Bitcoin ETF applicants ramp up BTC purchases ahead of SEC verdict

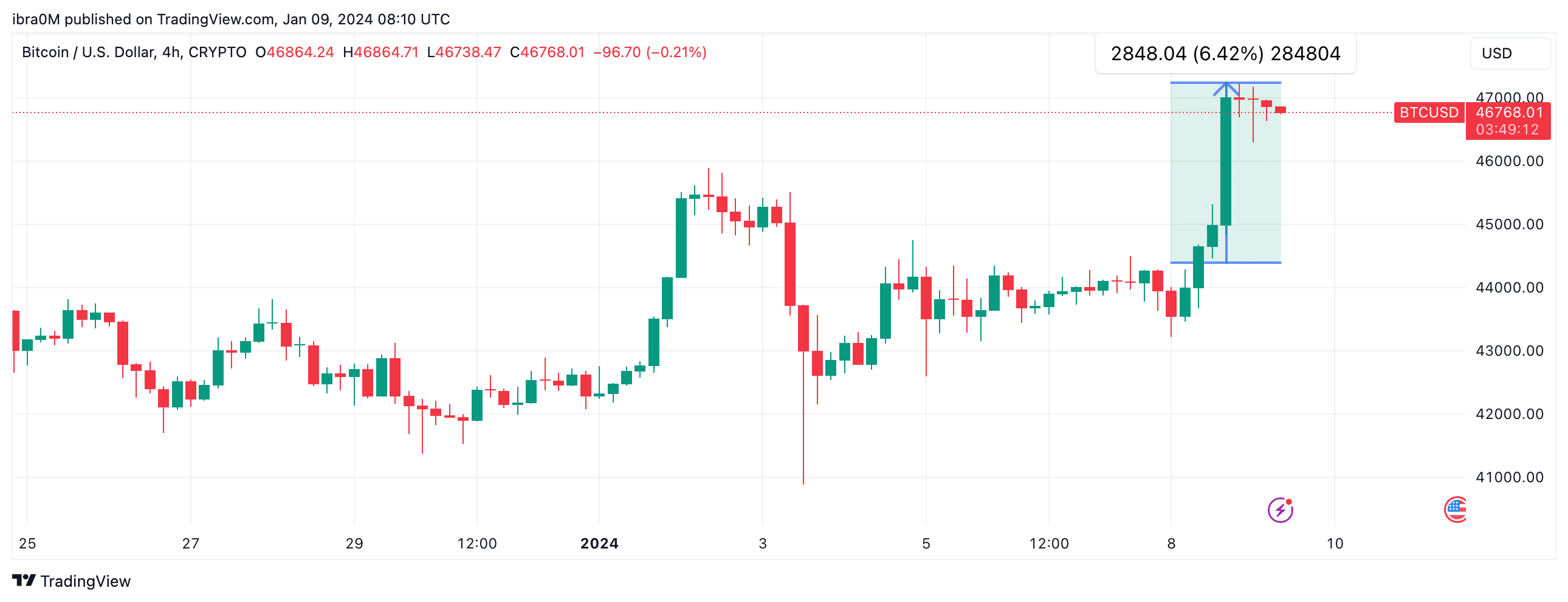

Bitcoin (BTC) price soared above $47,000 on Jan. 8 for the first time in 21 months amid Bitcoin ETF approval anticipation.

Recent developments surrounding the U.S. Securities and Exchange Commission’s (SEC) looming verdict on Spot ETF filings have been pivotal to the BTC price upswing.

On Jan. 8, the SEC chairman, Gary Gensler, issued a post on X (previously Twitter) warning investors of the potential crypto investing pitfalls. Markets reacted positively, as bullish investors interpreted it as a prelude to an imminent Spot ETF approval verdict.

Within 2 hours of Gensler’s posts, BTC price rose 6% from $44,462 to a daily timeframe peak of $44,771.

However, looking beyond the price charts, on-chain data trends reveal that the BTC rally on Jan. 8 was preceded by Bitcoin Spot ETF applicants ramping up last-minute purchases as the SEC verdict looms.

ETF applicants acquire BTC worth $60 million in last-minute purchases

Bitcoin spot ETF filings have been the subject of widespread market speculations in recent weeks. However, following the money, the on-chain data trail reveals that applicant fund sponsors have maintained a positive disposition.

