Avalanche rises after big token unlock; staking reward falls

Avalanche, the 14th biggest cryptocurrency, rose for the sixth consecutive day after a significant token unlock.

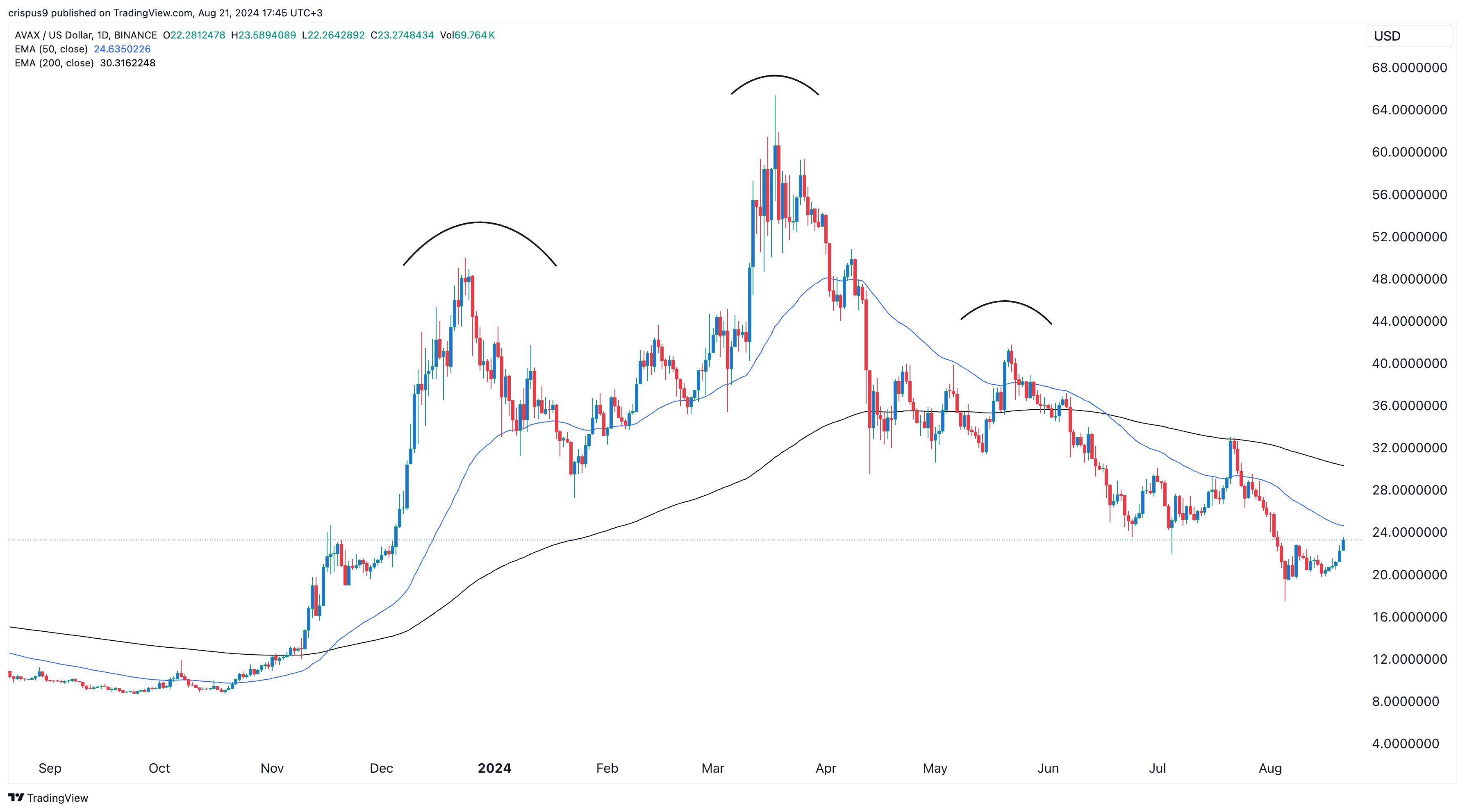

The Avalanche (AVAX) token reached a high of $23.25 on Aug. 21, its highest level since Aug. 3 and 32% above its lowest level in August.

Avalanche’s staking yield retreats

The rise happened a day after the network unlocked 9.5 million AVAX tokens worth over $202 million. The next unlock will occur on Nov. 18 this year.

