Avalanche eyes $70 price rally after banking collaboration with Chainlink

Avalanche (AVAX) price peaked at $59 on March 26 following another brazen attempt at breaking the $60 resistance, on-chain data trends show how recent team announcements have formed major bullish catalysts.

With 43% gains, Avalanche has emerged on the of the top gaining Layer-1 altcoins since March 11, outperforming the likes of Ethereum (ETH), and Ripple (XRP).

Can the recent bullish team announcements drive AVAX price towards the $70 milestone?

New users trooping into Avalanche ecosystem following recent team announcements

Over the past weeks, Avalanche team has made giant strides to enhance service offerings and help users ape-in on the current dominant crypto market narratives.

First, on March 21, in response to the memecoin mania that saw Solana ecosystem capture over $6 billion of capital inflows, the Avalanche foundation announced a $1 million “Memecoin Rush” fund to incentivize devs and liquidity providers to support native community-owned meme projects.

Furthermore, on March 23, the Australia and New Zealand Banking Group (ANZ) and Chainlink Labs unveiled the results of a close collaboration connecting blockchains – notably, Avalanche and Ethereum – for the global movement and settlement of tokenized assets.

These landmark announcements in quick succession, have triggered a noticeable surge in the organic growth of the Avalanche ecosystem, based on recent data trends.

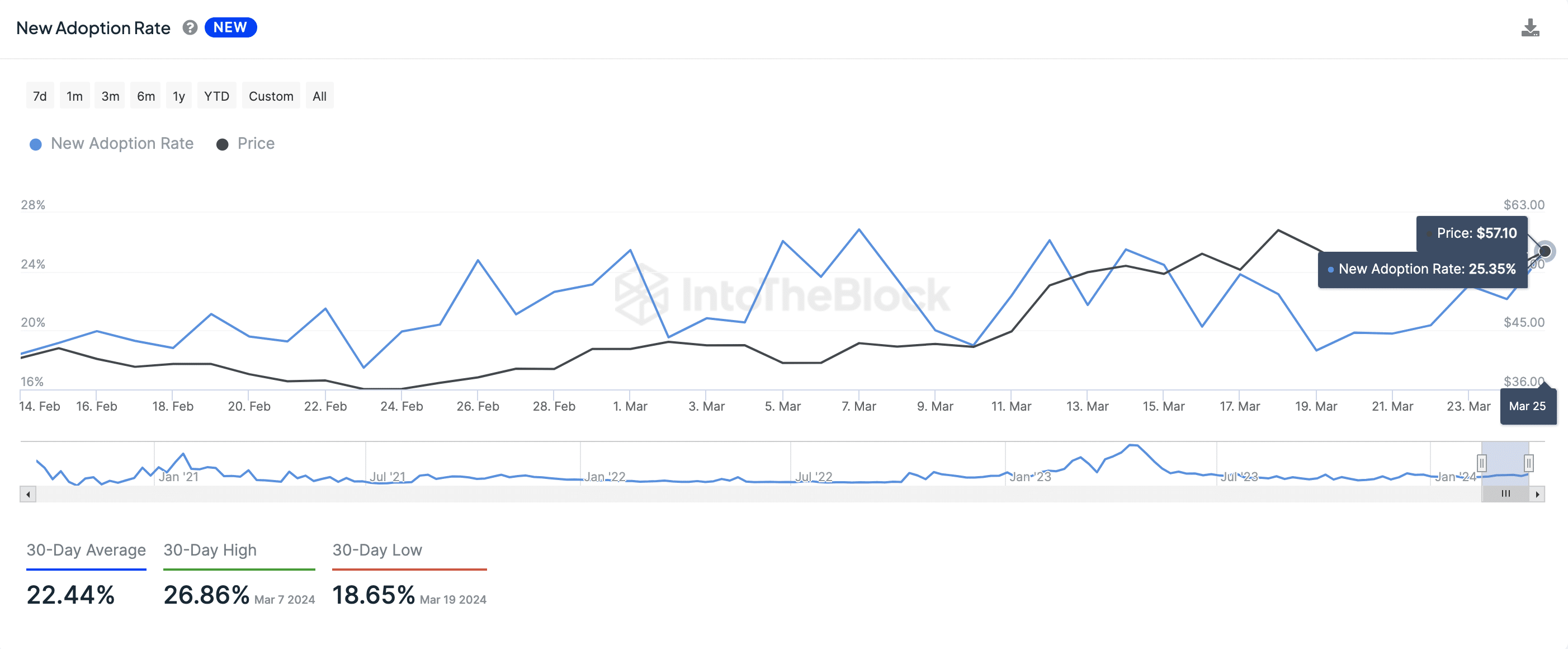

IntoTheBlock’s New Adoption rate metric tracks the percentage of total daily network transactions executed by wallets carrying out their very first trades. This serves as proxy for tracking the inflow of capital from new entrants.

The chart above shows that AVAX new adoption rate has been on the rise since the the team announced the $1 million memecoin rush fund on March 20.

