Avalanche is at risk as staking yield, active addresses dip

Avalanche, the 14th-biggest cryptocurrency, is stuck in a deep bear market amid weak on-chain metrics and falling staking yields.

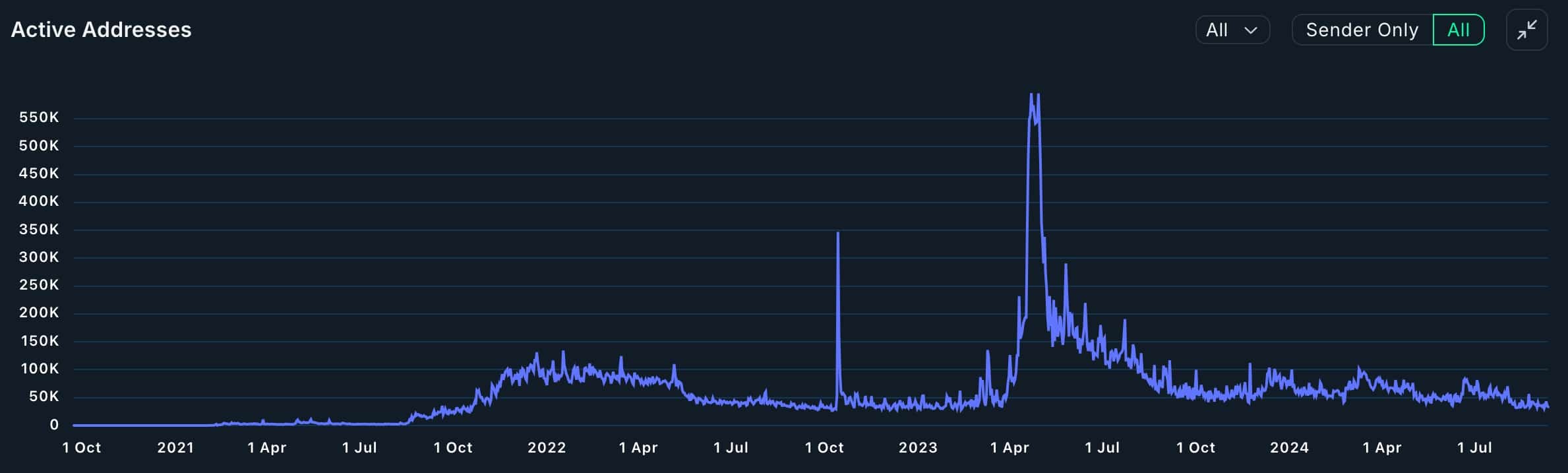

Avalanche active addresses are falling

Avalanche (AVAX) was trading at $23.8, down by over 63% from its highest point in March. Its market cap has fallen from over $22 billion in March to $9.57 billion.

This downtrend occurred as the network has shown weak on-chain metrics. Data from Nansen shows that the number of active addresses in the ecosystem has dropped to 43,208, down from over 91,000 in March and an all-time high of over 555,000 in April 2023.

The number of Avalanche transactions and gas fees has also been in decline. The network handled 155,000 transactions on Sept. 10, down from over 600,000 in March. Its gas fee stood at less than $20,000, compared to the year-to-date high of over $300,000.

