Bitcoin could top $150k in Q3 2025, chart veteran Peter Brandt says

Should past bull markets indicate how things will unfold today, Bitcoin could set its all-time high for the current bull cycle in 2025.

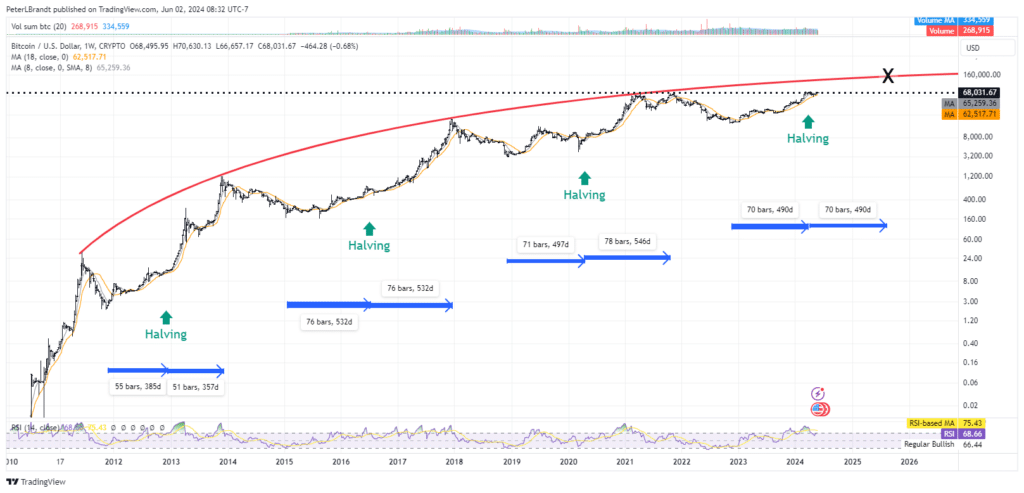

Peter Brandt, a well-known analyst focused on interpreting chart patterns, says Bitcoin is likely to set its maximum for this bull cycle not in 2024, but rather in 2025, should data from the previous bull markets act as a reliable indicator.

Brandt’s analysis hinges on the halvings, events where mining rewards are programmatically reduced by 50% once in four years. In a blog post, the chart veteran notes that historically, these halvings represented “almost perfect symmetry within past bull market cycles.”

“More specifically, the number of weeks from the start of each bull market cycle (the low following a 75%-plus decline) to the halving dates has been almost equal to the number of weeks from the halving dates to the subsequent bull market highs […].”

Peter Brandt

Should the pattern persist, Brandt suggests that Bitcoin could hit its next peak in late August or early September 2025.

In terms of potential price movements, the analyst points out that previous bull market peaks have aligned well with an “inverted parabolic curve.” Should this trend continue, BTC could reach a high between $130,000 and $150,000 in the next bull cycle.

However, Brandt remains cautious, noting that “as a trader, I avoid being dogmatic about any idea.” While this projection is his preferred analysis, he assigns a 25% probability that Bitcoin may have already peaked for this cycle, when the cryptocurrency set a new all-time high in March by soaring above the $70,000 mark.

The analyst notes that if Bitcoin fails to achieve a decisive new high and drops below $55,000, he will increase the probability of what he terms an “Exponential Decay” scenario. As of press time, Bitcoin is trading at $69,290, as per data from CoinGecko.

Bitcoin has been showing relatively no volatility over the past few weeks, staying within the $65,000 to $70,000 range. As crypto.news reported earlier, the head of blockchain analytics firm CryptoQuant Ki Young Ju sees the current volatility and on-chain activity resembling the mid-2020 timeframe, when Bitcoin was trading at $10,000.