Choosing the best cryptocurrency for mining: essential factors to consider

Which are the best cryptos for mining with ASICs in 2024, and how much can miners expect to earn?

The global crypto mining market, valued at nearly $4.67 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030, fueled by the increasing adoption of crypto assets and advancements in mining technology.

Table of Contents

A recent report by the Energy Information Administration (EIA) highlighted that crypto miners used as much electricity in 2023 as the entire country of Australia, accounting for about 1% of global electricity demand.

In the U.S., crypto mining operations consumed up to 2.3% of the nation’s total electricity demand. As a result, the U.S. has emerged as a major hub for Bitcoin (BTC) mining, hosting over 35% of the global Bitcoin network’s hash rate in 2024.

Bitcoin’s network hash rate has seen a colossal growth, reaching 582.80 million terahashes per second (TH/s), up from 365.11 million TH/s a year ago. In April 2023, it even touched levels above 720 million TH/s as Bitcoin’s price reached an all-time high.

This surge in mining activity has implications for energy consumption and costs. As of March 2024, Bitcoin’s daily power demand was estimated at about 20.08 gigawatt hours (GWh), leading to an annualized estimate of 176.02 terawatt hours (TWh).

Meanwhile, post the latest halving, the estimated cost of mining one Bitcoin has decreased to about $45,000, down from over $50,000 previously.

The high energy consumption and associated costs of Bitcoin mining play a crucial role in maintaining the network’s security.

The most recent research estimates that it would cost over $20 billion per hour to attack the Bitcoin network, suggesting its robust defense against vulnerabilities like Sybil attacks and 51% attacks.

Meanwhile, the energy mix for Bitcoin mining is evolving, with coal’s share decreasing over the years. Texas emerged as the top Bitcoin-producing state in the U.S. in 2023, suggesting the state’s growing importance in the global crypto mining market.

Adding to the challenges for crypto miners, President Biden’s Fiscal Year 2024 budget includes a proposal for a 30% excise tax on electricity used for mining cryptocurrencies.

This tax aims to raise about $3.5 billion over the next decade and will be phased in over three years, starting at 10% in the first year and increasing to 30% thereafter.

With these updates in mind, let’s delve into the specifics of what makes for ideal mining conditions and the best cryptocurrency for mining in 2024.

Things to consider before you start mining crypto

Venturing into crypto mining requires a strategic approach, given the competitive landscape of the industry.

Firstly, the choice of cryptocurrency is paramount. With thousands of cryptocurrencies available, selecting a profitable cryptocurrency to mine is crucial.

Factors such as the coin’s market stability, demand, and the complexity of mining algorithms should guide this decision.

Energy consumption and cost cannot be overstated. Mining is notoriously energy-intensive, and with electricity prices fluctuating globally, calculating operational costs becomes essential.

Meanwhile, regulatory compliance and tax obligations in your jurisdiction are crucial. With countries adopting varied stances on cryptocurrency mining—from outright bans to welcoming it with open arms—understanding and adhering to your local laws and tax regulations is vital to avoid legal pitfalls.

Lastly, hardware selection is another critical consideration. The mining landscape has evolved a lot over the years. The choice of hardware impacts not only the efficiency of your mining operations but also their longevity and scalability.

Types of mining hardware

Initially, mining started with central processing units (CPUs), the basic form of computing power in any computer. While accessible, CPU mining is significantly less efficient compared to newer technologies, making it largely obsolete for competitive mining operations.

The next leap came with graphics processing units (GPUs), which are more powerful than CPUs and capable of solving complex algorithms faster.

GPU mining became popular for its improved efficiency and ability to mine more profitably, though it also requires more energy and generates more heat.

Field-programmable gate arrays (FPGAs) introduced even greater efficiency by allowing miners to configure these chips for mining, offering better performance than GPUs without as much power consumption.

FPGAs strike a balance between customizable hardware and the efficiency needed for effective mining, but they can be complex to program and are often more expensive.

Application-specific integrated circuits (ASICs) represent the pinnacle of mining technology, designed specifically for mining cryptocurrencies.

ASIC miners are the standard for professional mining operations in 2024, particularly for mining Bitcoin, due to their superior processing power and energy efficiency.

They offer unparalleled efficiency and speed but come with a higher price tag and rapidly become obsolete due to the constant evolution of mining technology.

Best coins to mine in 2024: ASICs-based

Bitcoin (BTC): the most popular crypto to mine

As the most popular choice among miners, Bitcoin mining demands high computational power.

To effectively mine Bitcoin, one requires advanced ASIC equipment, such as the Antminer S21 Hyd, which is one of the most powerful mining hardware available.

This machine is designed to tackle Bitcoin’s complex mathematical puzzles with a hashrate of 335 terahashes per second (TH/s) and a power consumption of 5360 watts.

Mining profitability, however, is not guaranteed and depends on several factors, including hardware efficiency, electricity costs, and Bitcoin’s market value.

For instance, using the Antminer S21 Hyd, miners can expect daily revenue of around $17.02. However, this comes with an average electricity cost of $21.74, assuming an electricity rate of $0.169 per kWh in the U.S.

