Bitcoin Cash halving 2024: Is it a buying opportunity?

Bitcoin Cash’s price hit a yearly peak of $527 on March 3 but has since decoupled from the market trend, bringing the upcoming halving event to the forefront.

Despite the crypto market uptrend, Bitcoin Cash (BCH) price has struggled to maintain its bullish momentum in the past week. Historical market data provides critical insights into how the next Bitcoin Cash halving event could impact BTC price action.

Miners enter $1.1 billion selling spree ahead of halving

Bitcoin Cash has a four-year or 200,000-block halving cycle. The first occurred on April 8, 2020, while the expected date for the next BCH halving event at block 840,000 is April 4, 2024.

The current block reward is 6.25 BCH and will be slashed to 3.13 BCH in about 25 days, and this critical network event has triggered intense reactions among miners.

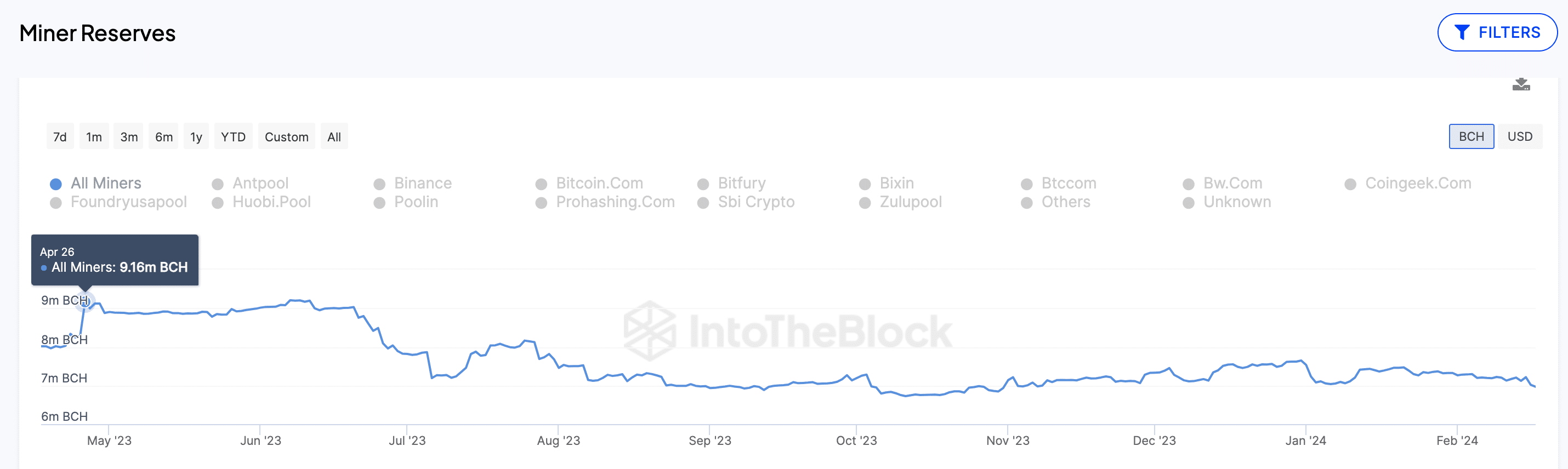

IntoTheBlock’s miner reserves data and presents the coins held in wallets controlled by recognized miners and mining pools. It shows that as of April 26, 2023, the BCH miners held a total balance of 9.2 million BCH. But as of March 2024, those balances have dwindled to just 6.65 million BCH

Miners have sold 2.51 million BCH worth approximately $1.1 billion and nearly 30% of holdings in the past year. This trend is expected to exacerbate as more miners look to cash in on high prices ahead of the rewards remission.

However, historical data suggests that this trend could reverse after the halving. In April 2020, the miners began to accumulate their reserves again shortly after the halving.

As rewards are cut, unprofitable miners may unplug from the Bitcoin Cash network. This could decrease mining difficulty and dynamically increase the mining revenue for those who can afford to stick to the game.

This trend was observed on the Bitcoin Cash network in 2020. As unprofitable miners sold out and exited the network, the remaining miners grew their reserve balances from 10.8 million on the April 8 halving date to a yearly peak of 13.5 million in November 2020.