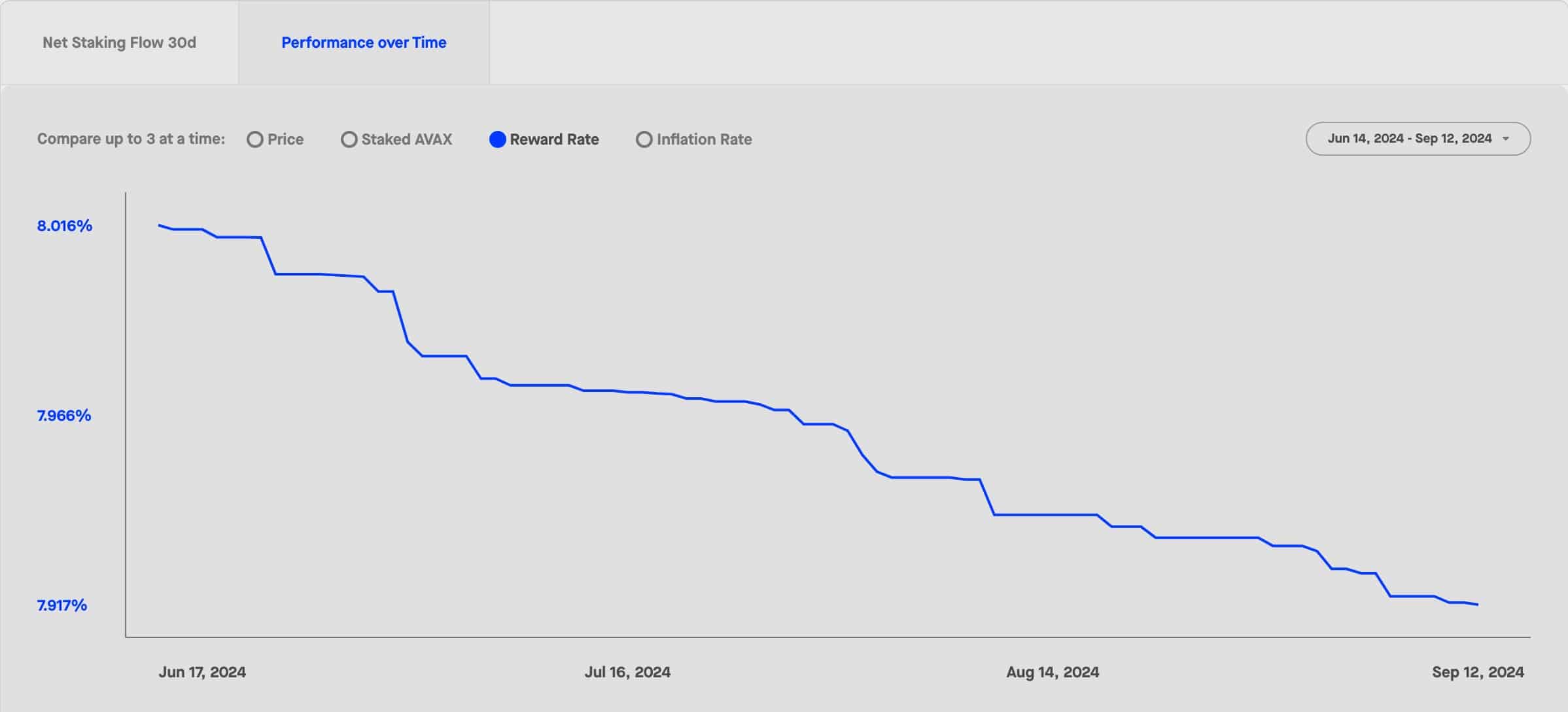

Meanwhile, data from StakingRewards shows that AVAX’s staking yield has continued to fall, reaching a low of 7.9%, its lowest level since November of last year. This drop occurred as the amount of AVAX staked in the network continued to decline.

Over 21 million tokens, worth over $494 million, have left the network in the last 30 days, with most of these outflows happening on Sept. 11.

Avalanche’s market share in the crypto industry has been slipping for a while as users opted for other layer 1 networks like Solana (SOL) and Tron (TRX) and layer-2 platforms like Arbitrum and Base.

For example, Base, which was launched in 2023, has gained over 1.6 million active addresses while the number of transactions in the network has jumped to a record high.

Base DEXes handled transactions worth $3.4 billion in the last seven days while Avalanche’s volume was over $554 million. Base has a DeFi TVL of over $1.4 billion while Avalanche has $923 million.

