Bitcoin call options clustering at $70k show bullish skew

Analysts highlight the significant concentration of call options for Bitcoin, set to expire at the end of March, with a strike price of $70,000.

This information, provided by Bitfinex‘s Head of Derivatives Jag Kooner, suggests a growing optimism regarding Bitcoin’s (BTC) value.

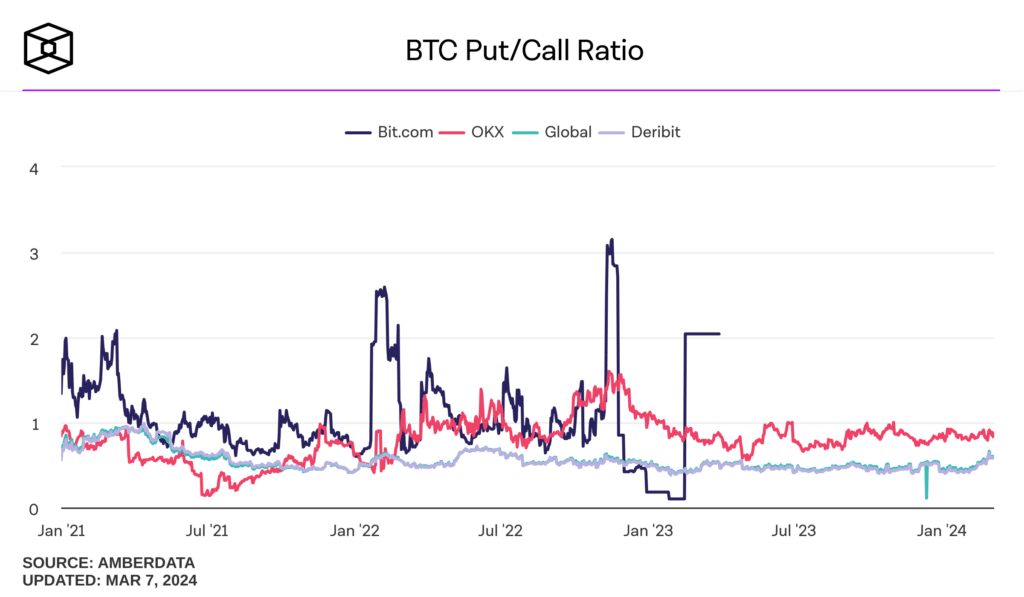

Kooner notes that the put-call ratio, a key indicator of market sentiment, has consistently remained below 0.6 for the first time in six months, indicating a bullish outlook among traders.

The global put-call ratio for Bitcoin options now stands at 0.6, according to The Block’s Data Dashboard. A ratio below 1 signals bullish sentiment, as it shows a preference for calls, which are bets on the asset’s price increase.

Conversely, a ratio above 1 would indicate bearish sentiment, highlighting a greater interest in puts, which are protective measures against a price decline.

Kooner pointed out that implied volatility in the options market has decreased noticeably. The decrease has reduced option premiums, making it more cost-effective for traders to enter positions.

Specifically, Deribit’s implied volatility index for Bitcoin fell from 77% to 72% over the past 24 hours. Lower volatility expectations suggest traders anticipate less price fluctuation shortly, affecting the pricing of options contracts.

Options are financial derivatives that allow traders the choice, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified date.

Call options grant the right to buy, whereas put options offer the right to sell. Purchasing put options generally reflects a bearish market view, while purchasing call options indicates a bullish stance.