Balancer protocol drained of $116m in ongoing cyberattack

An exploit has shaken the Balancer protocol, putting millions of dollars at risk within hours.

- Balancer exploited for $116 million, marking the first major crypto hack reported in November.

- October saw over $88 million stolen across around 20 separate incidents, bringing 2025’s total losses to more than $2 billion.

- Security concerns persist as DeFi protocols continue to face vulnerabilities despite increased audits and on-chain monitoring.

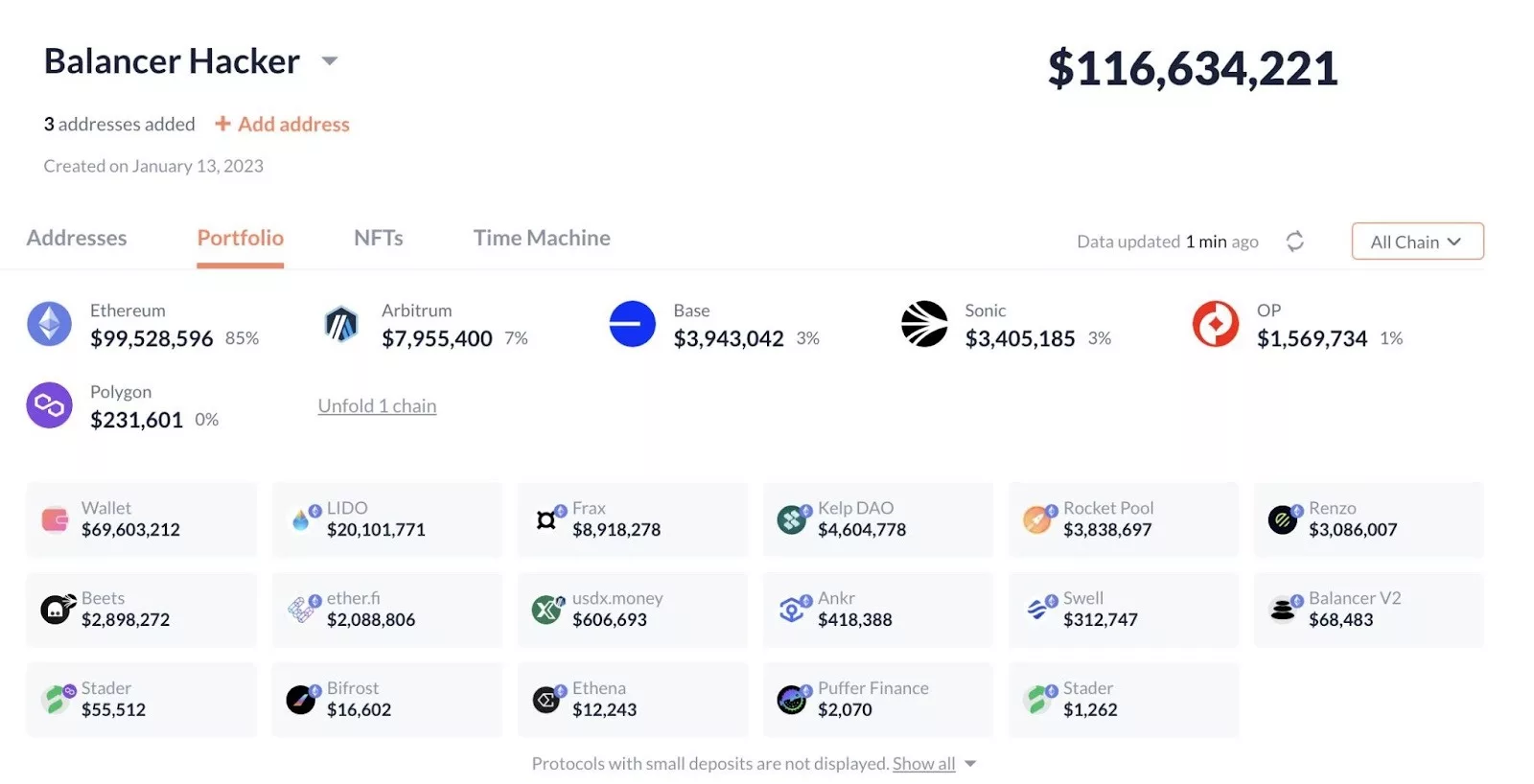

Decentralized exchange and automated portfolio management protocol Balancer was targeted in a large-scale attack earlier today with roughly $70.6 million in assets initially siphoned from the protocol. Data from Nansen shows that the funds included 6,587 WETH, 6,851 osETH, and 4,260 wstETH, which were swiftly moved out in a series of transactions.

The exploit did not stop there. Additional transfers continued throughout the morning, expanding the scale of the breach. As the activity spread, the total stolen amount climbed rapidly.

On-chain data now shows that the total amount stolen so far stands at $116.6 million. New tokens and chains were added to the attack, broadening the impact as funds moved across Ethereum, Arbitrum, Base, Sonic, OP, and Polygon networks.

The incident is still unfolding, with funds moving as investigations remain ongoing. The full scale and long-term repercussions of this exploit on Balancer and its users are yet to be determined.

Balancer hack builds on year-long trend

The Balancer exploit marks the first major hack reported in November, extending a worrying streak of security breaches that hit the crypto sector last month. October saw more than $88 million stolen across roughly 20 incidents, affecting both centralized platforms and DeFi protocols.

Among the most significant incidents in October were attacks on projects across multiple networks, including Ethereum, BNB Chain, and Base. Several protocols faced flash-loan manipulations, while others suffered from contract vulnerabilities that allowed hackers to drain liquidity pools within minutes.

The growing number of incidents has pushed 2025’s total losses from crypto hacks to more than $2 billion. This steady rise in stolen funds underscores how persistent the threat remains, even as projects strengthen security measures and conduct more frequent audits.