These costs can vary widely depending on your location, significantly impacting your bottom line.

As a result, the net daily profit for an Antminer S21 Hyd currently averages around -$4.72, meaning miners are operating at a loss under these conditions. This translates to an annual loss of approximately $1,722.

Given the volatility of electricity prices and Bitcoin’s market value, these estimates can change rapidly. Therefore, it’s crucial for you to approach Bitcoin mining with a balance of optimism and pragmatism.

Kaspa (KAS): a profitable alternative

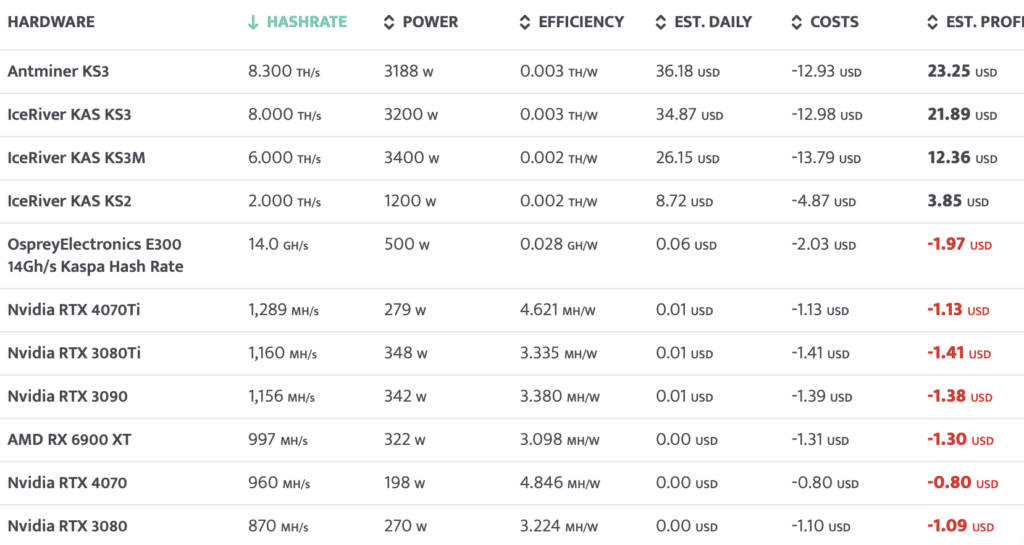

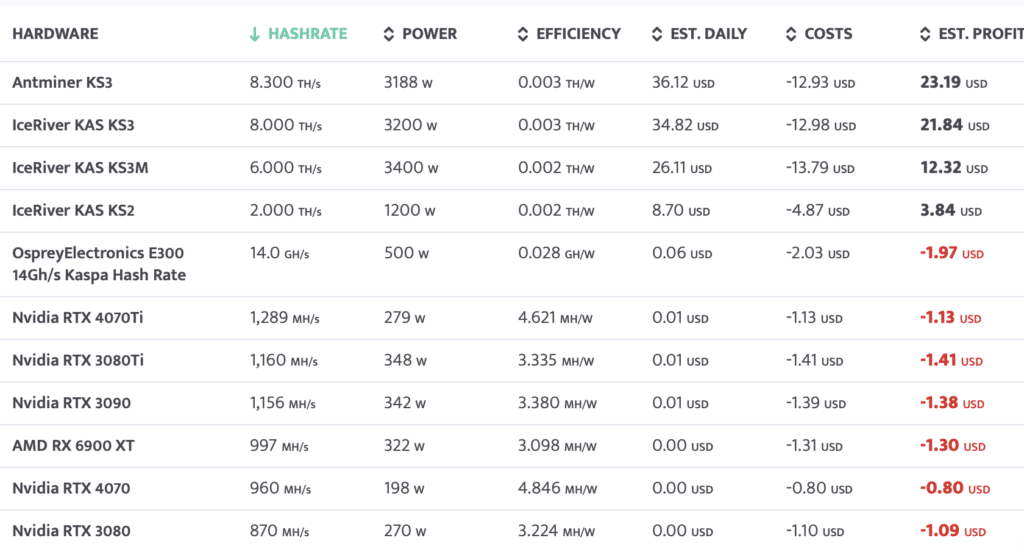

Mining Kaspa (KAS), a cryptocurrency that has been trending on Minerstat, can be particularly useful for those looking to maximize profitability through ASIC miners.

The Antminer KS3 is one of the leading ASICs for mining Kaspa, offering a powerful hashrate of 8.300 terahashes per second (TH/s) with a power consumption of 3188 watts.

Using the Antminer KS3, miners can expect to generate a daily revenue of approximately $36.18. However, this comes with an average electricity cost of $12.93, assuming an electricity rate of $0.169 per kWh in the U.S. These costs can vary depending on your location, significantly impacting your bottom line.

After accounting for electricity costs, the net daily profit for an Antminer KS3 stands at about $23.25. This translates to an estimated annual profit of approximately $8,486, making Kaspa mining a potentially lucrative venture.

However, it’s important to navigate these variables carefully. Potential market shifts, regulatory changes, and the risk of increased mining difficulty can all impact the long-term viability of Kaspa mining operations.