Unsurprisingly, the BCH price also experienced significant price gains during that period.

Bitcoin Cash’s 20% price dip presents buying opportunity

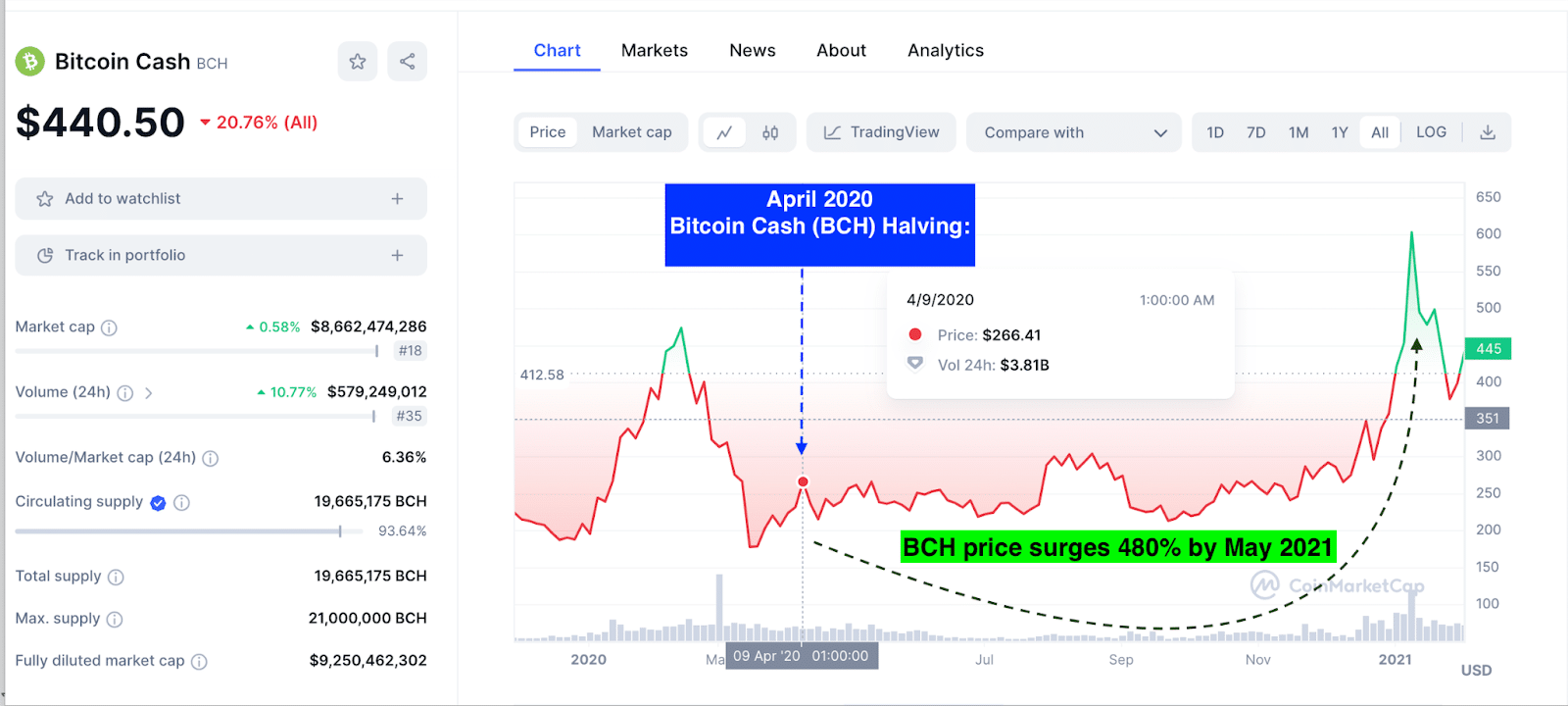

Bitcoin Cash had a solid start to the month, soaring to a three-year peak of $527 on March 2. However, since the BCH halving countdown rolled past the 30-day mark, the BCH price has decoupled from the broader crypto market uptrends and entered a steep 20% downtrend toward $440 at press time on March 11.

