BEAM futures open interest hits 3-month high as it secures top gainer spot

While the rest of the crypto market slumped, BEAM was up 7.4%, emerging as the leading gainer among the top 100 cryptocurrencies on Oct. 23.

Beam (BEAM) rose for five consecutive days to an intraday high of $0.0198, a 27% hike from its lowest point this week. This pushed the altcoin’s market cap past the $1 billion mark while its daily trading volume hovered over $101.8 million a 161% jump over the previous day’s level.

Beam’s rise coincided with a jump in its futures open interest. According to data from CoinGlass, open interest in the futures market reached a three-month high of $11.87 million, up from the Sept. 8 low of $3.54 million. A rise in futures open interest suggests increasing interest from traders, further adding momentum to the trend, which is bullish in this scenario.

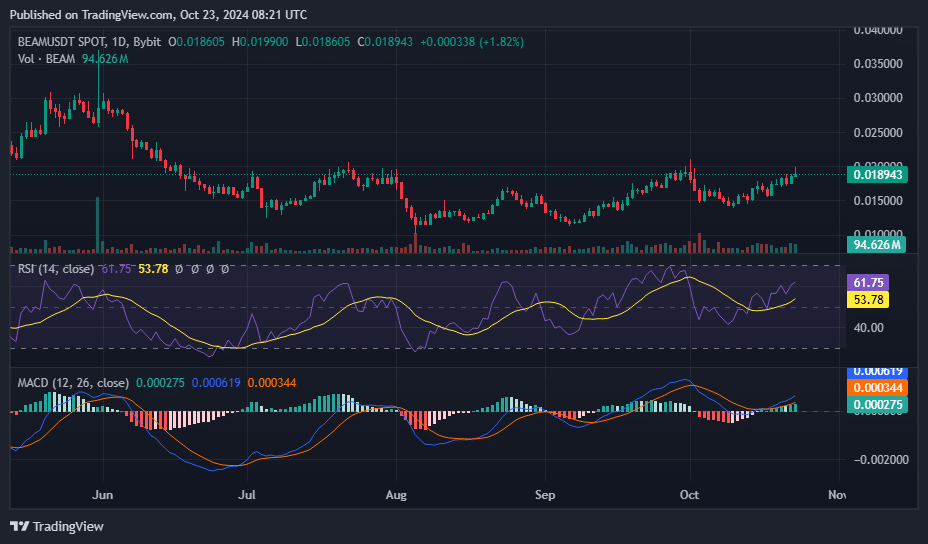

On the 1D BEAM/USDT price chart, BEAM traded above the 50-day and 100-day Exponential Moving Averages, signaling the continuation of a short-term bullish trend.

The Relative Strength Index line has surged to approximately 62, indicating strong bullish momentum. The positive divergence between the RSI and price action suggests that the market is likely experiencing a growing bullish trend, with further upward movement expected.

Simultaneously, the Moving Average Convergence Divergence indicator has plotted bullish histogram bars along with the MACD line crossing above the signal line, which further reinforces the ongoing buying pressure. This points to an accumulation phase among buyers, confirming the likelihood of sustained upward price momentum in the short to mid-term.

While the potential catalyst for Beam’s recent rally could not be confirmed, one analyst noted that the altcoin has broken out of a descending accumulation channel it has been forming since March. In technical analysis, such a breakout suggests a possible trend reversal adding to the bullish sentiment for the altcoin.

Pseudo-anonymous trader Mister Crypto predicted that if BEAM manages to break the resistance level at $0.020, which it has failed to surpass on multiple occasions since July, the breakout may trigger a strong bullish trend, leading to a potential price “explosion.”

On a bearish note, large holders of BEAM appear to be stepping back. Data from IntoTheBlock shows that they accumulated 3.49 billion tokens worth $63.5 million on June 18, but this has since dropped to around $1 million. With whales holding over 73.9% of the total BEAM supply, this sharp decline in inflows could increase downward pressure if these traders decide to sell their holdings.