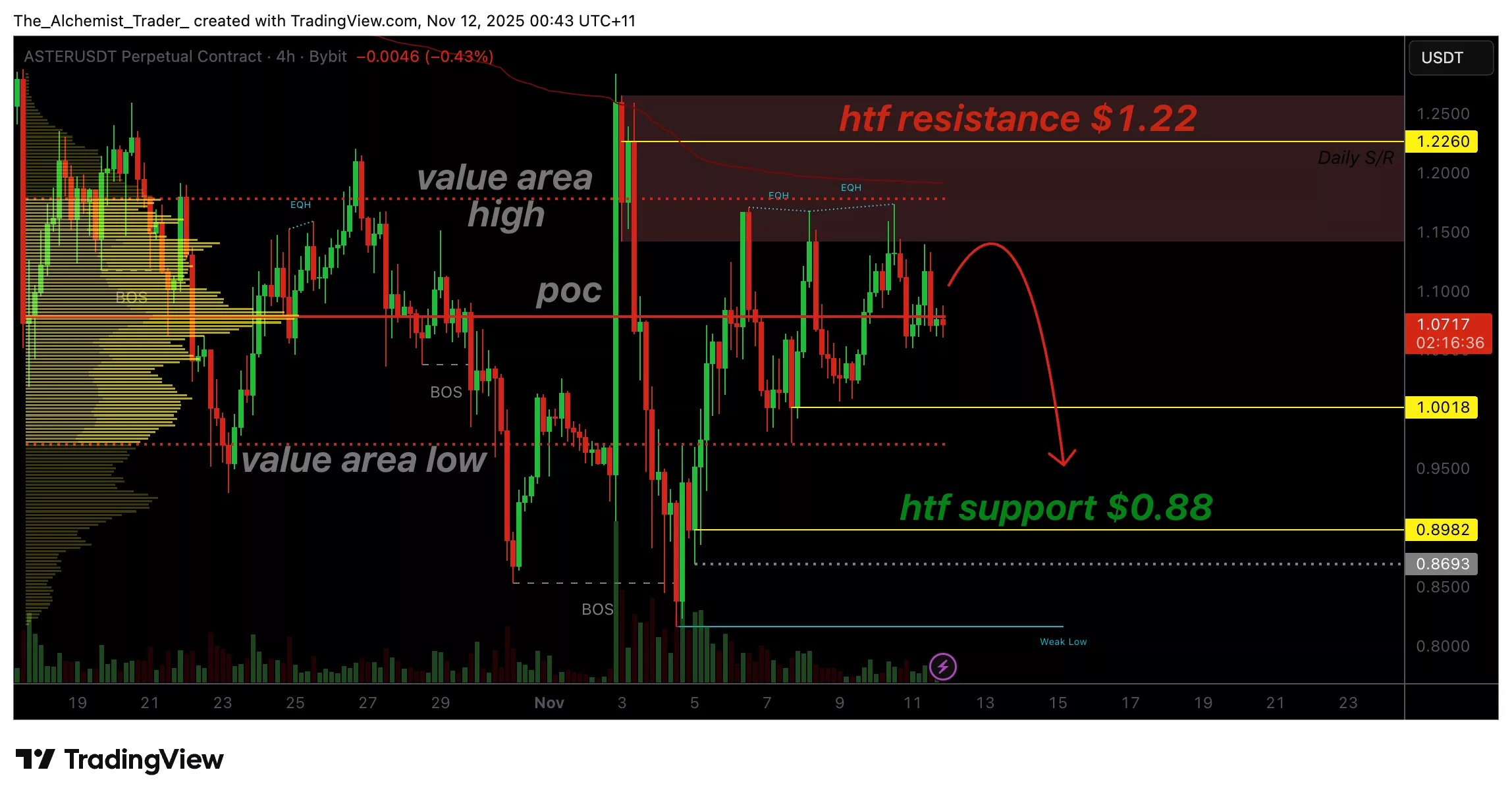

Aster struggles to keep $1 level afloat as buyers step back

The Aster token price shows fading momentum, as low volume limits upside potential. Technical indicators suggest a possible corrective move toward $0.88 support.

- Weak Momentum: Low volume limits upside follow-through.

- Key Level: $1 remains pivotal; loss could trigger correction.

- Downside Target: $0.88 serves as major support for potential reversal.

Aster (ASTR) token price has shown signs of exhaustion following a brief rally toward the $1 region. The price has struggled to maintain momentum, with volume notably declining and bullish follow-through remaining weak.

While the token continues to trade within its local range, technical indicators suggest that upside momentum is fading, and a corrective phase could be emerging as market strength wanes.

Aster token price key technical points:

- Resistance Region: $1 psychological level continues to cap upside momentum.

- Support Zone: $0.88 remains the key high-timeframe (HTF) support to monitor.

- Volume Weakness: Lack of strong bullish influxes hints at exhaustion and possible retrace.

From a technical standpoint, Aster’s rally into the $1 mark has failed to generate sufficient follow-through volume, resulting in a weak and short-lived bounce.

The structure of this move suggests that buyers are losing control as price begins to show early signs of exhaustion.

The lack of consistent bullish volume nodes suggests the current rally may not have the strength to continue toward higher resistance levels.

The $1 mark aligns closely with the current point of control (POC), which has historically served as both a magnet for liquidity and a pivot for directional moves. If Aster fails to hold above this region, the probability of a correction toward the value area low, around $0.88, increases.

This level also coincides with the next central high-timeframe support zone, a region where demand previously re-emerged to fuel a local reversal.

In short, losing the POC could confirm that the recent bounce was merely a temporary relief move within a broader corrective structure. Traders should monitor for a potential breakdown if volume fails to increase in the coming sessions.

The broader altcoin market remains fragile, with many assets exhibiting similar patterns of weak bounces and low trading volume.

Without strong capital inflows or renewed speculative interest, price action across the sector, including Aster, may continue to trade within tight ranges until volatility returns.

Price action

If Aster maintains the $1 level and gains volume support, a rotation toward $1.10–$1.15 could occur.

A decisive loss of the POC would likely trigger a correction toward $0.88, where fresh demand could emerge.