However, given the historical market data analyzed above, this price downtrend could present a profitable buying opportunity for strategic bullish traders.

The chart above shows that the BCH price exhibited a similar downtrend pattern ahead of the last halving event on April 8, 2020. However, interestingly, shortly after the halving, BCH entered a bullish cycle that saw prices soar 480% over the next year.

Recent on-chain data trends suggest that long-term holders have positioned for another bullish Bitcoin cash post-halving cycle.

Bitcoin Cash long-term holders positioned for post-halving rally

Bitcoin Cash miners halting their sell-off and stacking up their reserves contributed immensely to BCH price delivering a positive post-halving performance in 2020. The on-chain data metric has revealed that BCH long-term holders are now positioned for a bullish post-halving rally.

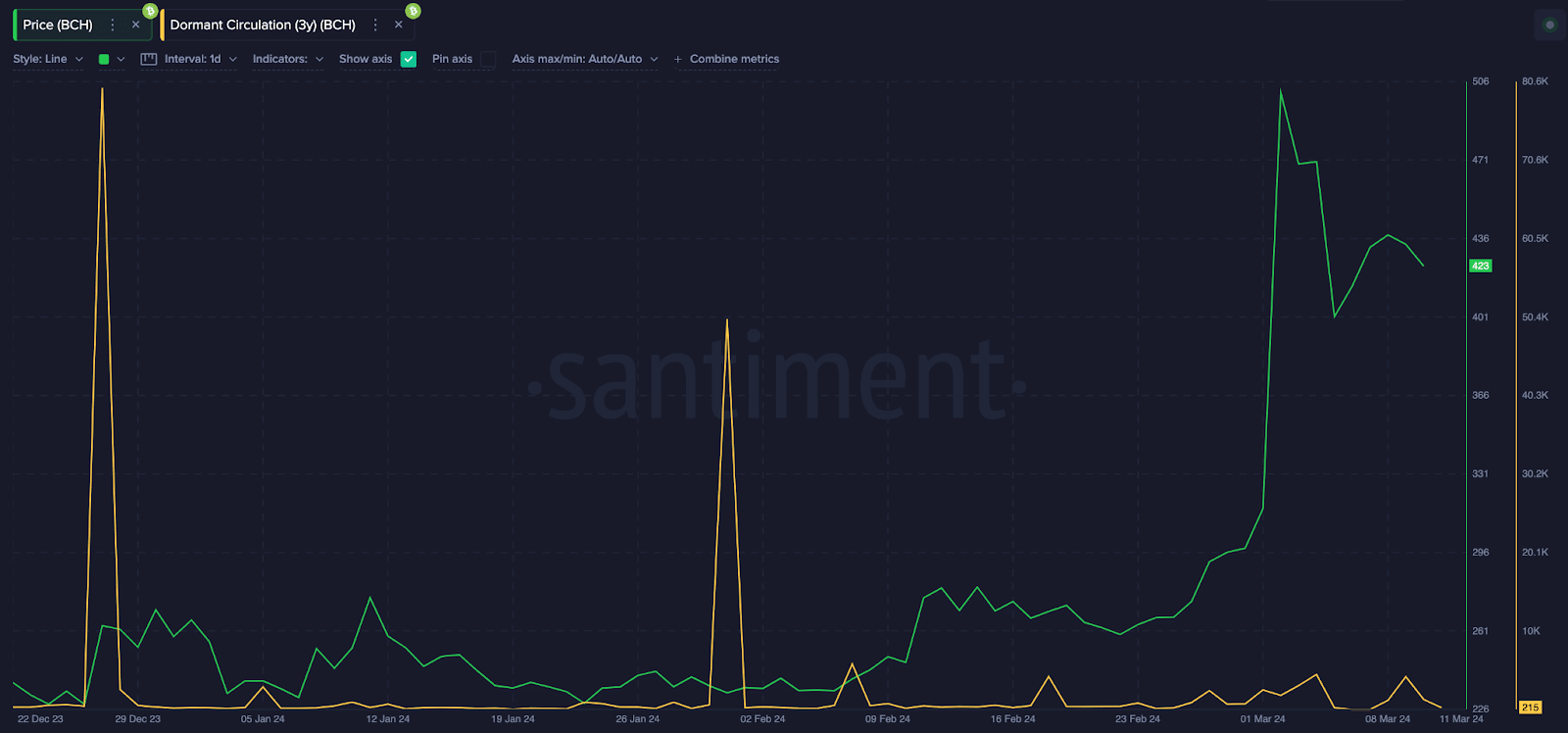

Santiment’s dormant circulation metric monitors the number of coins traded on a given day that were previously held unmoved for three years or more.