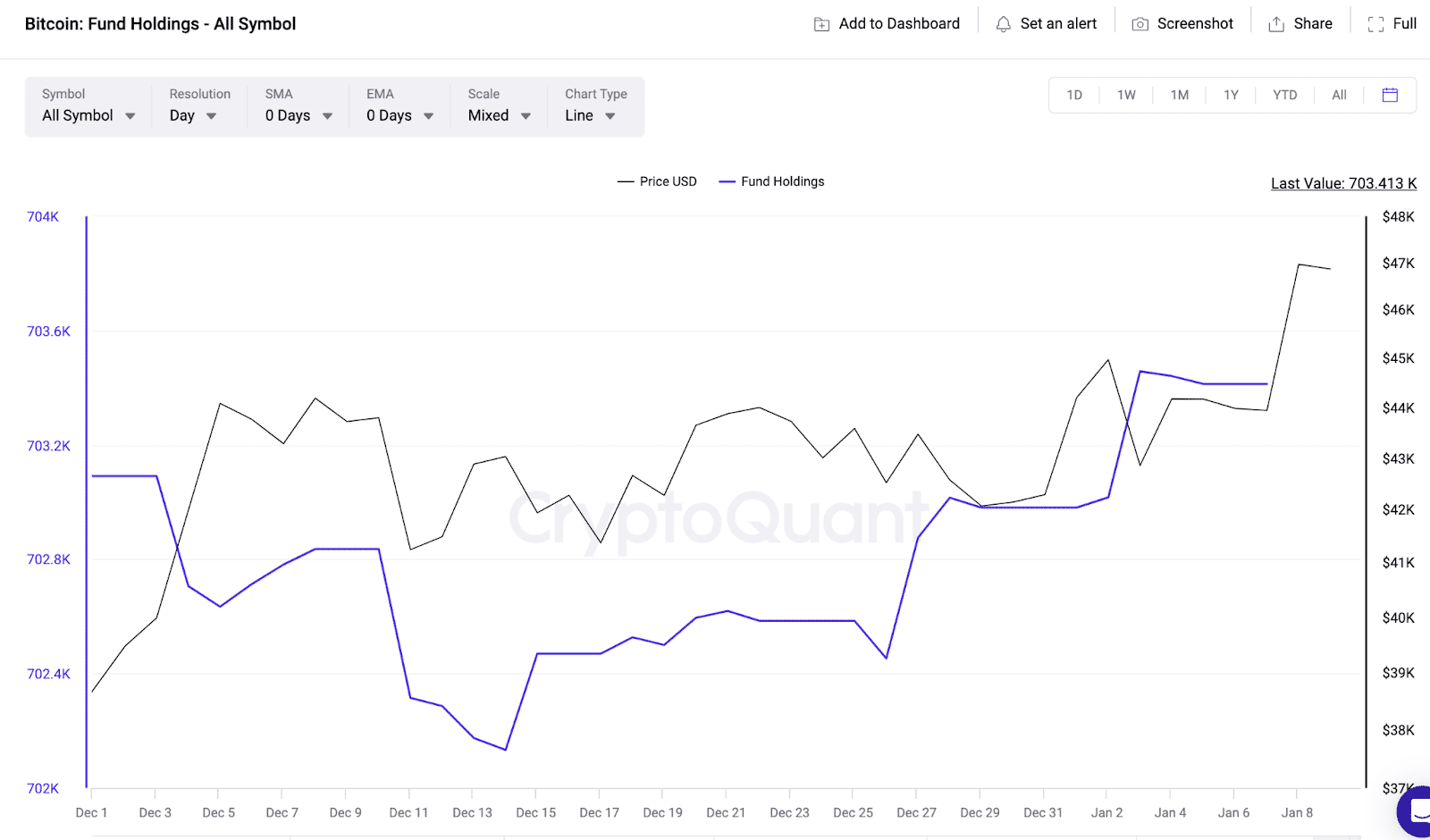

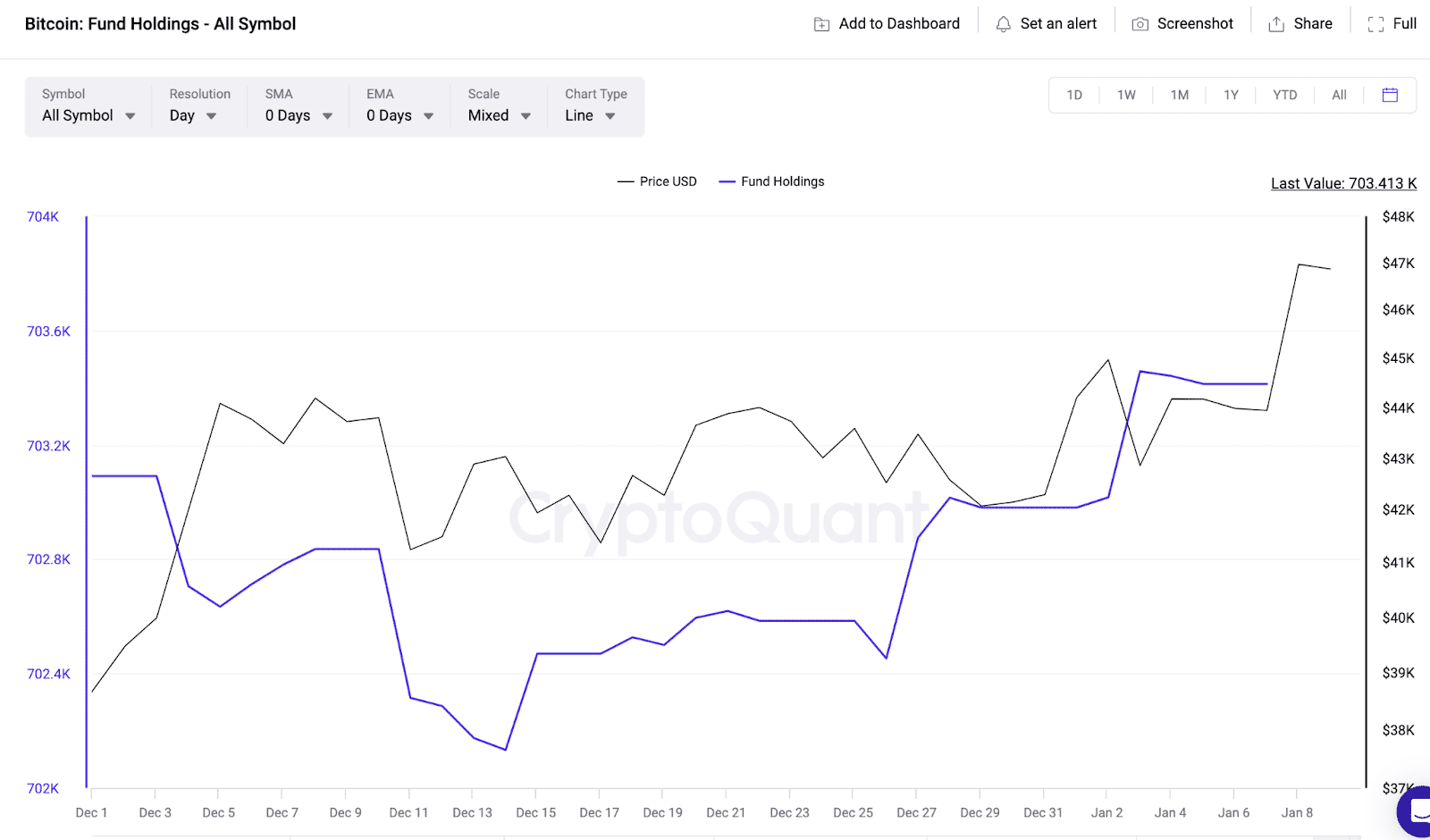

CryptoQuant’s Fund Holdings metric tracks real-time changes in BTC balances held by recognized Bitcoin trusts and dedicated index funds. This effectively serves as a proxy for monitoring aggregate BTC balances in the custody of ETF applicants such as Blackrock and Grayscale.

Indicatively, the Fund Holdings chart below shows that the applicants held a total of 702,133 BTC cumulatively as of Dec. 14. But as the SEC’s verdict drew closer, they have ramped up purchases by 1,280 BTC in the last three weeks. As of Jan. 8, the aggregate Fund Holdings has increased to 703,403 BTC.

Valued at the 8-day Exponential Moving Average (EMA) price of $46,125, the newly-acquired 1,280 BTC are worth approximately $59.08 million. Firstly, the timing of these large capital inflows by applicant Bitcoin ETF sponsors can be interpreted as a resolute stance against the purported dismissal verdict touted by bearish speculators in recent weeks.

More generally, when corporate whale entities make large purchases within a short period, it causes major spikes in market demand. Unsurprisingly, BTC price has increased 14% since the fund sponsors ramped up purchases around Dec. 14.

Forecast: can Bitcoin price reach $50,000?

Bitcoin price will likely reach $50,000 if the ETF applicants’ bullish stance is met by a timely positive verdict from the SEC. Drawing inferences from the on-chain data trends analyzed above, positive developments surrounding the Spot Bitcoin ETFs have been pivotal to the BTC price upswing above $47,000.

Additionally, a vital technical analysis indicator also affirms this bullish Bitcoin price outlook.

Following the latest rally on Jan. 8, BTC’s 8-day EMA (blue trendline) has now swung above the 21-day EMA (yellow trendline).

As seen in the chart below, BTC’s 8-day EMA Price is now at $46,125, which is significantly higher than the 21-day average of $45,120.

This alignment shows that the much-coveted Golden Cross phenomenon is now fully in play for Bitcoin price.

The Golden Cross is a bullish technical analysis pattern that occurs when a short-term moving average (e.g., 8-day EMA) crosses above a longer-term average (e.g., 21-day). Put concisely, it signals that, on average, investors are now willing to pay more for BTC than in previous weeks.

If the Bitcoin bulls capitalize on this positive momentum, they could drive prices toward the $50,00 territory in the coming days

However, the $50,000 territory could form a major psychological resistance zone. Considering that investors who bought BTC around that price range have been holding the bag for about 21 months, many of them could look to exit once the price approaches their break-even point again.

But if an SEC approval verdict spurs Fund sponsors to intensify their buying pressure, the bullish momentum could flip that sell wall.