Bitcoin’s price rally: where is BTC headed next?

What’s driving Bitcoin’s recent surge past the $50,000 mark, and how does it impact Bitcoin price prediction?

Bitcoin (BTC) has made a significant comeback, reaching the $50,000 mark for the first time since Nov. 2021, when it soared to an all-time high of nearly $69,000.

As of Feb. 15, BTC has climbed to $52 levels, marking over a 20% growth in the last month. BTC’s dominance is now at 52%, with its market cap surpassing $1 trillion, putting it ahead of major corporations like Tesla and Berkshire Hathaway.

This rise in BTC’s price is complemented by significant milestones, such as the approval of spot Bitcoin ETFs in the U.S.

The investment in Bitcoin ETFs has seen a massive inflow of funds with Bitcoin ETFs market cap surpassing $41 billion as of Feb. 15 within a month of its launch.

Let’s delve deeper into what is happening with Bitcoin and how all these elements combined could affect Bitcoin’s price prediction.

Why is Bitcoin price up?

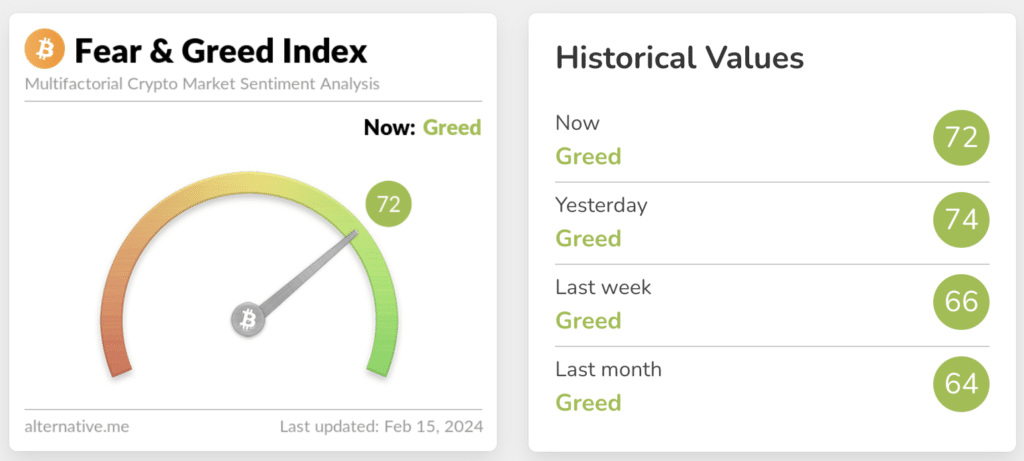

The recent surge in Bitcoin’s price past the $50,000 mark has triggered a notable shift in market sentiment, as evidenced by the Crypto Fear and Greed Index hitting 79 points on Feb. 13, indicating a state of “extreme greed.”

This level of market sentiment was last observed in Nov. 2021, just before Bitcoin reached its all-time high of $69,000. As of Feb. 14, the index slightly decreased to 72, still signaling a strong sense of greed among market participants.

Concurrently, the options market is witnessing a spike in activity, particularly for call options with Mar. 29 expiration dates at strike prices of $60,000, $65,000, and $75,000.

Such speculative interest, especially in call options above the current market price, reflects a collective anticipation of positive price movement, contributing to increased market volatility and liquidity.

This optimism aligns with key events on the horizon, such as the forthcoming Bitcoin halving event, scheduled for Apr. 2024, which has had a significant impact on Bitcoin’s valuation historically.

This halving event will reduce the supply of BTC miners from 6.5 BTC per block to 3.125 BTC, which if demand remains constant or increases, can lead to an optimistic Bitcoin price outlook.

ETFs fueling Bitcoin’s demand

Michael Saylor, MicroStrategy’s co-founder and executive chairman, attributes the recent uptick in Bitcoin’s price to the launch of Bitcoin ETFs.

He emphasizes that these ETFs are satisfying a decade of pent-up demand for Bitcoin, accessible now to mainstream investors. Saylor notes an overwhelming demand for Bitcoin through these ETFs, far outstripping the supply provided by miners.

This surge, he suggests, is driven by Bitcoin’s appeal as an asset uncorrelated to traditional risk assets, free from the influences of geopolitical and economic variables.

Additionally, Saylor’s announcement of MicroStrategy’s rebranding to a Bitcoin development company underscores a strategic pivot toward promoting Bitcoin’s growth.

Meanwhile, a Twitter thread has highlighted significant trends in the ETF market, particularly focusing on the dynamics between Grayscale Bitcoin Trust (GBTC) outflows and the influx of investments into other Bitcoin ETFs.

