Bitcoin ETFs compensate April outflows, analyst predicts long-term returns

Spot Bitcoin ETFs offset April losses in the first two weeks of May.

Eric Balchunas, Senior ETF Analyst for Bloomberg, noted that Bitcoin ETFs have already seen $1.3 billion in inflows in May, offsetting all of the negative inflows in April for a total inflow of $12.3 billion since launch.

The analyst urged investors not to worry about changes in capital inflows and outflows since this is part of ETFs’ natural cycle. Balchunas believes that spot Bitcoin ETFs will still generate positive long-term returns.

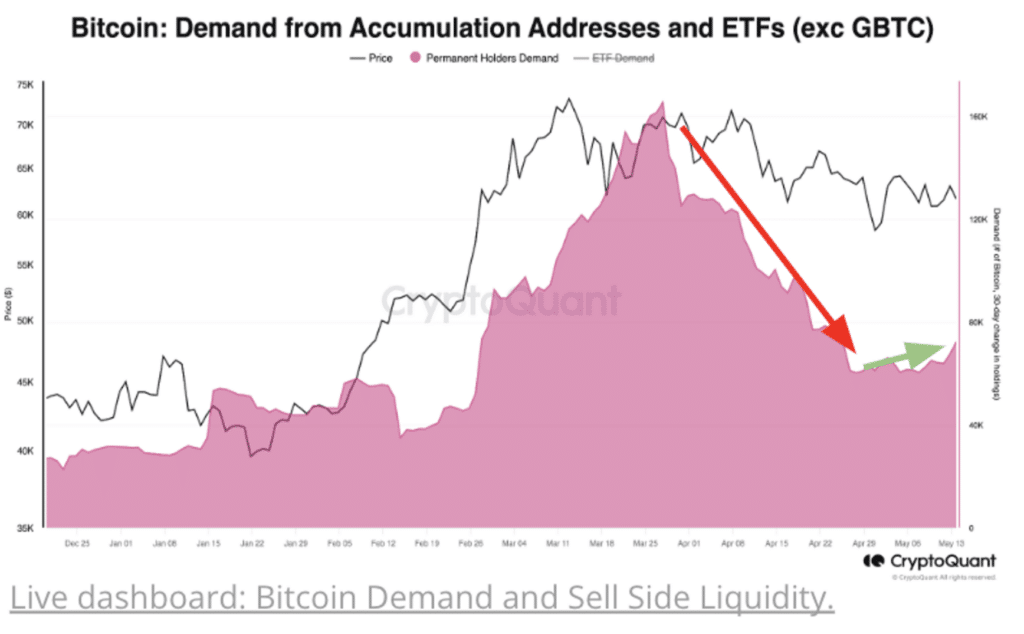

CryptoQuant notes that the restoration of dynamics is also combined with the restoration of demand for Bitcoin. The growth of Bitcoin’s balance with regular holders and large investors is again accelerating, signaling increased demand for Bitcoin from these market participants.

Over the past week, capital inflows into spot Bitcoin ETFs have recovered from the April drawdown. According to SoSo Value, the funds recorded $257.34 million in inflows on May 16.

The leader in the volume of funds raised was iShares Bitcoin Trust (IBIT) from BlackRock, which received $94 million in inflows. The fund’s capital under management reached $18 billion, slightly lower than that of the Grayscale Bitcoin Trust ETF (GBTC).

GBTC had a net daily inflow of $5 million on May 16, the third trading day the product closed in the green since its conversion from a trust to a spot ETF.