The latest data on March 25 shows that 25.4% of all transactions executed on the Avalanche network was from first-time users. Notably this is significantly higher than the 30-day average of 22.4%.

A surge in new-user transactions can be bullish for the underlying asset’s price for a number of reasons. Firstly, the influx of new users suggests a broader user base and increased network effect, which can enhance the ecosystem’s resilience and long-term viability.

With a larger user base, there is greater potential for network growth and expansion, leading to increased transaction volume and liquidity, which are generally positive indicators for asset price appreciation.

Additionally, first-time users often represents a fresh influx of capital into the market, as they may be purchasing the asset for the first time.

This new capital injection can create upward pressure on prices, particularly if demand outweighs supply in the market. Moreover, new users may hold onto their assets for longer periods, contributing to a reduction in available supply and further bolstering prices.

AVAX price forecast: Next target, $70?

Based on the recent surge in Avalanche new-user transaction, and overall optimistic sentiment generated by recent team announcement, AVAX price looks set to make another leg-up towards $70.

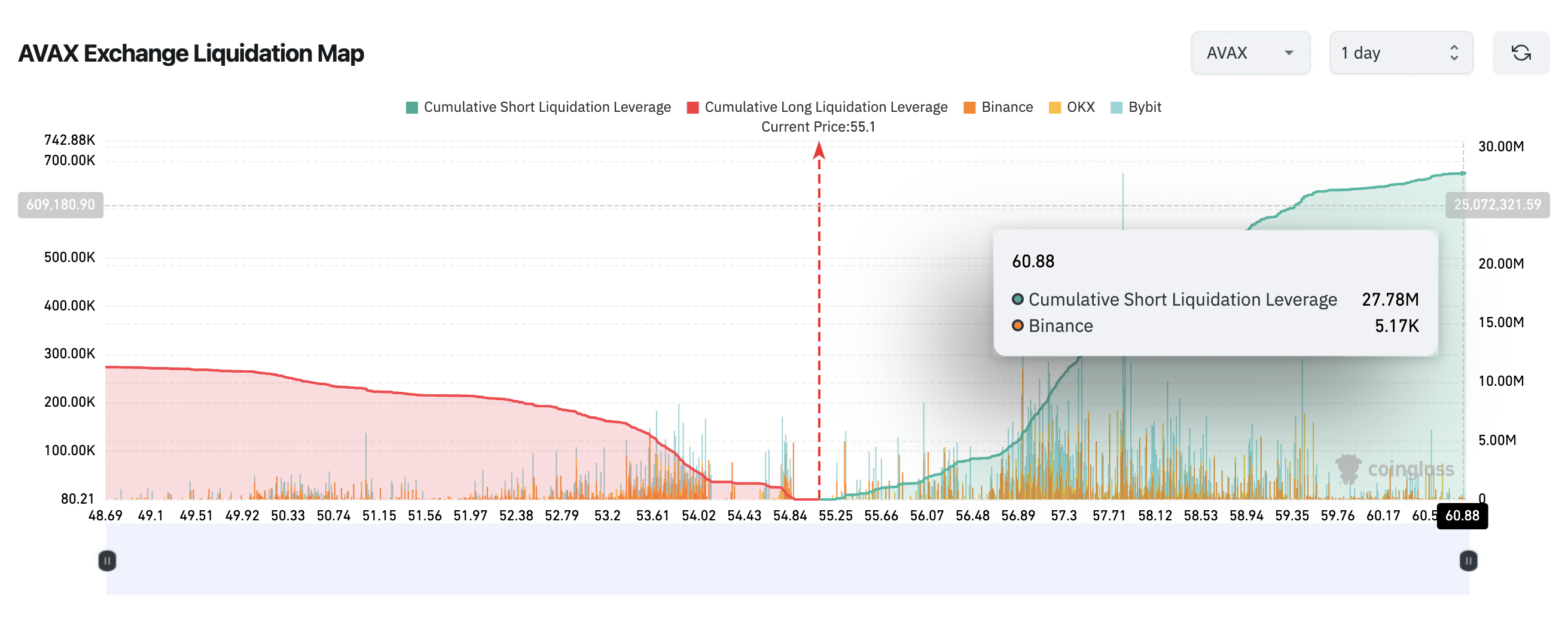

However, the Coinglass’ Liqudation Map data shows that AVAX bulls now face an uphill task breaking past the $60 resistance.

As seen in the chart below, the short traders have mounted leveraged positions that could see them lose $27.8 million if prices cross the $60.9 mark. As AVAX price approaches that critical area, those traders could execute strategic stop-loss orders to mitigate the potential downside.

But if Avalanche’s rising new-user demand persists, AVAX could scale that sell-wall and head towards the $70 target, as predicted.

On the flip side, if the sell-offs trigger a major market downturn, AVAX price stands the risk of dipping below the $50 mark. But in this scenario, long traders could regroup to form a suppor buy-wall at the $53 area to avoid losing out on their $7 million active leveraged positions.