Bitcoin enters the oversold zone after falling below $63k

The Bitcoin (BTC) price has been consistently declining over the past two weeks, consequently putting the flagship cryptocurrency in the undervalued zone.

BTC dipped by 3.2% in the past 24 hours and is trading at $62,300 at the time of writing. Notably, this is the first time in six weeks that the Bitcoin price plunged below the $63,000 mark. The asset’s market cap is down to $1.22 trillion, last seen on May 15.

On the other hand, the daily BTC trading volume surged by 91% over the past day, surpassing the $17 billion mark.

It’s important to note that spot BTC exchange-traded funds (ETFs) in the U.S. recorded six consecutive days of outflows, bringing heightened FUD (fear, uncertainty and doubt) to the cryptocurrency market.

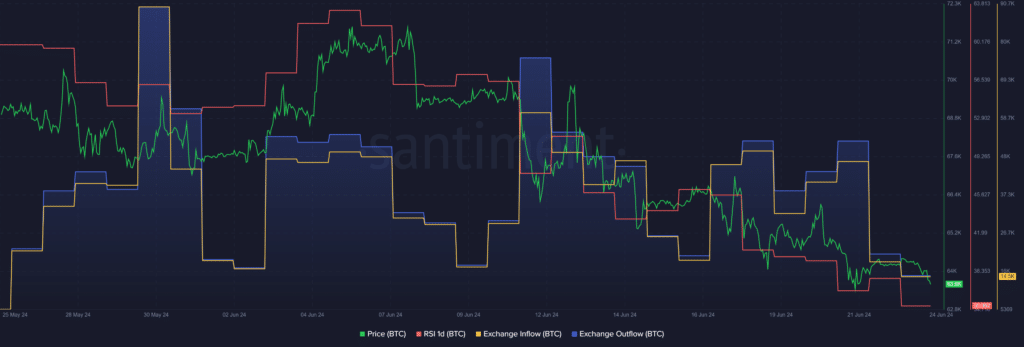

According to data provided by Santiment, the BTC relative strength index (RSI) is currently sitting at the 35 mark after witnessing three weeks of constant declines. The indicator shows that Bitcoin is oversold at this point, hinting at a potential price rally.

Despite the declining RSI, the massive surge in Bitcoin’s daily trading volume could hint at high price volatility.

Data from the market intelligence platform shows that the BTC exchange inflow plunged from 18,726 coins to 14,547 coins over the past 24 hours. Moreover, the BTC exchange outflow dropped from 20,344 tokens to 14,648 tokens in the same timeframe.

The movements show that investors might be trying to accumulate Bitcoin at this price point, seeing the $62,000 mark as a local bottom for the leading cryptocurrency.