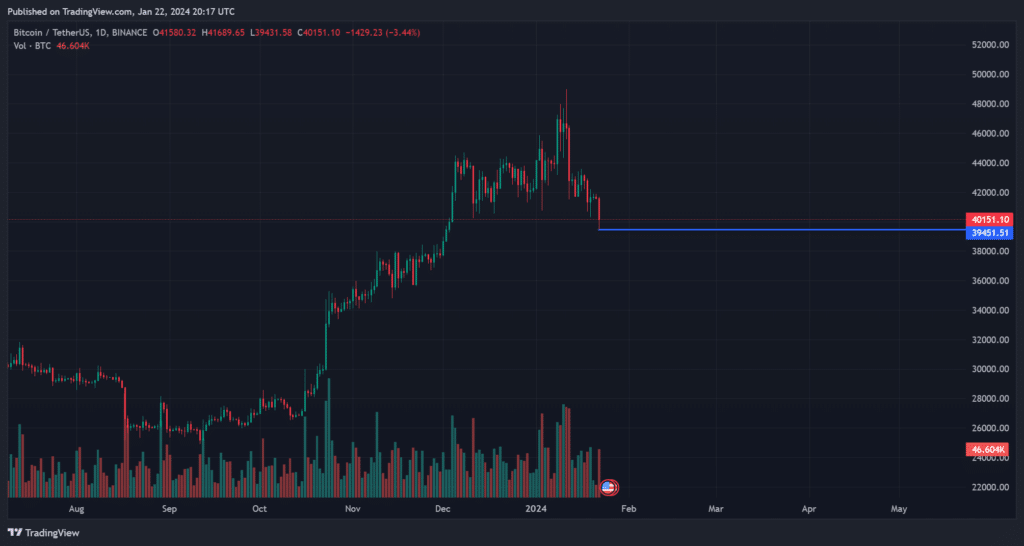

Bitcoin dips below $40k amid BTC ETF selloffs

Bitcoin dropped under $40,000 amid GBTC sell-offs from bankrupt crypto exchange FTX and BTC deposits on Coinbase by spot BTC ETF issuer Grayscale.

Bitcoin (BTC) slid down nearly 9% on Jan. 22, exchanging hands around $39,700 on venues like Binance and Coinbase. The largest cryptocurrency likely saw depreciating prices due to outflows from Grayscale’s spot Bitcoin ETF, a fund built on the firm’s long-standing GBTC product.

GBTC is the largest spot BTC ETF in the U.S. marketing with over $20 billion in assets under management. The fund has seen daily outflows of up to $500 million since the Securities and Exchange Commission (SEC) permitted exchange-traded funds that track spot Bitcoin prices, resulting in over $2.8 billion leaving GBTC.

Since actual Bitcoins underpin these ETFs, Grayscale has also sent BTC to exchanges for liquidation and redemption. Grayscale has deposited 52,227 BTC worth an estimated $2.2 billion into Coinbase Prime accounts from its custodial wallets, per crypto.news. The firm’s GBTC Bitcoin is also held with Coinbase.

A major entity exiting GBTC, as revealed on Jan. 22, is the defunct crypto exchange FTX. Under bankruptcy administrator and CEO John J. Ray III, FTX’s estate has sold millions of GBTC shares for $1 billion.

In addition, FTX-affiliated crypto hedge fund Alameda Research voluntarily dropped its lawsuit against Grayscale and its parent company, Digital Currency Group, that alleged internal malpractice from the pair — the lawsuit aimed to unseal $9 billion on behalf of FTX debtors.

Elsewhere, the SEC acknowledged Nasdaq’s request for spot BTC ETF options. These types of derivatives allow traders to either speculate on an asset’s volatility or hedge against it in a move that may pull more capital into Bitcoin ETFs.