BERA price crashes as Berachain transactions, stablecoins plunge

Berachain’s token crashed to a record low this week, erasing hundreds of millions of dollars in value as concerns about its network escalated.

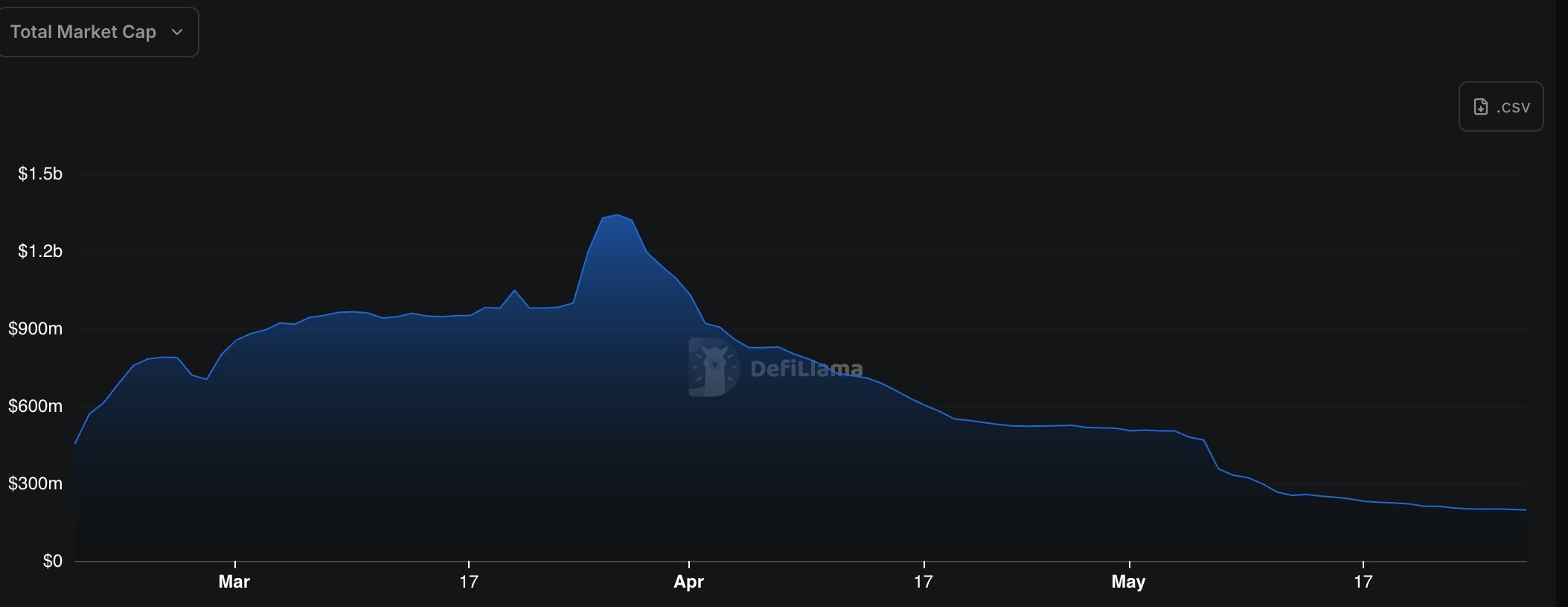

Berachain (BERA) price dropped to $2.689, down 70% from its highest level this year. This steep decline has reduced its market cap from over $920 million in March to $339 million.

Activity on Berachain’s network continues to decline. According to Nansen data, it had only 104,000 active addresses over the past seven days, trailing behind other top chains like Sui (SUI) and Base.

Berachain’s transactions fell more than 40% in the last seven days to 4.245 million, making it the worst-performing chain tracked by Nansen. Fees on the network also dropped 37% to $5,200 over the same period.

This trend is mirrored over the past 30 days, with total transactions down 67% to 26.78 million and fees halved to $36,000.

Stablecoins are also fleeing the Berachain ecosystem. The network now holds $197 million in stablecoins, a sharp decline from its year-to-date peak of $1.34 billion. PayPal USD supply on Berachain has dropped 42% in the last 30 days to $105 million, while Honey has fallen 68% to $87 million.

Worse, Berachain has had outflows of US dollars into its ecosystem for all days since March 27. The total value locked in its platform has dropped by 50% in the last 30 days to $2.92 billion.

These figures indicate that Berachain is rapidly losing traction, marking one of the steepest downfalls in the crypto industry this year.

BERA price technical analysis

Berachain has been in a strong downtrend since hitting its post-airdrop high of $9.1823 on March 2.

The eight-hour chart shows that BERA price is hovering near its all-time low of $2.70, forming a double-bottom pattern. A double bottom is one of the most bullish reversal signs in technical analysis.

However, BERA remains below its 50-period and 100-period moving averages. While the double-bottom pattern may suggest a potential relief rally, a drop below $2.7021 would invalidate the bullish case and could open the door to further downside, potentially targeting the psychological level of $2.50.