You should prepare for these fluctuations and continually reassess the profitability of their mining activities.

Dash (DASH): privacy-focused crypto to mine

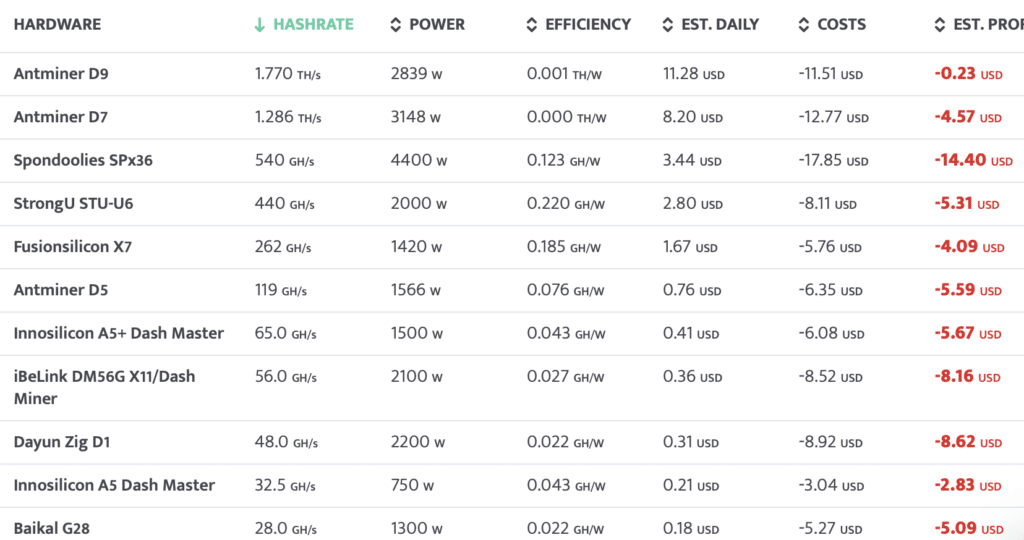

Mining Dash (DASH), a crypto known for its focus on privacy and fast transactions, also relies on ASIC miners due to their efficiency and processing power.

The Antminer D9 is a popular choice for mining Dash, offering a hashrate of 1.770 terahashes per second (TH/s) with a power consumption of 2839 watts.

Using this hardware, miners can expect a daily revenue of approximately $11.30. However, with average daily electricity costs of $11.51 (assuming an electricity rate of $0.169 per kWh in the U.S.), the net loss comes to around $.21 per day.

In comparison, a less powerful ASIC like the Antminer D7 yields a daily loss of $4.56.

The profitability of mining Dash with an Antminer D9 or any mining hardware is subject to numerous variables.

Annual losses, which could potentially reach $77 with an Antminer D9, are influenced by fluctuating electricity prices, changes in Dash’s market value, and adjustments in mining difficulty.

However, it’s important to note that these figures are subject to change based on market conditions and operational factors. You should conduct thorough research and consider these variables carefully before engaging in Dash mining operations.

Key considerations before selecting the top crypto to mine

Remember that the profitability of mining any cryptocurrency is heavily influenced by electricity, hardware, and maintenance costs (if any), which vary widely across the globe.

While the calculations provided are based on average electricity rates in the U.S., countries like Ireland, with higher electricity costs (approximately $0.52 per kWh), or Iran, where electricity may be subsidized for low-income citizens, will see different profit margins.

Additionally, the volatile nature of cryptocurrency prices, mining difficulty, and market demand can all significantly impact your potential earnings.

Changes in these factors can either enhance or diminish the profitability of your mining operation overnight. Therefore, miners must monitor these variables and continuously adjust their mining strategies accordingly.

FAQs

What is the best cryptocurrency to mine for beginners?

For beginners, the best crypto to mine now includes options like Kaspa (KAS) and Dash (DASH). However, you should be aware of the risks involved. Market volatility can greatly affect profitability, and the costs of electricity and hardware maintenance can outweigh earnings, especially in regions with high energy prices. Beginners should approach mining with caution, conducting thorough research and considering the potential for both profits and losses.

What is the easiest crypto to mine?

The easiest cryptocurrencies to mine are usually those that can be mined with CPU and GPU setups, which are less expensive and more accessible for beginners compared to ASIC miners. Examples include coins like Monero (XMR) and Zcash (ZEC), which are designed to be resistant to ASIC mining, thus leveling the playing field for individuals with less powerful hardware. However, while CPU and GPU mining may be more accessible, they often yield lower profits due to the lower processing power. This, combined with the cost of electricity and the potential for increased difficulty as more miners join the network, can result in minimal earnings or even losses for the miner.

What are the best crypto mining sites?

When it comes to finding the best crypto mining sites, it’s crucial to look for platforms that offer detailed analytics, mining profitability calculators, and up-to-date mining pool statistics. Sites like Minerstat and NiceHash are highly regarded in the mining community for providing insights into the profitability of various cryptocurrencies, including emerging coins that are considered the best crypto to mine now.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.