As seen below, BCH’s three-year dormant coins in circulation have been in a relatively flat trend, forming lower peaks in the last three months. The latest spike on March 9 saw long-term investors trade 4,208 BCH coins previously held for three years or more at 28% lower than the previous month’s peak.

Essentially, BCH’s three-year dormant supply in circulation for March is trending lower than the previous month’s peaks, signaling that long-term investors are growing increasingly reluctant to sell as the April 4 halving date.

If this trend persists, other strategic investors could also take a cue from the long-term holders’ optimism and start to take on a bullish disposition.

BCH price prediction: more correction before $750 breakout?

Based on the data trends analyzed above, the Bitcoin Cash miners selling frenzy could put downward pressure on BCH price, potentially forcing a downswing below $400 ahead of the halving.

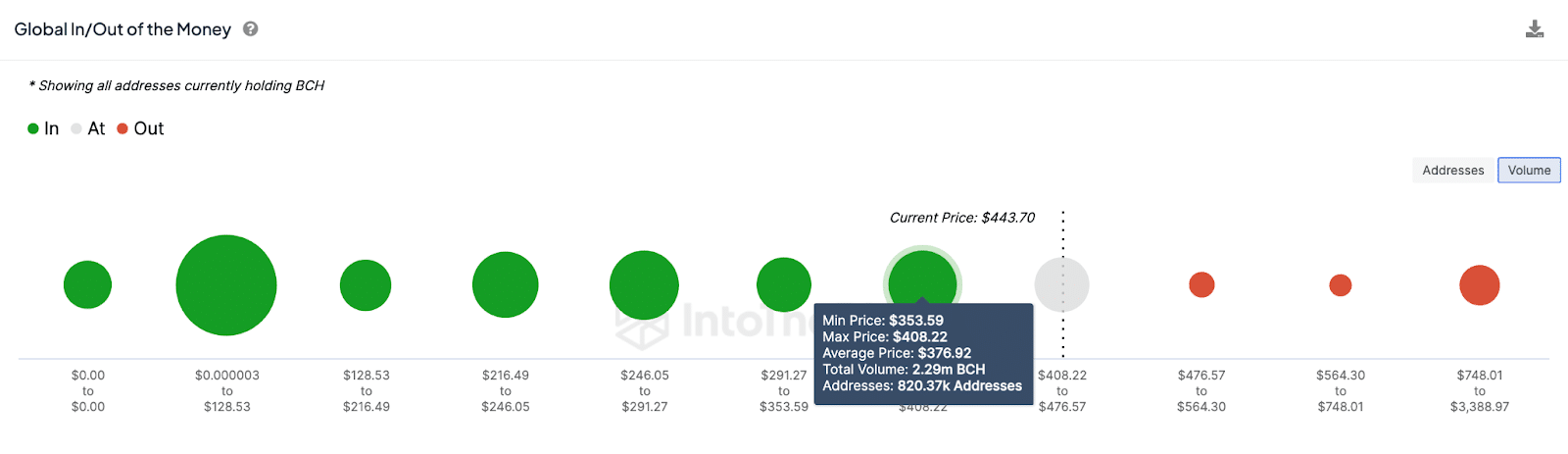

However, in the short term, the bull can count on the looming buy-wall at $410 for initial support.

IntoTheBlock’s global in/out of the money chart shows that 820,370 addresses had acquired 2.3 million BCH at the maximum price of $408.

Given the curtailed selling pressure from long-term holders. BCH can put up a solid front to defend the critical support level.

Conversely, the bears could mount significant resistance at $750 in a post-halving bullish cycle. But if the bulls can smash through that key resistance level, a move above $1,000 could be on the cards.