Bitcoin broke $97k with 83% odds of reaching $100k this month

Bitcoin has been consistently hitting new all-time highs over the past two weeks.

Bitcoin (BTC) is up 5.8% in the past 24 hours and is trading at an ATH of $97,750 at the time of writing. The digital gold’s market cap is currently sitting at $1.93 trillion with a 57.9% dominance over the crypto market.

Its daily trading volume also broke the $85 billion mark.

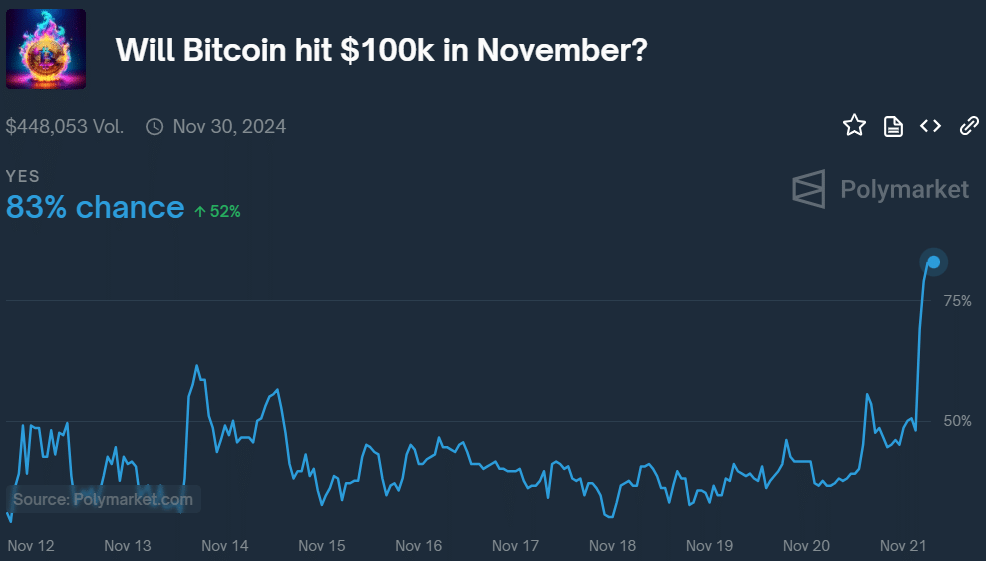

Thanks to the strong bullish momentum, a poll on the market prediction platform Polymarket shows that Bitcoin has an 83% chance of reaching the $100,000 mark before December.

With Bitcoin’s gains, the global crypto market capitalization also reached an ATH of $3.33 trillion, according to data from CoinGecko.

What’s driving the bulls?

Many factors are driving the Bitcoin price upward. The strong momentum was triggered after the “crypto president” Donald Trump won the U.S. presidential election on Nov. 6.

Pro-crypto politicians also dominated the U.S. House of Representatives and the Senate, leading to the expectations of crypto-friendly regulations with Trump’s second term.

Moreover, Ki Young Ju, the CEO of market analysis platform CryptoQuant, believes this year’s bullish momentum “resembles” the 2020 bull run.

One of the main factors is the strong whale accumulation, per Young Ju. Large over-the-counter deals, most likely by institutions rather than individuals, brought a steady surge to the Bitcoin price.

On April 20, the Bitcoin halving took place, slashing the block reward in half for miners and demanding a price rally to keep the miners profitable, the CEO of CryptoQuant added in the thread.

The latest catalyst for the Bitcoin price is the launch of spot BTC exchange-traded fund options in the U.S. — the first investment product to get the green light from the U.S. Securities and Exchange Commission was BlackRock’s iShares Bitcoin Trust.

Notably, spot BTC ETF options are expected to increase the demand for the digital gold as investors could manage their investment risks.