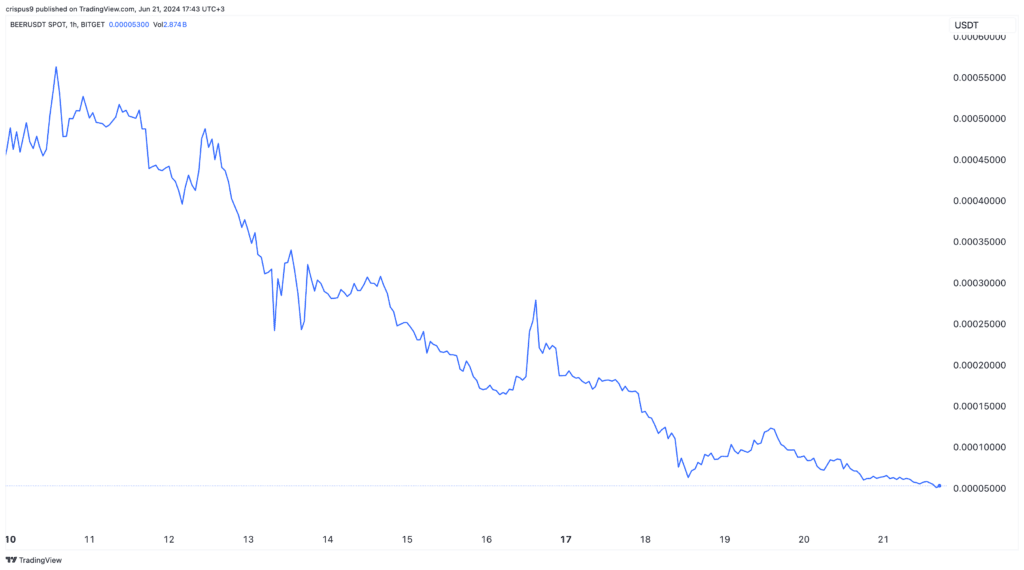

Beercoin price hits all-time low as trader predicts a rebound

Beercoin price continued its downward on Friday and has now dropped in 10 of the past 11 days, pushing its total market cap from over $307 million to just

Beercoin price has.crashed

Beercoin’s crash happened as many insiders dumped their tokens in a bid to take profits. This trend pushed more traders and investors to exit their positions.

The crash also coincided with the weak performance of Bitcoin and other altcoins. Bitcoin has moved below $64,000 while LayerZero dumped by over 23% as predicted on Thursday. Other meme coins like Popcat, MOTHER, and DADDY have all crashed.

Still, some analysts believe that Beercoin has the potential to rebound now that it has become highly oversold. In a recent X (Tweet), Decu, who tracks meme coins predicted that it will ultimately bounce back.

History suggests that the token could rebound as investors buy the dip. For example, Pepe price initially jumped to $0.000004448 in May and then tumbled by over 82% by June. It then soared nearly 3,000% to a high of $0.00001725 in May.

Similarly, Floki price soared to $0.000068 shortly after launch in 2022 and then crashed by almost 80%. It then rebounded by over 2,400% and reached an all-time high of $0.00034 this year. Most meme coins have experienced such drawdowns in their initial days.

BEER price chart

Potential catalysts for BEER price

Beercoin’s recovery will depend on the performance of other cryptocurrencies like Bitcoin, Ethereum, and Solana. In most cases, meme coins tend to do better than Bitcoin when cryptocurrencies are rallying.

There are two potential catalysts for cryptocurrencies this year. First, the Securities and Exchange Commission (SEC) has signaled that it will approve spot Ethereum ETFs this year, a move that could trigger a rebound.

Second, the Federal Reserve has hinted that it will start cutting interest rates this year. Crypto and other risky assets do well when the Fed is dovish. Already, the European Central Bank (ECB), Bank of Canada (BoC), and the Swiss National Bank have already slashed their rates and the BoE pointed to a cut in August