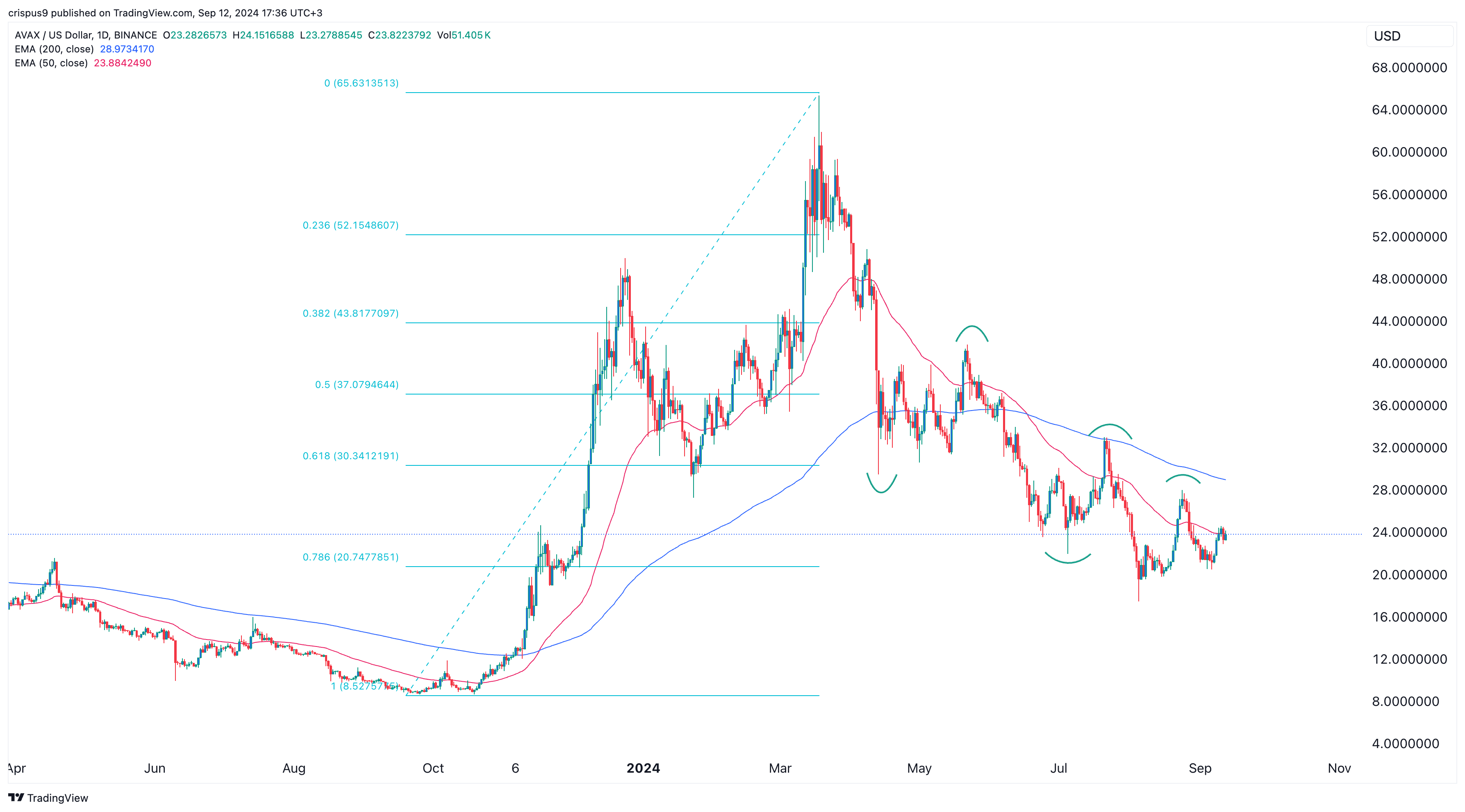

Avalanche has formed lower highs

Avalanche is at risk of further downside. It formed a death cross pattern in June as the 200-day and 50-day moving averages made a bearish crossover.

Since then, the coin has continued forming a series of lower lows and lower highs. It also remains below the 50-day moving average and the 61.8% retracement point.

Therefore, the bearish trend will likely persist as long as it remains below the 200-day moving average.