The analysis points out that despite the continued outflows from GBTC, the market is witnessing inflows into other ETFs, notably IBIT (BlackRock) and FBTC (Fidelity), which are attracting substantial investments.

Specifically, IBIT achieved a $5 billion inflow within just five weeks of its launch, underscoring the demand for Bitcoin ETFs.

Factors to watch out for

To gauge the Bitcoin forecast effectively, several pivotal factors need close monitoring in the coming days:

Inflation data

The January Consumer Price Index (CPI) report indicated a 3.1% year-on-year inflation rate, surpassing the analysts’ prediction of 2.9%.

The upcoming FOMC gathering is slated for Mar. 20. According to data from the CME Group, there’s an 89.5% likelihood that interest rates will remain unchanged, with the remaining 10.5% of observers anticipating a potential easing of rates by the committee.

This shift suggests a more cautious approach from the Fed towards easing monetary policy, potentially affecting Bitcoin’s trajectory.

Investors should watch for future CPI reports and Federal Reserve announcements, as these could either propel or dampen Bitcoin’s price momentum.

Open interest data

The aggregated BTC open interest on platforms like Binance reached $5.88 billion, attaining a peak not observed since Nov. 2021.

Open interest represents the total number of outstanding derivative contracts, such as futures and options, that have not been settled.

A surge in open interest indicates a growing interest or speculation in Bitcoin’s price direction. High levels of open interest can lead to increased price volatility, suggesting that traders should prepare for possible dynamic price movements in the near term.

ETF data

Inflows and outflows into BTC ETFs are critical indicators of investor sentiment and market liquidity.

Significant inflows suggest increasing demand and potentially bullish sentiment for Bitcoin, while outflows might signal caution or a bearish outlook.

Investors should keep an eye on recent trends in ETF activities to gauge the broader market sentiment and the potential impact on Bitcoin’s future price.

Bitcoin price prediction: short-term view

Several prominent figures in the cryptocurrency space have recently shared their predictions for Bitcoin, offering insights into the potential short-term price movements.

Michaël van de Poppe, a well-known crypto analyst, outlined his perspective on Bitcoin’s price trajectory. According to him, if Bitcoin manages to maintain its position above $46,000, there’s a possibility of it surging to the range of $53,000 to $57,000 before the next halving event.

Echoing similar sentiments, another analyst on Twitter emphasized the importance of defending the $42,500 level. Looking ahead, the analyst in its Bitcoin forecast expects BTC to consolidate around its current level before potentially ascending to the $52,000 to $53,000 range in the near future.

Furthermore, the ability of BTC to close a weekly candle above the $50,900 threshold could set the stage for reaching a $55.4K Bitcoin price target, another analyst noted.

They also mentioned that given the extremely bullish momentum observed, this upper target may be achievable sooner rather than later, even within this week.

Multiple analysts have shared their Bitcoin forecast for the short term, with emphasis on key support and resistance levels. While each perspective offers valuable insights, it’s essential to recognize the inherent volatility of the crypto market and never invest more than you can afford to lose.

BTC price prediction: long-term view

While it’s hard to predict how high Bitcoin can go, several long-term Bitcoin price predictions have surfaced:

Bitcoin price prediction for 2024

PlanB, a pseudonymous analyst known for his Bitcoin Stock-to-Flow (S2F) model, unveiled his own BTC price prediction. According to the analyst, Bitcoin is currently in a “pre-bull market” and on track towards a full-blown bull market after halving in 2024.

According to PlanB’s model, the stock-to-flow ratio is expected to increase significantly in 2024, with the projected Bitcoin price eventually surpassing the $70,000 mark.

British lender Standard Chartered also forecasts that the Bitcoin rate could hit the $100,000 mark by the end of 2024 as the so-called “crypto winter” is now over.

In an analytical note in April 2023, Standard Chartered’s Head of Digital Assets Research Geoff Kendrick noted that even though “sources of uncertainty remain,” the bank thinks that the “pathway to the $100,000 level is becoming clearer.”

In July 2023, the British bank doubled down on its prognosis, saying Bitcoin might reach $120,000 by the end of 2024.

Meanwhile, VanEck analysts Matthew Sigel and Patrick Bush claim Bitcoin is poised to break its all-time high in Q4 2024, fueled by a confluence of factors, including a surge in voter participation in global elections, mounting evidence of a rejection of the Green lobby’s anti-growth agenda, and a potential victory for Donald Trump in the 2024 presidential election.