Avalanche holders should expect more unlocks in the next few years, as just 64% of the total tokens have been unlocked. Over 255 million tokens will be unlocked by August 2029.

Token unlocks are generally negative for existing holders since they increase the amount of available coins. Also, they impact staking rewards since some of these tokens flow to staking pools.

Data by StakingRewards shows that AVAX’s staking yield has been in a downtrend in the past few weeks and is nearing its lowest level in months. It dropped to 7.93% on Aug. 21, down from 7.97% on July 21.

More data shows that staking inflows rose after the token unlock on Aug. 20 after falling for six consecutive days, a sign that some investors exited their respective stakes before the token unlock.

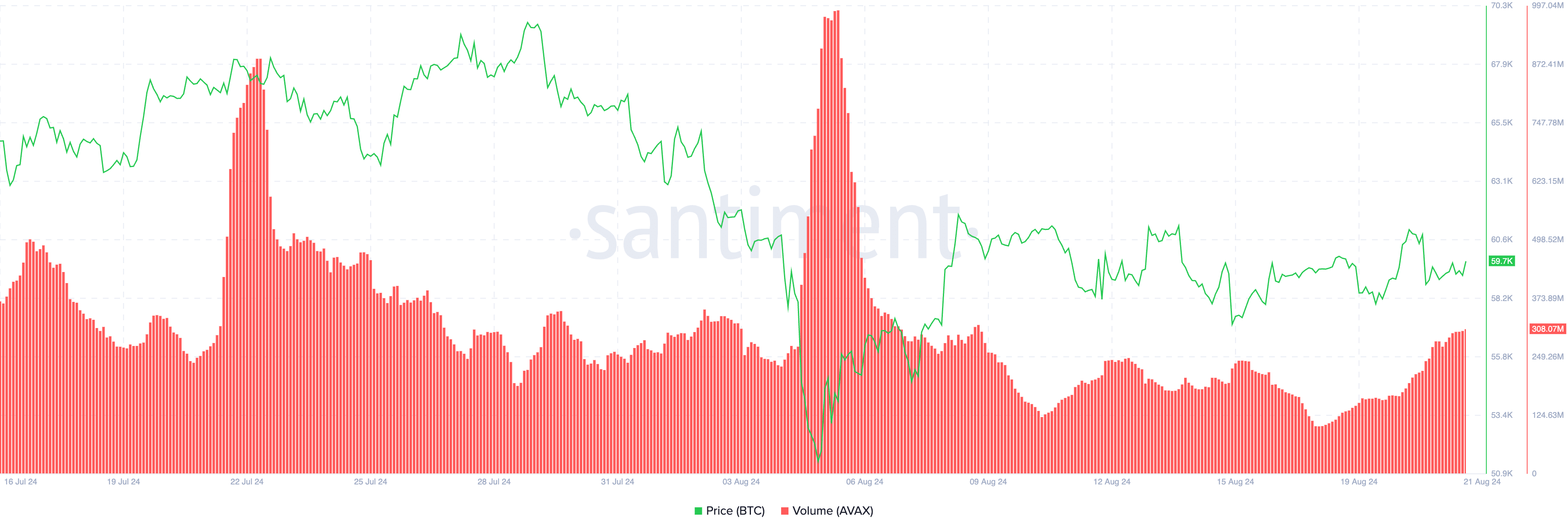

Avalanche’s token also rose after Santiment data showed that intraday volume grew to over 309 million, the highest point since Aug. 7.

AVAX price formed a death cross and a head and shoulders pattern

Avalanche has been under substantial pressure this year. The token has dropped by over 64% from its highest level in March. It formed a death cross and a head-and-shoulders pattern in June, often leading to more downside.

Also, Avalanche has continued to lose market share in the Decentralized Finance market. Data by DefiLlama shows that its total value locked has moved to $882 million, making it the ninth biggest chain in the industry.

Avalanche has been passed by newer chains like Base and Arbitrum (ARB), which have assets of $1.49 billion and $2.68 billion, respectively.

Other networks have also passed it in decentralized exchange volume. Its weekly DEX volume stood at $421 million, while Arbitrum had $3.7 billion and Base had $3.18 billion.

A likely reason for this is that, unlike Solana (SOL) and Base, Avalanche’s meme coins like Coq Inu (COQ), Kimbo, and Gecko Inu have not become highly popular. Instead, Solana tokens like Dogwifhat (WIF) and Bonk (BONK) have gained market share.