Bitcoin breaks $70k after Trump’s Nashville remarks

Bitcoin reached a two-month high as bullish sentiment engulfed the cryptocurrency, and capital market linkage suggested a bigger appetite for risk assets.

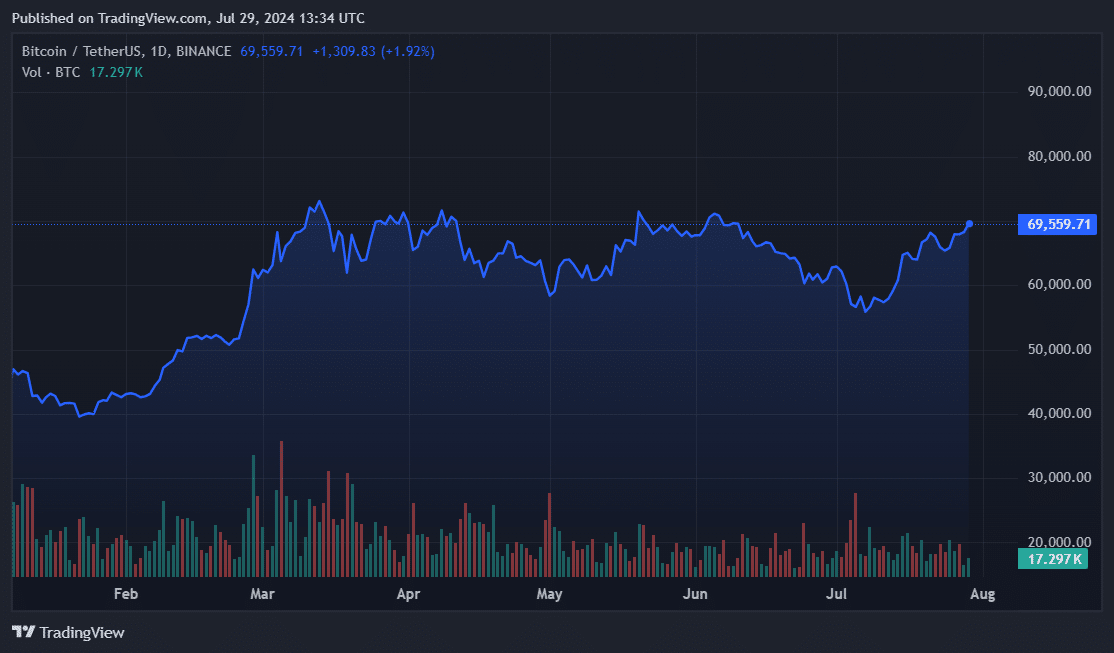

Bitcoin (BTC) touched $70,000 on July 29 for the first time since mid-May. The asset posted gains along with the broader cryptocurrency market, which was up over 2.6% and showing signs of a steady market uptrend.

Since last week, investors have tabled demands for Bitcoin and other digital assets as bearish momentum subsided. According to CoinShares, BTC products received $519 million in capital between July 22 and July 26. Bitcoin’s inflows for this month have surpassed $3.6 billion, primarily driven by U.S. spot BTC exchange-traded funds. This comes despite a staggered start to the month.

July has historically been a positive month for BTC, and this year is no different. BTC has jumped over 15% in the last 30 days and boasts more than $19 billion in year-to-date inflows, a new record.

Bitcoin rally or another fake out?

Still, there are questions over whether this is a sustained rally or another modest market rebound. Bitget Research chief analyst Ryan Lee said market sentiment is relatively optimistic due to remarks from former President Donald Trump and Senator Cynthia Lummis.

Trump and Lummis individually announced plans to create a national strategic BTC reserve. Lummis proposed that the U.S. Treasury purchase an additional one million BTC, and Trump promised to halt all government Bitcoin liquation.

Lee noted that U.S. capital market linkage may also allow BTC to attract even more investor demand. Seven major U.S. tech giants are scheduled to release financial reports this week.

Positive data could buoy the Nasdaq’s weekly numbers and direct capital to assets like BTC. Lee added that widely anticipated dovish remarks from the Federal Reserve this week could bolster BTC’s bullish thesis.

Meanwhile, on-chain showed that BTC balances on crypto exchanges increased by some 35,000 tokens. The coins were deposited within a two-week period between July 15 and July 28. Users usually, despite BTC on trading platforms with intentions to sell.

Roughly $2.4 billion in BTC deposited on exchanges could induce sell pressure on the asset. It’s unclear if this number includes Mt. Gox repayments, another event that might stress BTC’s market price and stagger a possible rally back above all-time highs.