British cryptographer and cypherpunk Adam Back, who’s also the CEO of Blockstream, a blockchain technology company, is convinced that Bitcoin is poised to go as high as $1 million after the 2024 halving as the cryptocurrency may benefit most from an intergenerational transfer of wealth.

While the Blockstream CEO didn’t provide specific dates, he noted that Bitcoin “will surely flip physical gold sooner or later” as the probability of this scenario is high enough for “this halving cycle.”

Bitcoin price prediction for 2025

The Bitcoin price prediction for 2025 varies significantly among experts.

DigitalCoinPrice projects a bullish outlook, forecasting a price of $121,139.59, indicating strong confidence in Bitcoin’s growth potential.

On the other hand, CoinCodex presents a broader range, with a low prediction of $29,268 and a high of $149,245 in 2025.

Bitcoin price prediction for 2030

Yassine Elmandjra, an analyst at Ark Investment Management, believes that Bitcoin’s price could eventually surpass $1 million.

In an interview with Bloomberg, Elmandjra cited Bitcoin’s underlying technology, growing adoption by institutional investors, and potential to become a global reserve currency as key factors supporting his bullish outlook.

You should approach Bitcoin price predictions with caution. These forecasts are speculative and based on current trends and assumptions, which can change due to various.

It’s crucial to conduct thorough research, consider diverse viewpoints, and not base investment decisions solely on predictions.

Diversifying your investment portfolio and consulting with financial advisors is also advisable to mitigate risks associated with the volatile cryptocurrency market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

Is Bitcoin a good investment?

Like any cryptocurrency, Bitcoin is an extremely volatile asset, and its price can fluctuate wildly in the short term. As a result, it is not suitable for all investors. However, some believe that Bitcoin has the potential to be a good long-term investment due to its limited supply and growing adoption by institutional investors.

Will Bitcoin’s price go up?

Predicting Bitcoin’s price is a hard nut to crack as the cryptocurrency market is highly unpredictable. However, some analysts believe that Bitcoin’s price could continue to rise in the long term, driven by factors such as increased institutional adoption, growing investor demand, and the upcoming Bitcoin halving event.

How can I buy Bitcoin?

There are a number of ways to buy Bitcoin. You can buy Bitcoin through a cryptocurrency exchange or a peer-to-peer (P2P) marketplace, exchange it for altcoins through cross-chain bridges, or, eventually, mine it with an ASIC rig.

How many Bitcoins will be mined?

There will only ever be 21 million BTC mined. As of press time, over 19 million Bitcoins have been mined. However, as noted by IntoTheBlock, nearly 30% of BTC supply hasn’t moved in over five years. It’s possible that a large part of these coins were lost forever, analysts alleged in an X post.

When is the next Bitcoin halving?

The next Bitcoin halving is expected to occur in April 2024. This event will reduce the reward miners receive for validating transactions by half from the current 6.25 BTC to 3.125 BTC. Learn more about Bitcoin halvings in our special report.

Can Bitcoin reach $1 million by 2030?

No one can say for sure. Ark Investment Management analyst Yassine Elmandjra and Blockstream CEO Adam Back have both predicted that Bitcoin’s price could eventually surpass $1 million, but analysts’ predictions may be inaccurate and have been wrong in the past.

Can you earn free bitcoins?

You can earn free bitcoins through various methods, although the amount you can earn might be relatively small. Here are some ways people have earned or can earn free bitcoins:

Faucets: These are websites or apps that dispense small amounts of Bitcoin for completing tasks, watching ads, or playing games.

Airdrops: Sometimes, new cryptocurrencies distribute free tokens or coins to holders of an existing cryptocurrency like Bitcoin.

Bounty programs: Some blockchain projects offer rewards in the form of bitcoins or other cryptocurrencies for completing tasks, such as marketing activities, bug reporting, or content creation.

Referral programs: Certain platforms offer rewards for referring new users. By sharing referral links and getting people to sign up, you can earn a percentage of their activities on the platform.

Mining pools and cloud mining services: Some mining pools or cloud mining services offer sign-up bonuses or promotional offers that could provide you with a small amount of free bitcoins initially.

Interest on Bitcoin holdings: Some platforms and services offer interest for holding your bitcoins with them. However, these might involve risks and might not truly be free as they often require you to deposit and hold a certain amount of cryptocurrency.

Microtasks and freelancing: Platforms sometimes pay in bitcoins for completing small tasks or freelance jobs.

Note, be cautious of scams or offers that seem too good to be true, and always research and use reputable platforms when engaging in any activity to earn free bitcoins.