Bitcoin breaks the $45k zone, indicator suggests a further rally

Bitcoin (BTC) had been consolidating around the $42,500 zone with the arrival of the holidays, but a key indicator suggests a further rally for the flagship cryptocurrency.

BTC is up by 6.9% in the past 24 hours and is trading at $45,250 at the time of writing — marking a 21-month-high, last seen in early April 2022. The market cap of the leading cryptocurrency surged to $886 billion.

Moreover, Bitcoin’s daily trading volume also recorded a 60% rally, reaching $27 billion.

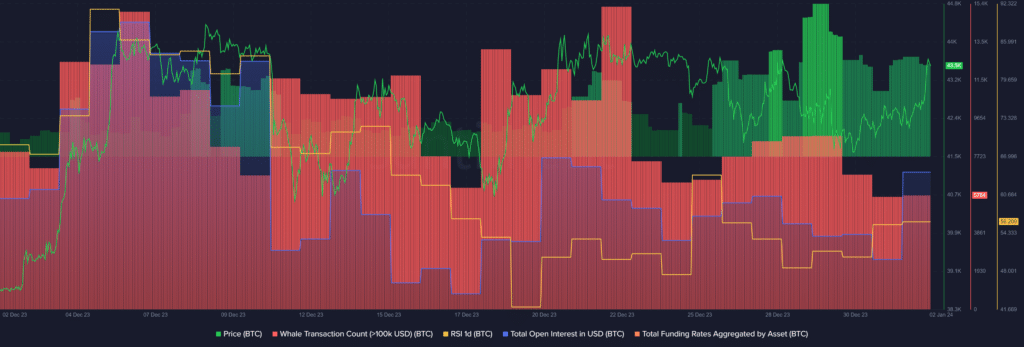

According to data provided by the market intelligence platform Santiment, the Bitcoin Relative Strength Index (RSI) recorded a slight increase over the past day — rising from 55.7 to 56.2. This shows that the leading crypto asset still has not faced strong selling pressure, especially from big whales — ultimately suggesting a further price surge.

For Bitcoin to stay bullish, the RSI indicator would need to stay below the 60 zone.

Furthermore, Bitcoin’s whale activity has also been declining over the past few days. Per Santiment, whale transactions consisting of at least $100,000 worth of BTC fell from 8,769 trades on Dec. 29 to 5,764 unique transactions at the time of writing.

When the whale activity declines, lower price volatility is usually expected for an asset.

Santiment data shows that Bitcoin’s total open interest (OI) registered a 5.5% increase — surging from $7.22 billion to $7.61 billion.

As the total BTC OI rises, the amount of long-position contracts slightly dominates short-position holders. According to Santiment, the total funding rates aggregated by Bitcoin currently hovers around 0.03% — showing that the majority of traders are longing the asset until further price movements.

However, the exact amounts of long and short positions are still not clear.

According to a report on Jan. 1, a YouTube analyst believes that the crypto market looks bullish in 2024. He added that the market recorded significant gains in 2023 despite all the regulatory challenges.